Investment Ideas (Not Green Line Rules)

An excellent way to improve your trading skills is to see what others are doing. Per TradingView, Trade ideas can come in many forms whether it be predictions, market analyses or trade set-ups based on concrete market conditions. Ideas can also contain educational material and show how trading methods, analysis approaches or tools exactly work. There are many areas of technical analysis, some are basic, others more sophisticated and all are supported with intelligent drawing tools, many bar styles, lots of data and a host of indicators.

Ideas can relate to any asset class like currencies, stocks or futures or any trading method like harmonic patterns, wave analysis or chart patterns. Often traders use a combination of several methods and look for confluence and increase their odds. There are also ideas on risk management, trading psychology and trading plans. Regardless of the method you use, it’s indisputable that the cycle of creating, sharing, collaborating and learning based on well-thought-out ideas will help you improve your trading skills.

Below are some current Ideas for US Stocks. If you have any questions or comments please feel free to leave a message in our forum. We are always interested to hear what you have to say.

-

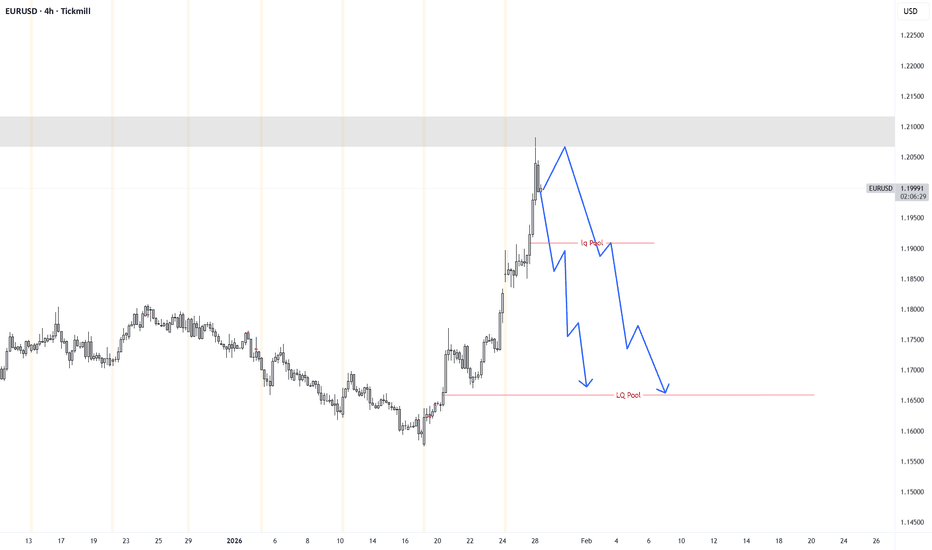

EURUSD Bearish long term idea

EU liquidity Pools at 1.19094 , 1.16614 EU to likely go bearish to tap into the liquidity... Read more

EU liquidity Pools at 1.19094 , 1.16614 EU to likely go bearish to tap into the liquidity... Read more -

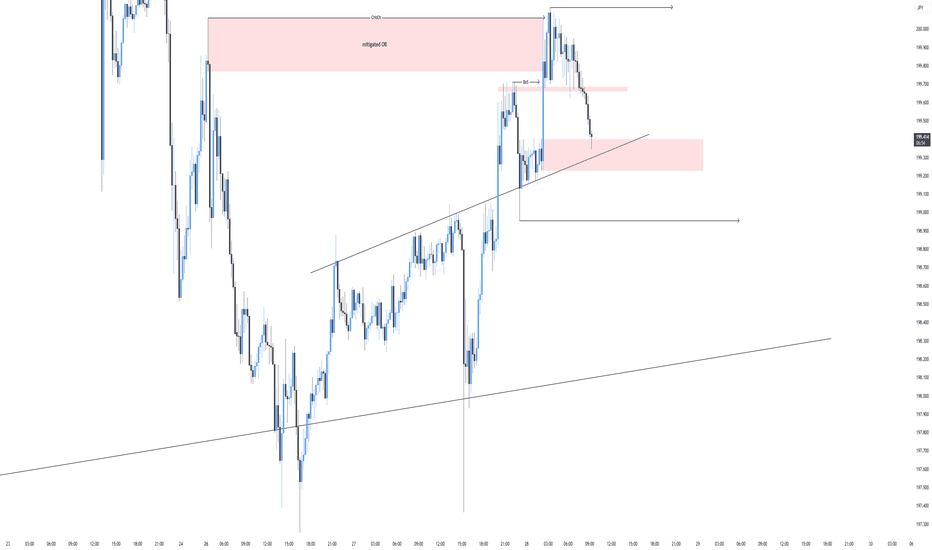

Why I would blindly enter this trade

1. Trendline Retest 2. High volume OB 3. FVG 4. LTF BoS 5. Mitigated OB 6. HTF ChooCH 7. HTF Uptrend 8. FIB 0.5 (Golden reversal) 9. Highest volume candle entry 10. Low volume node entry 11. Entry is also support zone... Read more

1. Trendline Retest 2. High volume OB 3. FVG 4. LTF BoS 5. Mitigated OB 6. HTF ChooCH 7. HTF Uptrend 8. FIB 0.5 (Golden reversal) 9. Highest volume candle entry 10. Low volume node entry 11. Entry is also support zone... Read more -

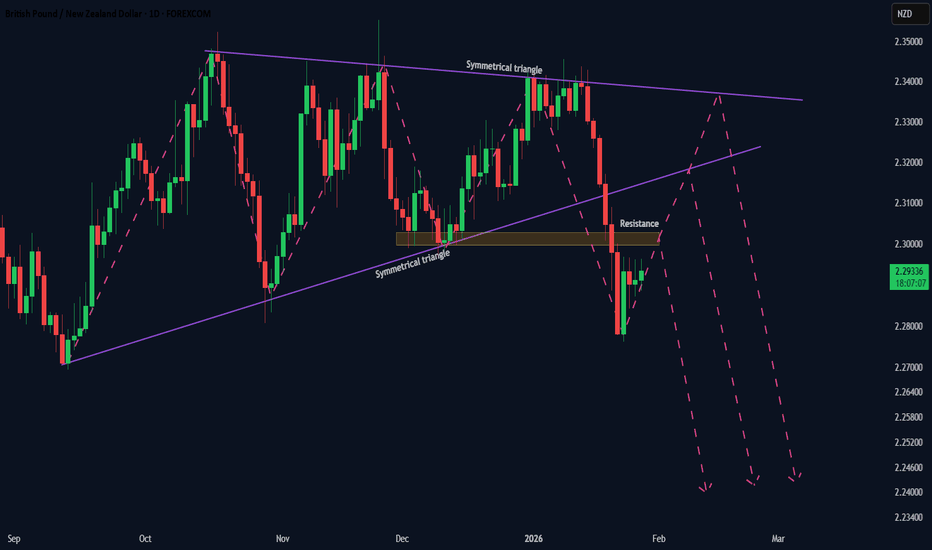

Market Pressure (Part 1) | Symmetrical Triangle Breakdown

Price previously developed inside a clear symmetrical triangle on the Daily chart, representing a prolonged phase of balance between buyers and sellers. That balance was resolved to the downside with a decisive breakdown, signaling that selling pressure has taken control . Price is now in a pullback phase , which is a natural behavior after a strong directional expansion. This is not a prediction — it is an observation of how market pressure interacts with structure after imbalance . 📉 Scenario Observations – Pullback Within Bearish Pressure Possible pullback paths while bearish pressure remains dominant: • pullback into prior resistance , then continuation lower • pullback toward the ascending trendline , followed by rejection • deeper pullback toward the descending triangle trendline , then continuation lower All three scenarios reflect corrective movement within a bearish pressure environment . ⚠️ Pressure Reassessment If price breaks and sustains above the descending trendline... Read more

Price previously developed inside a clear symmetrical triangle on the Daily chart, representing a prolonged phase of balance between buyers and sellers. That balance was resolved to the downside with a decisive breakdown, signaling that selling pressure has taken control . Price is now in a pullback phase , which is a natural behavior after a strong directional expansion. This is not a prediction — it is an observation of how market pressure interacts with structure after imbalance . 📉 Scenario Observations – Pullback Within Bearish Pressure Possible pullback paths while bearish pressure remains dominant: • pullback into prior resistance , then continuation lower • pullback toward the ascending trendline , followed by rejection • deeper pullback toward the descending triangle trendline , then continuation lower All three scenarios reflect corrective movement within a bearish pressure environment . ⚠️ Pressure Reassessment If price breaks and sustains above the descending trendline... Read more -

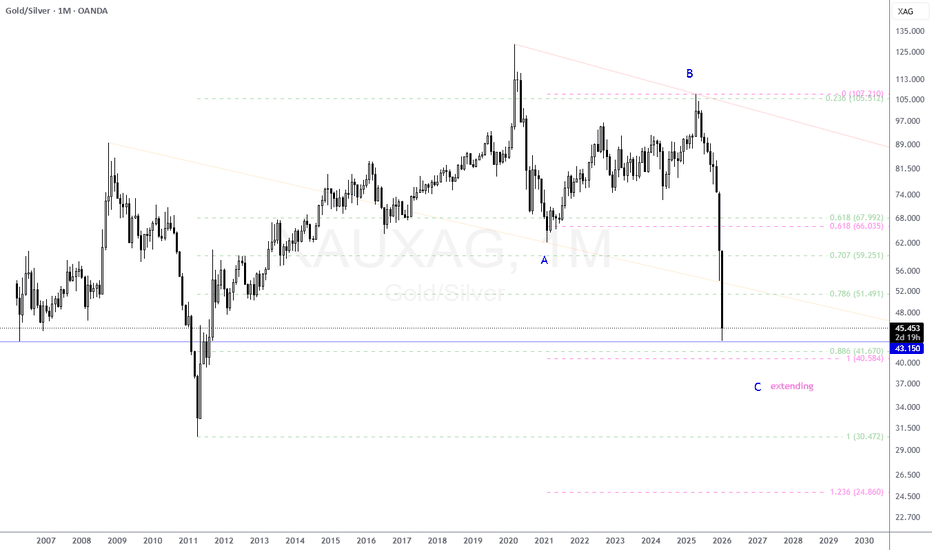

Gold/Silver Ratio (Monthly): ABC Correction in Progress — C-Wave

The Gold/Silver ratio on the monthly timeframe appears to be unfolding as a large ABC corrective structure, with Wave C currently in progress and potentially extending. Wave A completed with a sharp decline. Wave B retraced deeply but failed near long-term channel resistance and Fibonacci confluence. The recent impulsive selloff suggests C-wave continuation, not just noise. Key Level to Watch: 43.15 — prior major swing low and structural inflection zone. Holding above this level may allow stabilization or a complex pause. A decisive monthly close below 43.15 would strongly favor a C-wave extension, opening lower extension zones. This is a ratio chart, so moves reflect relative performance between gold and silver, not outright price direction. Structure will be reassessed as new data develops. Not financial advice.... Read more

The Gold/Silver ratio on the monthly timeframe appears to be unfolding as a large ABC corrective structure, with Wave C currently in progress and potentially extending. Wave A completed with a sharp decline. Wave B retraced deeply but failed near long-term channel resistance and Fibonacci confluence. The recent impulsive selloff suggests C-wave continuation, not just noise. Key Level to Watch: 43.15 — prior major swing low and structural inflection zone. Holding above this level may allow stabilization or a complex pause. A decisive monthly close below 43.15 would strongly favor a C-wave extension, opening lower extension zones. This is a ratio chart, so moves reflect relative performance between gold and silver, not outright price direction. Structure will be reassessed as new data develops. Not financial advice.... Read more -

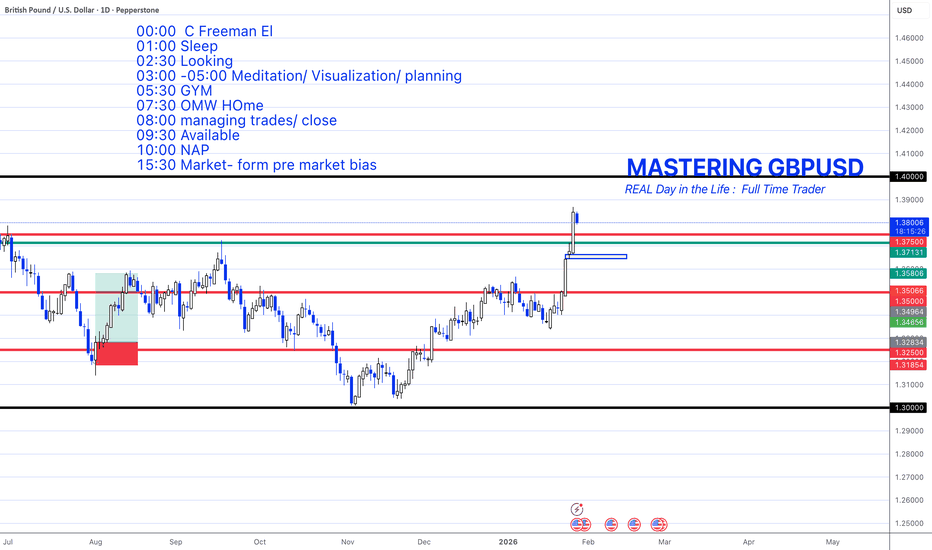

What a Trading Day Actually Looks Like (No Clickbait)

This idea breaks down a real trading day from start to finish without highlights or hype. No constant chart watching and no overtrading just structure and intention. We walk through how the day is organized including when the charts are reviewed how planning is done before price moves and why most of the day is intentionally quiet. This includes non trading routines like meditation gym time and stepping away from the screen so decisions are not made from fatigue or impulse. The focus is on building consistency through rhythm not intensity. Trading is treated like a professional practice not an all day reaction to every candle. Key takeaway If your day has no structure your trading will not either. Discipline outside the charts creates clarity on the charts. For educational purposes only not financial advice... Read more

This idea breaks down a real trading day from start to finish without highlights or hype. No constant chart watching and no overtrading just structure and intention. We walk through how the day is organized including when the charts are reviewed how planning is done before price moves and why most of the day is intentionally quiet. This includes non trading routines like meditation gym time and stepping away from the screen so decisions are not made from fatigue or impulse. The focus is on building consistency through rhythm not intensity. Trading is treated like a professional practice not an all day reaction to every candle. Key takeaway If your day has no structure your trading will not either. Discipline outside the charts creates clarity on the charts. For educational purposes only not financial advice... Read more -

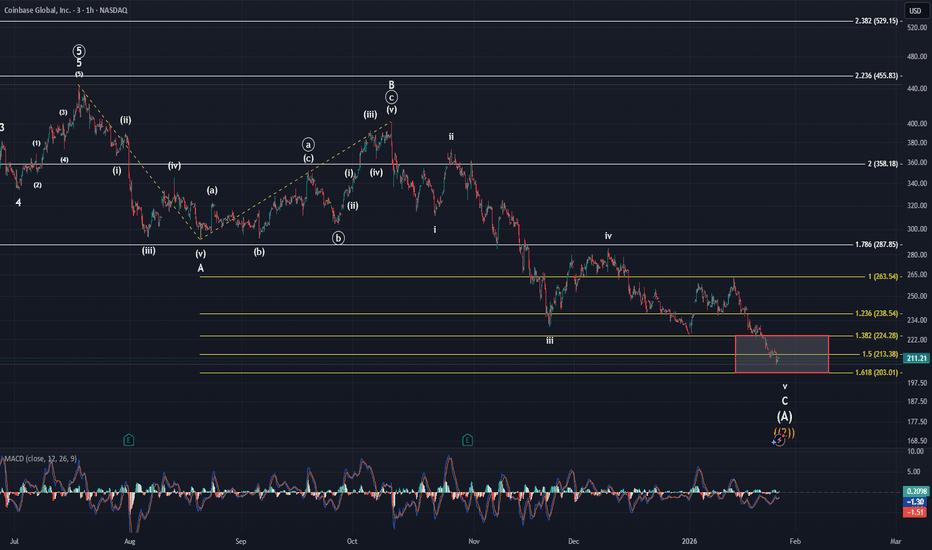

Coinbase

I'm sure I am starting to sound like a broken record in regard to Coinbase at this point and time. However, the signs that I am interpreting still maintain that the bottom is nearby. The structure gave us a little hood wink at the beginning of the month; however, we are now right in the area of the 1.618. This is the place that I said was possible for price to go to way back in October of last year. If you look at the correlation of price and MACD since August of 2025, you can see that price has been making lower lows while MACD has been making higher lows. This is a big glowing sign that the momentum to the downside is becoming very weak. Once that weakness finally breaks momentum should ideally shift to the upside. When price does move to the upside, we have two possible... Read more

I'm sure I am starting to sound like a broken record in regard to Coinbase at this point and time. However, the signs that I am interpreting still maintain that the bottom is nearby. The structure gave us a little hood wink at the beginning of the month; however, we are now right in the area of the 1.618. This is the place that I said was possible for price to go to way back in October of last year. If you look at the correlation of price and MACD since August of 2025, you can see that price has been making lower lows while MACD has been making higher lows. This is a big glowing sign that the momentum to the downside is becoming very weak. Once that weakness finally breaks momentum should ideally shift to the upside. When price does move to the upside, we have two possible... Read more -

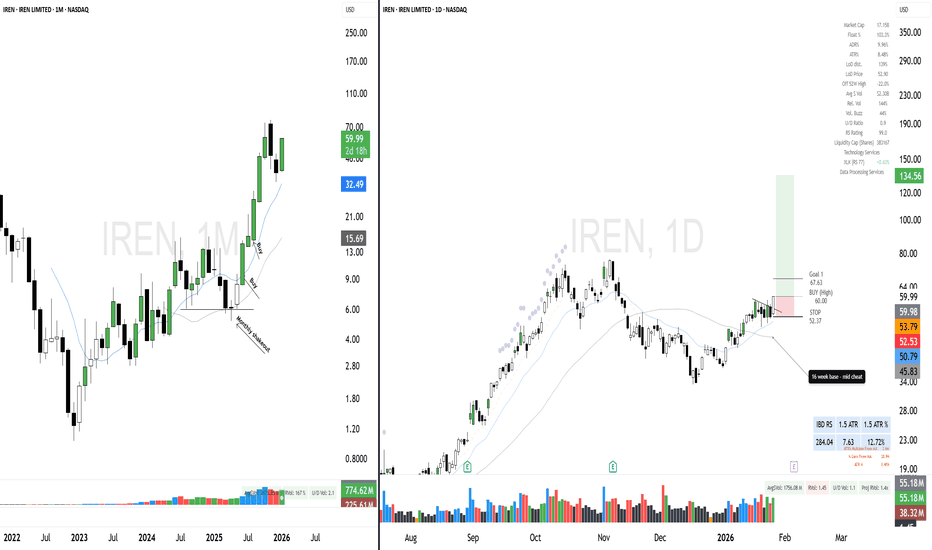

IREN: Bitcoin/AI Pivot – Mid Cheat Entry

The Setup: IREN (Iris Energy) is part of the strongest industry group right now (High Performance Computing / Bitcoin Mining). The stock has spent the last 16 weeks building a solid base, digesting its previous run. Technically, we are seeing a "Mid Cheat" entry. This is an early pivot within the base that allows us to get positioned before the stock challenges its all-time highs. The industry tailwinds are massive, and this consolidation looks ready to resolve to the upside. For aggressive traders: Watch AMEX:IRE (2x Leveraged ETF) for amplified exposure. Reasoning: Strong Industry/Sector (HPC / Bitcoin Mining) 16-Week Base (Solid structural support) Mid Cheat Entry (Early pivot point) Leverage Option: AMEX:IRE (2x ETF) for aggressive plays If Labelled a Swing trade(2-6 Week Holds) Entry: Full position on breakout (See Chart) Profit Taking: Sell 1/3 at Goal 1 Final Exit: Remainder at Goal 2 If labelled a long term trade... Read more

The Setup: IREN (Iris Energy) is part of the strongest industry group right now (High Performance Computing / Bitcoin Mining). The stock has spent the last 16 weeks building a solid base, digesting its previous run. Technically, we are seeing a "Mid Cheat" entry. This is an early pivot within the base that allows us to get positioned before the stock challenges its all-time highs. The industry tailwinds are massive, and this consolidation looks ready to resolve to the upside. For aggressive traders: Watch AMEX:IRE (2x Leveraged ETF) for amplified exposure. Reasoning: Strong Industry/Sector (HPC / Bitcoin Mining) 16-Week Base (Solid structural support) Mid Cheat Entry (Early pivot point) Leverage Option: AMEX:IRE (2x ETF) for aggressive plays If Labelled a Swing trade(2-6 Week Holds) Entry: Full position on breakout (See Chart) Profit Taking: Sell 1/3 at Goal 1 Final Exit: Remainder at Goal 2 If labelled a long term trade... Read more -

IndiGo – Watching for Potential RSI Positive Divergence Reversal

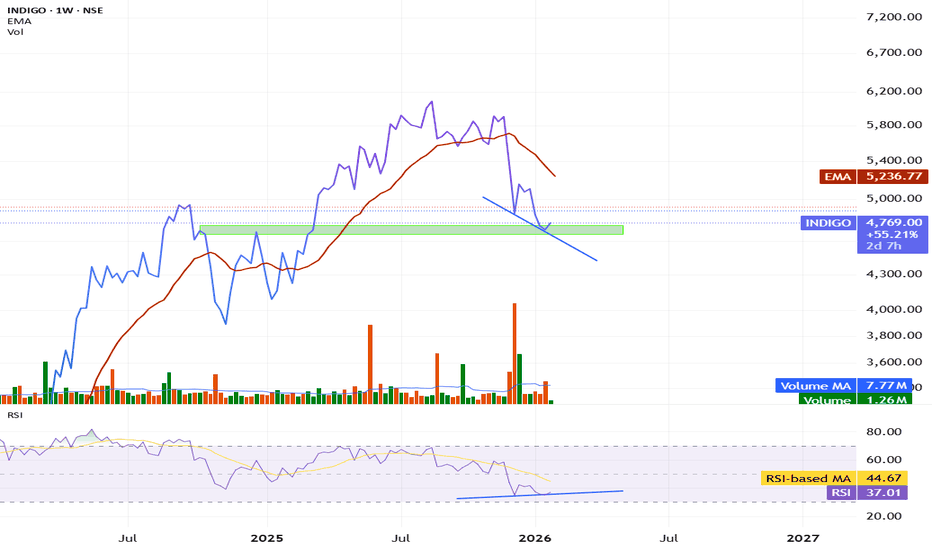

INDIGO is trading near an important weekly zone after a healthy corrective phase, with price currently around 4,769 and weekly RSI cooling off towards the lower band. The earlier decline was largely driven by the flight‑cancellation chaos and related news flow, but much of that impact now appears to be digested both in price and in recent results. On the weekly chart, price is still above the long‑term EMA but has meaningfully corrected from recent highs, bringing the RSI into a potential oversold / value zone. At the same time, a developing RSI positive divergence is visible – price is retesting a similar band while RSI is trying to form a higher low instead of making a new low. This structure often signals loss of downside momentum and the possibility of a medium‑term reversal, but confirmation is still pending and not yet complete. My view at this stage is anticipatory:... Read more

INDIGO is trading near an important weekly zone after a healthy corrective phase, with price currently around 4,769 and weekly RSI cooling off towards the lower band. The earlier decline was largely driven by the flight‑cancellation chaos and related news flow, but much of that impact now appears to be digested both in price and in recent results. On the weekly chart, price is still above the long‑term EMA but has meaningfully corrected from recent highs, bringing the RSI into a potential oversold / value zone. At the same time, a developing RSI positive divergence is visible – price is retesting a similar band while RSI is trying to form a higher low instead of making a new low. This structure often signals loss of downside momentum and the possibility of a medium‑term reversal, but confirmation is still pending and not yet complete. My view at this stage is anticipatory:... Read more -

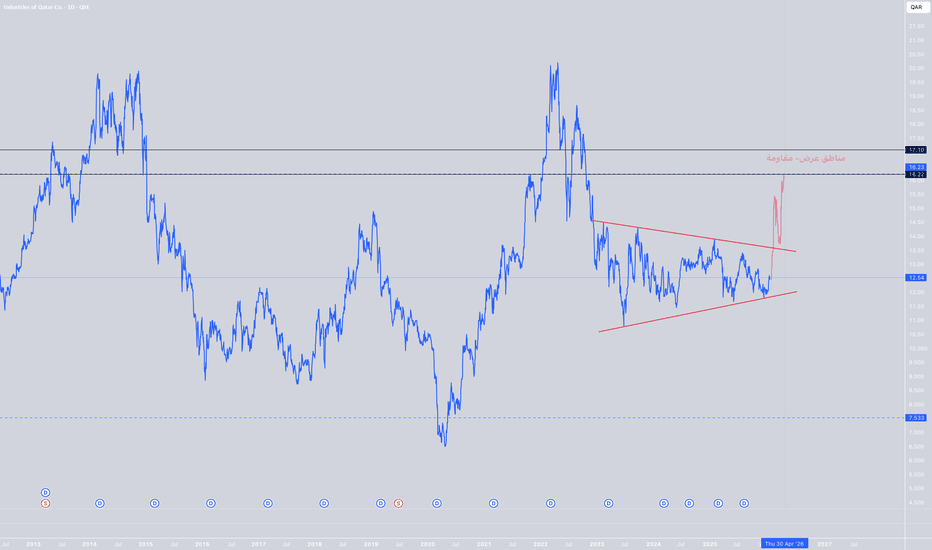

IQCD

Stock: Industries Qatar 🔹 Big Picture The stock has been in a broad sideways range since the 2022 peak. Price is currently moving inside a symmetrical triangle (higher lows + lower highs). This structure usually represents accumulation before a strong move. 🔹 Key Price Levels 🟥 Resistance / Supply Zones 16.20 – 16.30 Major resistance + upper boundary of the supply zone. 17.10 Very strong historical resistance (previous major peak). 🟩 Support Zones 12.20 – 12.40 Current support + lower boundary of the triangle. 11.00 – 10.80 Medium-term support. 7.50 – 7.60 Long-term historical support (only in a deep bearish scenario). 🔹 Expected Scenarios ✅ Bullish Scenario (Technically Favored) Clear breakout and weekly close above 16.30 Upside targets: 🎯 17.10 🎯 18.80 🎯 20.00+ (medium-term) 📌 Fits well with QGMD’s nature as a dividend + steady growth stock. ⚠️ Bearish Scenario Weekly close below 12.20 Downside targets: 11.00 Then 10.00... Read more

Stock: Industries Qatar 🔹 Big Picture The stock has been in a broad sideways range since the 2022 peak. Price is currently moving inside a symmetrical triangle (higher lows + lower highs). This structure usually represents accumulation before a strong move. 🔹 Key Price Levels 🟥 Resistance / Supply Zones 16.20 – 16.30 Major resistance + upper boundary of the supply zone. 17.10 Very strong historical resistance (previous major peak). 🟩 Support Zones 12.20 – 12.40 Current support + lower boundary of the triangle. 11.00 – 10.80 Medium-term support. 7.50 – 7.60 Long-term historical support (only in a deep bearish scenario). 🔹 Expected Scenarios ✅ Bullish Scenario (Technically Favored) Clear breakout and weekly close above 16.30 Upside targets: 🎯 17.10 🎯 18.80 🎯 20.00+ (medium-term) 📌 Fits well with QGMD’s nature as a dividend + steady growth stock. ⚠️ Bearish Scenario Weekly close below 12.20 Downside targets: 11.00 Then 10.00... Read more -

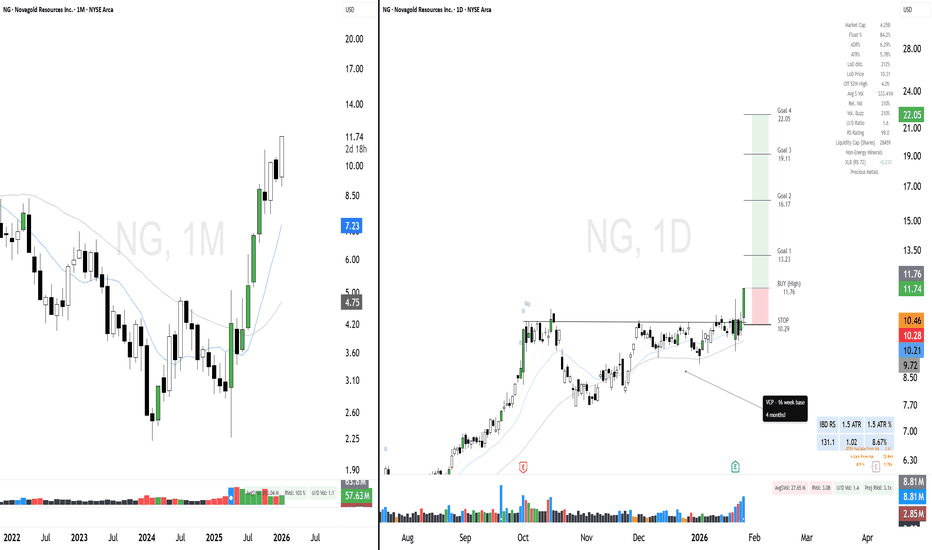

NG – Volatility Contraction Pattern (VCP)

The Setup: Gold is acting well, and the miners are starting to follow. NovaGold ( VANTAGE:NG ) is showing a classic Volatility Contraction Pattern (VCP). The price action has tightened up significantly (volatility drying up) from left to right, indicating that sellers are exhausted. We are now seeing a Breakout on Strong Volume. This volume surge is the "footprint" of institutional money stepping in to start the new trend. Reasoning: Strong Industry/Sector (Gold / Precious Metals) Volatility Contraction Pattern (VCP) - Supply drying up Breakout on Strong Volume (Institutional confirmation) Lagging sector now waking up If Labelled a Swing trade(2-6 Week Holds) Entry: Full position on breakout (See Chart) Profit Taking: Sell 1/3 at Goal 1 Final Exit: Remainder at Goal 2 If labelled a long term trade (3-12 Month Holds) Entry: Full position on breakout (See Chart) Profit Taking: Sell 1/4 to 1/5 at Goal 1 Exit Signal: Close... Read more

The Setup: Gold is acting well, and the miners are starting to follow. NovaGold ( VANTAGE:NG ) is showing a classic Volatility Contraction Pattern (VCP). The price action has tightened up significantly (volatility drying up) from left to right, indicating that sellers are exhausted. We are now seeing a Breakout on Strong Volume. This volume surge is the "footprint" of institutional money stepping in to start the new trend. Reasoning: Strong Industry/Sector (Gold / Precious Metals) Volatility Contraction Pattern (VCP) - Supply drying up Breakout on Strong Volume (Institutional confirmation) Lagging sector now waking up If Labelled a Swing trade(2-6 Week Holds) Entry: Full position on breakout (See Chart) Profit Taking: Sell 1/3 at Goal 1 Final Exit: Remainder at Goal 2 If labelled a long term trade (3-12 Month Holds) Entry: Full position on breakout (See Chart) Profit Taking: Sell 1/4 to 1/5 at Goal 1 Exit Signal: Close... Read more -

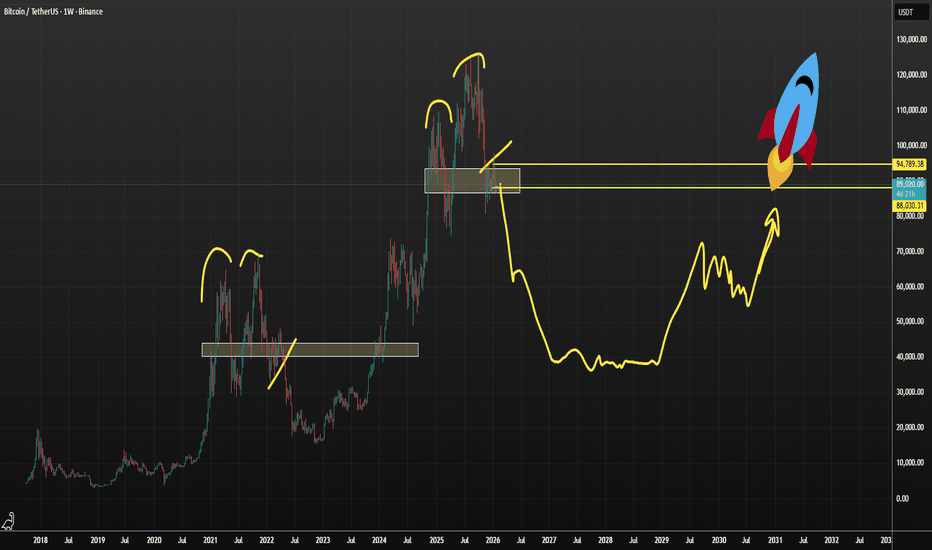

Crazy idea

Levels and distance in time are not to scale. I have no idea what the bottom would be or for how long the run would last but the pattern looks similar to me and if it will repeat we should see a big drop for a full bear run followed by a major rally... Read more

Levels and distance in time are not to scale. I have no idea what the bottom would be or for how long the run would last but the pattern looks similar to me and if it will repeat we should see a big drop for a full bear run followed by a major rally... Read more -

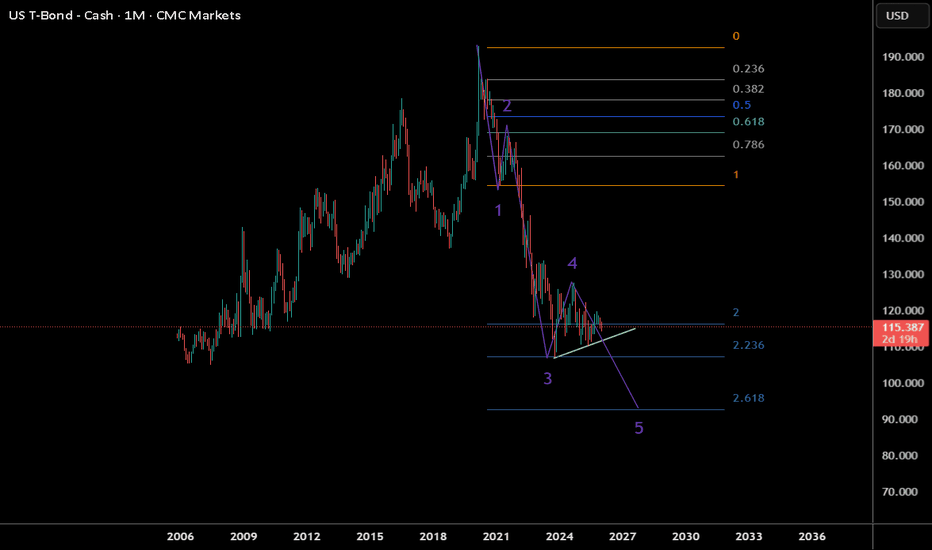

T bonds crashing

Since the Fed began easing policy and trimming the federal funds rate, short-term borrowing costs have indeed drifted lower as expected. However, long-term Treasury yields — like the 10- and 30-year — have stubbornly stayed high or even climbed, pushing bond prices down. That’s the opposite of what “textbook” rate cuts usually do, but markets aren’t textbook right now. The disconnect comes from the fact that Fed rate cuts only directly influence short-term rates, not the entire yield curve. Longer maturities reflect market expectations about inflation, growth, fiscal policy, government debt issuance and global demand for U.S. debt over decades — all of which can outweigh the effect of near-term Fed action. Investors remain concerned about persistent inflation above target, heavy Treasury supply, fiscal deficits and weaker foreign demand, so they’re demanding higher yields for long-dated bonds to compensate for those risks. A higher yield means a lower bond price,... Read more

Since the Fed began easing policy and trimming the federal funds rate, short-term borrowing costs have indeed drifted lower as expected. However, long-term Treasury yields — like the 10- and 30-year — have stubbornly stayed high or even climbed, pushing bond prices down. That’s the opposite of what “textbook” rate cuts usually do, but markets aren’t textbook right now. The disconnect comes from the fact that Fed rate cuts only directly influence short-term rates, not the entire yield curve. Longer maturities reflect market expectations about inflation, growth, fiscal policy, government debt issuance and global demand for U.S. debt over decades — all of which can outweigh the effect of near-term Fed action. Investors remain concerned about persistent inflation above target, heavy Treasury supply, fiscal deficits and weaker foreign demand, so they’re demanding higher yields for long-dated bonds to compensate for those risks. A higher yield means a lower bond price,... Read more -

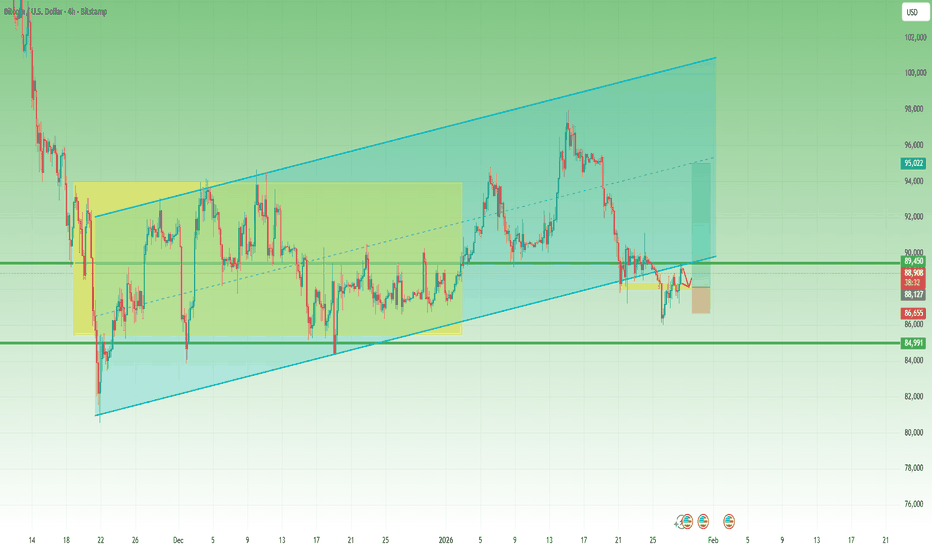

Bitcoin — Bearish Bigger Picture, But a Short-Term Reversal?

When it comes to the overall outlook for BTC, I remain far from optimistic and continue to hold a bearish bias on the medium to longer term. That said, markets move in waves — and based on last week’s price action, I’m now expecting a short-term upside reversal. 🔎 What Changed on the Chart After breaking below the flag formation that had defined price action since late November, BTC dropped into the 86k zone, where it formed a local low. What’s important is what happened next: - price reversed quickly - and moved back up to retest the broken flag structure Under normal circumstances, a clean break from a continuation pattern like this should lead to acceleration to the downside. The fact that this acceleration did not happen is, in itself, information. 👉 This behavior strongly suggests the possibility of a false break. ⚖️ Two Time Horizons, Two Different Biases... Read more

When it comes to the overall outlook for BTC, I remain far from optimistic and continue to hold a bearish bias on the medium to longer term. That said, markets move in waves — and based on last week’s price action, I’m now expecting a short-term upside reversal. 🔎 What Changed on the Chart After breaking below the flag formation that had defined price action since late November, BTC dropped into the 86k zone, where it formed a local low. What’s important is what happened next: - price reversed quickly - and moved back up to retest the broken flag structure Under normal circumstances, a clean break from a continuation pattern like this should lead to acceleration to the downside. The fact that this acceleration did not happen is, in itself, information. 👉 This behavior strongly suggests the possibility of a false break. ⚖️ Two Time Horizons, Two Different Biases... Read more -

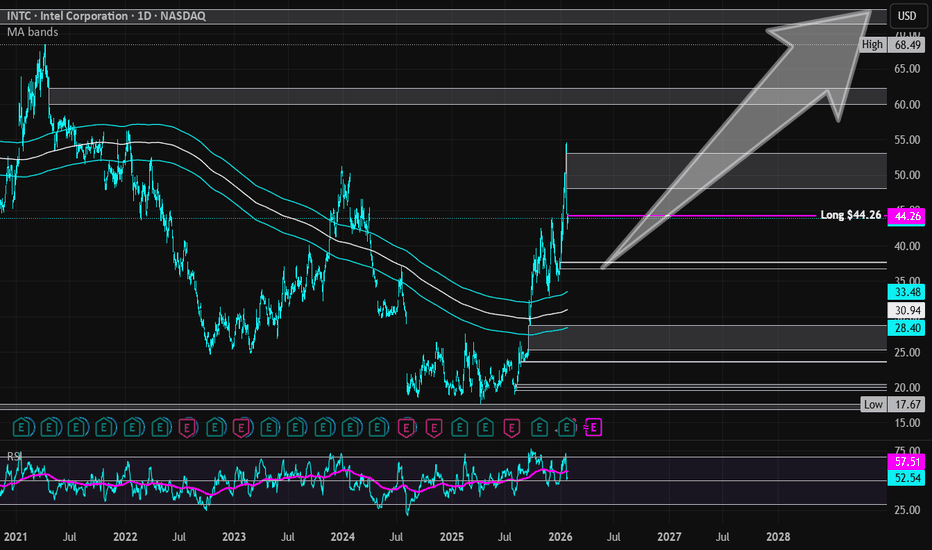

Intel Corporation | INTC | Long at $44.26

Entered Intel NASDAQ:INTC after-hours at $44.26. The US government is too heavily invested in this one to let it truely slide. The earnings / EPS projections show a likely major turnaround. Any dips are purely programmatic for entry (watch insiders and politicians . I may sound like a conspiracy theorist here, but a $8.9 billion investment from the US government is absolutely going to lead to major returns by 2028/2029. There is a major price gap a lot of people aren't seeing all the way back to the year 2000 between $71.38 and $73.44. That's my main target. And, like dot-com crash, it may go further until.... So, in the near-term, there could be weakness and a dip to retouch the historical average band ($30's - another entry). But my outlook is longer. And, given the need for chips and the government wanting a major return on their investment, I... Read more

Entered Intel NASDAQ:INTC after-hours at $44.26. The US government is too heavily invested in this one to let it truely slide. The earnings / EPS projections show a likely major turnaround. Any dips are purely programmatic for entry (watch insiders and politicians . I may sound like a conspiracy theorist here, but a $8.9 billion investment from the US government is absolutely going to lead to major returns by 2028/2029. There is a major price gap a lot of people aren't seeing all the way back to the year 2000 between $71.38 and $73.44. That's my main target. And, like dot-com crash, it may go further until.... So, in the near-term, there could be weakness and a dip to retouch the historical average band ($30's - another entry). But my outlook is longer. And, given the need for chips and the government wanting a major return on their investment, I... Read more -

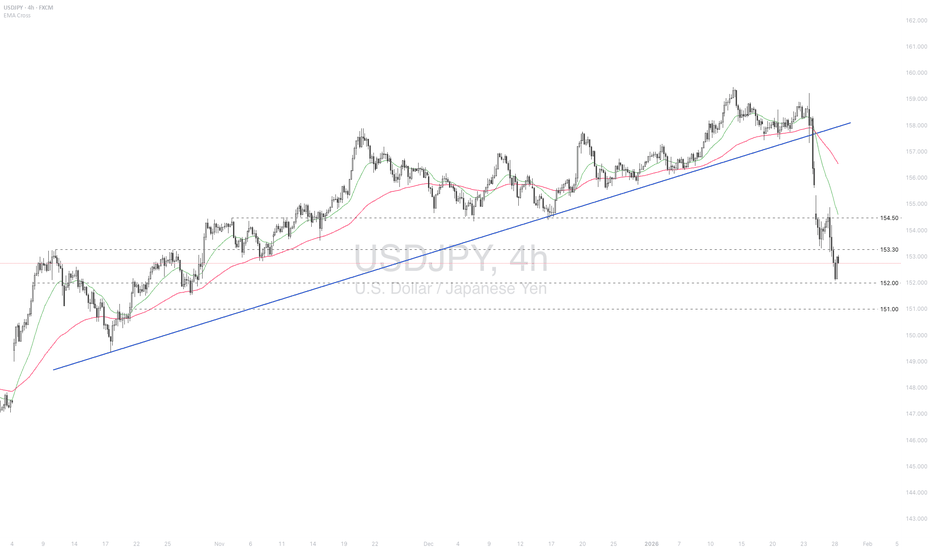

USDJPY slid on US uncertainty and Japan’s intervention risk

< Fundamentals > The dollar-yen continued to weaken amid speculation of intervention, weighing on sentiment. Meanwhile, the BoJ Dec meeting minutes revealed that the board anticipates several rate hikes to reach the expected neutral rate, though the pace will remain gradual and data-dependent. Concerns over intervention and the broader weakening of the US dollar remain to support the yen. USDJPY breached above 154.50 but failed to hold above the level and fell below 153.30. Diverging bearish EMAs indicate a downtrend extension potential. If USDJPY breaks below 152.00, the price may retreat further toward the next support at 151.00. Conversely, returning above 153.30 may lead to an advance toward the subsequent resistance at 154.50.... Read more

< Fundamentals > The dollar-yen continued to weaken amid speculation of intervention, weighing on sentiment. Meanwhile, the BoJ Dec meeting minutes revealed that the board anticipates several rate hikes to reach the expected neutral rate, though the pace will remain gradual and data-dependent. Concerns over intervention and the broader weakening of the US dollar remain to support the yen. USDJPY breached above 154.50 but failed to hold above the level and fell below 153.30. Diverging bearish EMAs indicate a downtrend extension potential. If USDJPY breaks below 152.00, the price may retreat further toward the next support at 151.00. Conversely, returning above 153.30 may lead to an advance toward the subsequent resistance at 154.50.... Read more