-

Investment Newsletter

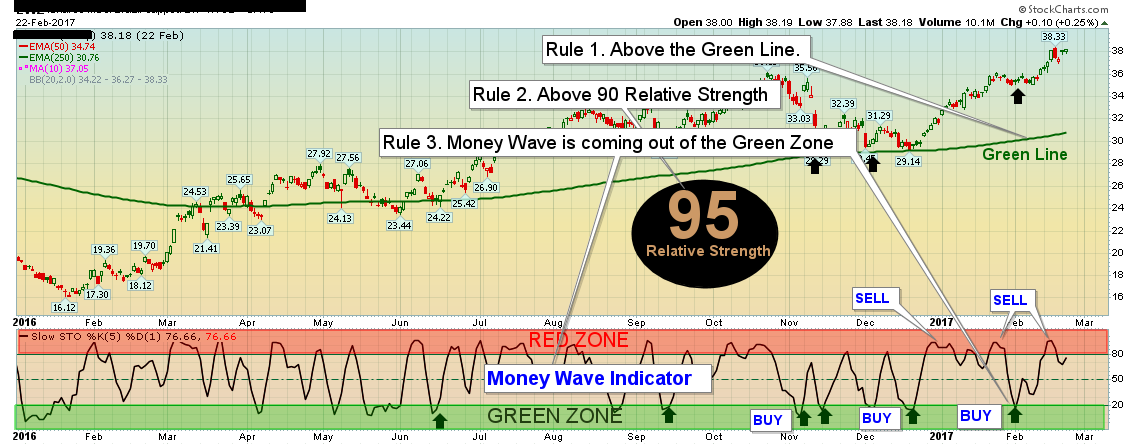

#1 Public Site at Stockcharts.com. The Green Line System can help you make more Money in the Stock Market! We Buy the Strongest Stocks & ETFs on … Continue Reading…

Stock of the Week (TPOW)

The Weekly Stock Pick strategy from Above the Green Line focuses on selecting stocks with a high SCTR (StockCharts Technical Rank) rating above 90, breaking out of the Green Zone, and showing strong trading volume. This approach identifies high-probability trades that are positioned for short-term gains, aiming to sell by Friday or when the stock achieves a 8% profit.[More]

Dynamic Charts

Dynamic Charts from Above the Green Line deliver real-time technical views with Green Zone indicators, SCTR rankings, and price momentum overlays. These charts help identify optimal buy/sell points and monitor swing setups. Updated throughout the day, they support precision trading for active investors looking to capitalize on technical patterns with confidence and discipline.[More]

Real-Time Trade Alerts

Stay ahead of the market with real-time Buy and Sell alerts based on the Green Line strategy. Our system monitors momentum, breakouts, and volume to notify you of high-probability trading opportunities—right when they happen. [More]

Stay ahead of the market with real-time Buy and Sell alerts based on the Green Line strategy. Our system monitors momentum, breakouts, and volume to notify you of high-probability trading opportunities—right when they happen. [More]