Short Selling

By Author

Updated February 8, 2024

What is Short Selling?

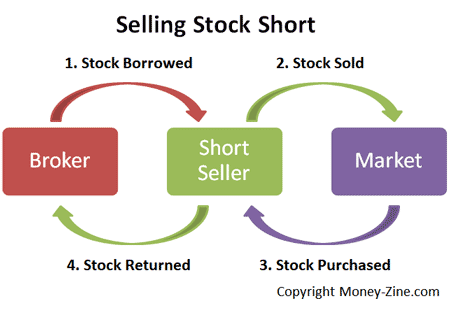

Short selling is somewhat of an untraditional method of investing that allows investors to profit from securities when they decrease in value. This method of investing is considered quite advanced and should only be undertaken by experienced traders and investors. To short sell, an investor or trader borrows shares of a security that they believe will decrease in value by a predetermined date. The investor then sells the borrowed shares to buyers who are willing to pay the current market price. By the predetermined expiration date of the lending period, the investor is obligated to return the borrowed shares to the lender. At this point, the investor hopes to purchase the shares back at a lower cost and accrue a profit. In order for someone to short sell, an investor must have a margin account. A margin account is a brokerage account where the broker lends their customer money so they can purchase securities. Loans from margin accounts come with periodic interest rates, thus when a short seller is buying back their shares, they must take into consideration the interest of their loan before calculating their profits or losses. Usually, the broker also handles locating the shares and setting the end date of the loan.

Should You Short Sell?

Profitability

This condensed version of short selling makes the process sound fairly simple. You may be wondering why engaging in short selling is not as common for investors as owning a stock. This is because the risks associated are fairly high. Generally, investors purchase stocks that they expect to rise in the future due to the nature of the market. In the long term, the market has historically risen while experiencing small periods of decline. The profitability of short selling usually comes alongside those small periods of decline. If an investor feels confident that a security will drop in price in the near future, short selling becomes a profitable option. In the short term, short selling is a manner of profiting while other investors are watching their portfolios bleed. For example, let’s say stock X is valued at $70.00 and an investor believes that it will drop in price within the next three months. The investor then borrows 100 shares of stock X from a brokerage and sells them to another investor. If the stock drops from $70.00 to $50.00 after three weeks, the investor may decide to buy 100 shares to return to the broker. Not including the interest of the loan, the investor would walk away with $2,000 of profit. The profits gained from short selling can be massive and enticing, yet so can the losses. If stock X instead rose to $80.00, the investor would take a loss of $1,000 and additionally have to pay interest on their loan.

Risks

Short selling can be an incredibly profitable investment decision, but it also carries a risk of great loss. Unlike purchasing shares of stock, investors who short sell can lose more than what they paid for their investment. This means that the losses for an investor who shorted a stock are practically infinite while the losses of an investor who purchased shares of a stock are limited. Additionally, short selling involves borrowing funds which in turn requires opening a margin account. On top of having to pay interest on the loan, an investor has to meet the minimum maintenance requirement of 25%. A maintenance requirement is the minimum amount of funds an investor must maintain within their margin account. If an investor’s account dips below the 25% minimum, a margin call may be forced upon their account. Another risk lies in the trading volume of the stock. If a stock is being actively traded, the investor who shorted it may find themselves having trouble buying back the number of shares loaned to them. If there are many investors who shorted one stock, an influx of buybacks may actually raise the price of the stock. This predicament is referred to as a short squeeze. The last and perhaps most unfortunate risk a short seller may experience is shorting a stock at the wrong time. A stock might have a high probability of dropping in price, but it might not happen within the time period that an investor may expect it to. As such, an investor may short a stock that doesn’t decline before the end date of their loan. Even if the investor does not suffer a loss, they are subjected to the interest rates of the margin account.

Conclusion

Overall, short selling has the potential to provide investors with quick, large profits, yet may also result in quick, large losses. If you are thinking about shorting a financial instrument, be certain to weigh the risks associated. As previously mentioned, the losses from short selling are practically infinite. In accordance with this, short selling is not for everyone and should only be attempted by experienced investors.