Multiple Time Frame Strategy

By Author

Updated October 2, 2024

What is Multiple Time Frame Analysis?

The multiple time frame investment strategy can best be defined as an approach that examines securities at different intervals of time. A security is any financial instrument that holds monetary value. It can be a stock, bond, currency pair, etc. When using multiple time frame analysis, an investor will typically examine three or more different periods of time; any less than this can result in a considerable loss of data. Generally, analysts believe that the more intervals surveyed, the more reliable the data. However, when it comes to exactly what intervals should be surveyed, it varies.

How to Use

How one employs multiple time frame analysis depends entirely on the investor’s strategy. For instance, a long term trader might examine data over weeks to months while a swing trader may focus on weekly or daily charts to identify short term trends. A day trader may identify short term trends using minute charts that can range from 15 to 240-minutes. There are many ways an investor can utilize this approach. Commonly, once an investor decides upon their desired holding period they will settle into their choice and seldom think to change it. While stability can be beneficial, being unable to consider a change in methodology can cause one to overlook the bigger picture. On the other hand, switching from time frame to time frame impulsively is often unwise. It is important to find a middle ground between these two extremes and consider data from a multitude of time frames.

The Significance of the Time Frame Scale

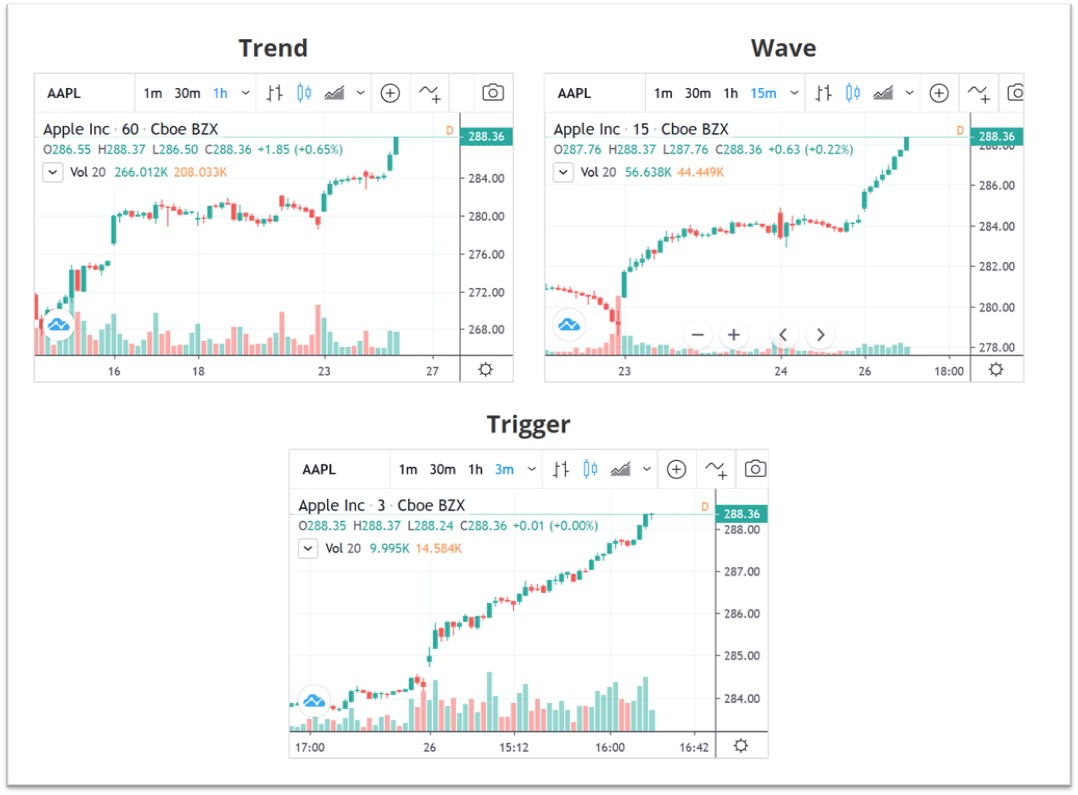

As seen in the image below, security can be examined over a long and/or short period of time. Here, we will discuss the meaning and importance of the examination of a range of time frames from long to short-term. Examining a long-term time frame will provide the dominant trend. It is commonly advised to trade in the direction of the dominant trend for results with a larger expectation of profit. Nevertheless, one could still trade against the dominant trend. The fundamentals of fundamental analysis, as discussed in a prior article, have a large impact on the direction of the trend and should be frequently observed. Additionally, interest rates are another component to monitor when utilizing a long-term time frame as they are crucial to determining financial instruments such as the exchange rate.

Out of the three, the medium-term time frame is the most flexible due to the fact that it has components of both long-term and short-term frequencies. When observing this time frame, one is able to zoom in on the broader, dominant trend and thus smaller components come to light. Applying the medium-term time frame is particularly significant as one should plan their trade at this stage.

Lastly, the short-term time frame is the point of action. While examining this time frame, price fluctuations become increasingly more clear. Due to this, a trader is able to better choose a point of entry. It is important to note that fundamental components and economic indicators do play a role in this time frame, but one that is very short-term. The narrowness of this particular examination causes the role of fundamentals to appear grand and volatile, but normally the changes they create do not stick around for too long. However, it is still imperative one observes them as a trader should avoid making decisions during a temporary imbalance.

From long to short-term, each time frame has its benefits that are crucial when it comes to participating in a trade. When all three of the time frames are considered and employed correctly in the evaluation of securities, the probability of success for a trader improves significantly.

Key Takeaways

Overall, applying multiple time-frame analysis can greatly improve the outcome of a trade. Settling into a specified comfort zone is more than likely of no benefit to a trader. Multiple time frame analysis provides a comprehensive view of security trade that will result in a larger profit target for a trader.