The Markets are down again today, on low Holiday Volume. Not much Selling, and the The S&P could be back in the Green Zone for a bounce soon.

Leaders are no longer Over-bought. The Strongest Leaders are coming back down into the Green Zones for a bounce soon. Only Buy Investments that made fresh New Highs. The Reward / Risk ratio of investing now is poor, so please do not Buy then unless you are VERY NIMBLE, as the Leaders are still Way Above the Green Lines.

We are waiting for the S&P 500 to correct back down near the Red Line (50-day avg.) to set up for a good bounce.

[s_static_display]

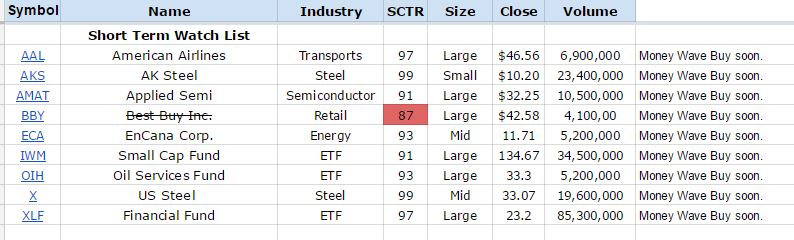

Money Wave Buys soon!

The Following Investments will probably have a Money Wave Buy Signal

(Slow Stochastic Closing > 20) on today’s Close.

Many Money Wave Buys setting up for next week (See Chart Above). NONE Today

SELLS

Exit CLF if it is going to Close below $8.41.

Exit TECK if it is going to Close below $20.13 Support.

EXIT NBR if it is going to Close below the Pink Line of $16.29.

EXIT VALE if it is going to Close below $7.90.

ON DECK: See List Above. We will email or text when they are ready.

Click for WATCH LIST

Click for STOCKCHARTS LIST

Click for OPEN POSITIONS

Many like to buy the day before, if the Investment has not popped up too much.

Money Wave Buys are usually good for a 3-6 % move in a few days.

About 1/3 of the time, the Money Wave Buys will result small losses, so please use a Sell Stop Loss after all Buy orders.