By ATGL

Updated September 25, 2025

In today’s stock market, prices can flicker and change in the blink of an eye. For retail investors, this rapid pace can seem chaotic, driven by invisible forces moving faster than human thought. That invisible force is often High-Frequency Trading (HFT), a dominant but poorly understood aspect of modern finance—where trades execute in microseconds and physical proximity to an exchange’s servers can decide the edge.

This guide demystifies HFT for retail traders: what it is, how it works, and—most importantly—how it affects your experience. Understanding this high-speed ecosystem is essential for navigating modern markets and complements broader research you might already follow in our market insights.

What Is High-Frequency Trading (HFT)?

High-Frequency Trading is a form of automated trading that uses powerful computers and sophisticated algorithms to fire off vast numbers of orders at extreme speeds. Positions are held for fractions of a second; the goal is to capture tiny price discrepancies and repeat that edge at scale. The model differs from standard algorithmic strategies by prioritizing raw speed, ultra-short holding periods, and exceptionally high order-to-trade ratios.

HFT is dominated by large institutions—investment banks, proprietary trading firms, and quantitative funds—that invest heavily in infrastructure for a microsecond advantage. For retail traders, the takeaway isn’t to “compete on speed,” but to understand how that speed shapes quotes, spreads, and intraday volatility.

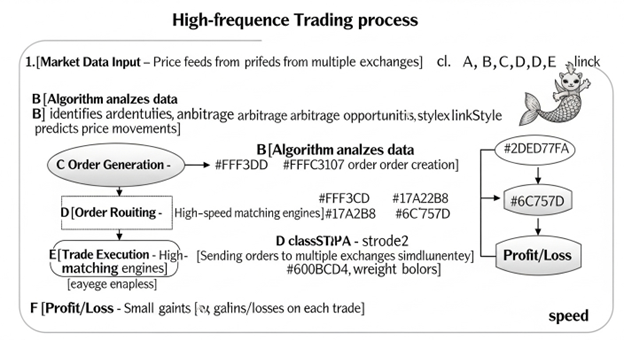

How High-Frequency Trading Works

The mechanics of HFT revolve around two pillars: quantitative algorithms and ultra-low-latency infrastructure.

Algorithms and computation. Quant models scan price changes, order-book depth, and cross-venue quotes for fleeting inefficiencies. Orders are generated, routed, and executed without human intervention. Because opportunities can vanish in microseconds, firms deploy high-performance servers tightly integrated with exchange gateways.

Ultra-low latency. Latency—the time it takes data to travel and orders to reach the matching engine—is minimized through co-location (placing servers in the same data center as the exchange), microwave links, tuned network stacks, and lean hardware paths. Every component is optimized to shave microseconds.

A simple illustration. If an algorithm detects a large buy order forming, it may buy first, anticipating a near-instant uptick, then exit as the price adjusts. Detection, execution, and unwind can all occur faster than a blink, and the edge disappears just as quickly.

Common HFT Tactics (Market Making, Arbitrage, Sniping)

HFT strategies are proprietary, but most fall into familiar buckets:

- Market Making. Posting both bids and offers to earn the spread while providing liquidity. At scale, thousands of tiny spread captures add up and help tighten the market for everyone.

- Arbitrage. Exploiting temporary cross-venue or cross-product mispricings (e.g., NYSE vs. Nasdaq quotes drifting for a few microseconds). Rapid arbitrage tends to realign prices quickly.

- Sniping and order-flow prediction. More controversial: modeling the likelihood and path of large orders, briefly getting in front of them, and exiting as prices adjust. This often involves high cancel-replace activity and can sharpen the short-term game around visible liquidity.

Pros And Cons Of HFT In Modern Markets

HFT’s impact is double-edged.

Liquidity & spreads. Continuous quoting can deepen order books and narrow bid-ask spreads, lowering transaction costs and improving fill probability for most participants.

Fairness & instability. Access to co-location and speed-sensitive tech can tilt the field toward large players. In stressed moments, synchronized algorithms may withdraw or flip behavior at once, amplifying volatility—an ingredient in several modern “flash-like” events.

For retail traders, the right takeaway is not alarm but context: HFT improves day-to-day execution quality in stable conditions while sometimes heightening short-term noise. Aligning your approach with sound investment strategies helps you benefit from the former and sidestep the latter.

How HFT Affects Retail Traders

HFT shapes your execution experience even if you never run an algorithm.

Order quality. Deeper books and tighter spreads often mean faster fills near displayed prices. That’s the upside.

Slippage. In fast markets or larger orders, algorithms detecting emerging demand can edge prices away from you by a cent or two before your trade completes. The effect per trade is small but can accumulate.

What Retail Traders Can Do to Minimize Disadvantage

• Use Limit Orders. Define your worst acceptable price to control slippage during fast moves.

• Avoid the most volatile windows. The first/last 30 minutes often feature the most churn and HFT sensitivity.

• Break up larger orders. Smaller slices are less likely to telegraph intent to models that infer order size.

These habits won’t out-speed HFT; they render its advantages less relevant to your outcomes and keep your fills aligned with plan.

Regulation And The Future Of HFT

Safeguards like limit-up/limit-down bands and market-wide circuit breakers were designed to curb runaway moves and restore orderly trading. Debate continues around ideas such as “speed bumps” or fees that discourage excessive cancel-replace traffic. Meanwhile, exchanges experiment with queueing rules and order types to balance fairness and efficiency.

On the horizon, faster hardware and smarter models (AI-assisted and beyond) will keep raising the bar. Expect regulation and market design to iterate alongside that arms race—nudging incentives toward resiliency, even as speed remains central to competition.

Making Informed Investment Decisions

HFT is now part of the market’s fabric. You don’t need to beat it on speed; you need to operate on a time frame where speed is a rounding error. Lean on process, risk control, and clear objectives. Tight spreads and abundant liquidity are advantages when you trade deliberately; short-term noise is manageable when you set price boundaries and avoid the most chaotic windows.

For deeper orientation beyond HFT specifics, join Above The Green Line and revisit our broader market insights, explore foundational investment strategies, and, if you’re curious about systematic ideas at a human time scale, scan algorithmic strategies that don’t depend on microseconds. The right mix of strategy, discipline, and time horizon keeps you in control—even in a market shaped by speed.