Fundamental Analysis vs. Technical Analysis

By Author

Updated February 8, 2024

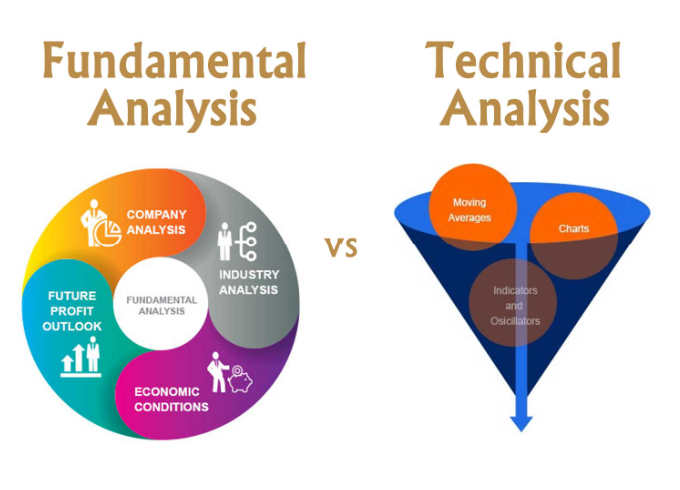

When it comes to investing your money, it is important to have a grasp of the basic schools of thought: fundamental analysis and technical analysis. Both approaches differ greatly from one another, yet both are immensely useful depending on your interests and goals.

Fundamental Analysis

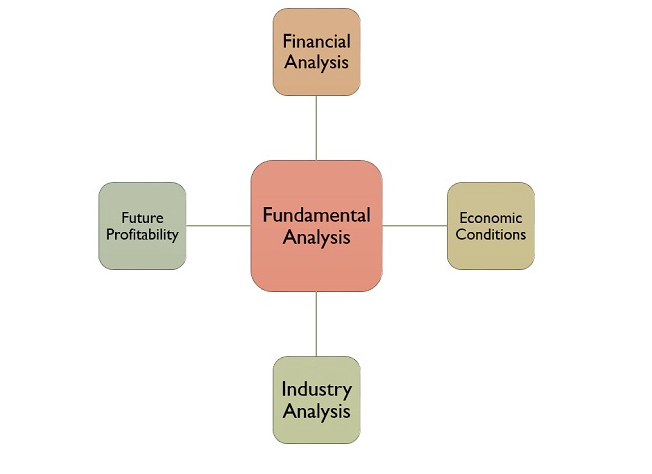

Fundamental analysis is named as such because it thoroughly examines a set of basic economic factors, also known as fundamentals, that impact the stock price of a company in the future. Fundamental factors include financial statements, management processes, industries, competitions, business concepts, etc. There are three phases of analysis: the economy, the industry, and the company.

The analysis of the economy examines the general economic condition of the country using economic indicators, the industry is inspected to determine its industry classification in relation to its competitiveness and life cycle, and the company is analyzed to determine whether to buy, hold, or sell based on the financial and non-financial characteristics of the firm. This particular form of analysis is an approach to investment that does not consider short term pricing or trading swings, rather, it is a long term investment strategy. Ultimately, the goal of this form of analysis is to provide the intrinsic value of a stock, gathered by considering both past and present statistics concerning the fundamental factors.

Technical Analysis

Key Differences, 13 Aug. 2019, keydifferences.com/difference-between-fundamental-and-technical-analysis.html

Similarly to fundamental analysis, technical analysis aims to determine the future price of a stock. However, technical analysis examines differing data and has a varying purpose. Focusing solely on past data, technical analysis considers charts, trends, and patterns to predict the price movements of a share in the near future. This process does not evaluate the company itself, but rather it examines the market activity surrounding the investment. Technical analysis considers the price history of the share, trading volumes over time, industry trading trends, and the width of the change in price. After employing this approach to analysis, the reasons why the price of a share changes become abundantly clear. Thus, the methodology of technical analysis aims to ultimately identify the right time to exit or enter the market and is relevant for only short term investment strategies and trading.

Key Differences

Fundamental and technical analysis differ in many ways, but there are a few key differences that are important to know. As previously stated, fundamental analysis is concerned with aiding long term investment strategies, while technical analysis is utilized for short term trading strategies. The purpose of fundamental analysis is to determine the intrinsic value of a stock, while technical analysis aims to determine when to enter and exit the market.

Which One Is For Me?

Which methodology should you utilize? Well, that depends on a variety of components. For one, if you are an investor you should consider employing fundamental analysis as the process heavily relies on understanding the underlying value of a company which will ultimately drive returns. If you are a trader, you might want to apply the methodology of technical analysis as it examines recent past data to attain near future data and therefore can accurately pinpoint the right time to enter and exit the market. Don’t know if you want to be a trader or an investor? Consider the time commitment. As an investor, you will make long term investments but the effort in maintaining them is little to none. As a trader, you will make short term investments that require frequent and active participation to maintain them. Overall, both fundamental and technical analysis both have their benefits, and when used correctly, are profitable approaches.

Follow the Rules: Above the Green Line + Above 90 Relative Strength

[…] still trade against the dominant trend. The fundamentals of fundamental analysis, as discussed in a prior article, have a large impact on the direction of the trend and should be frequently observed. Additionally, […]