By ATGL

Updated March 2, 2025

The retention ratio, sometimes called a plowback ratio, stands as a critical financial metric used to assess a company’s approach to distributing earnings. It quantifies the proportion of net income retained for reinvestment within the company, rather than disbursed as dividends paid out to shareholders.

This important metric offers deep insights to both investors and analysts, shedding light on a company’s growth prospects, operational tactics, and even future stock performance. Proficiency in comprehending the retention ratio is imperative for making well-informed investment choices.

The Role of Retention or Plowback Ratio in Stock Performance

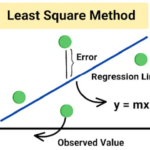

The retention ratio isn’t just a number or ratio percentage, it’s a narrative about a company’s growth ideology. It mirrors a firm’s preference for fuelling its future over appeasing shareholders with immediate rewards. The following is the retention ratio formula:

Retention Ratio = (Net Income – Dividends Distributed) / Net Income,

This ratio is especially crucial in understanding how a company disburses dividends to shareholders and manages its profits, which in turn influences its stock prices. However, its significance extends beyond mere calculation; the context of industry standards, market conditions, and the company’s specific growth stage makes interpreting this ratio more complex and enlightening.

What Does High Retention Mean for a Company’s Growth?

High retention rates, or reinvestment rates, typically characterize companies in aggressive growth phases, particularly in innovation-driven sectors like technology. This implies a strategic choice by management to reinvest earnings in areas like research and development, market expansion, or product diversification. Such reinvestment is often a precursor to future profitability, potentially leading to an appreciating stock value.

However, it’s crucial to discern whether this reinvestment effectively drives growth or is merely a hoarding of capital. The true value of a high retention ratio lies in its ability to translate retained earnings into tangible, value-creating projects that enhance long-term shareholder value.

What Does Low Retention Mean for a Company’s Profitability?

Conversely, a diminished retention ratio is frequently observed in well-established, mature companies (e.g. blue chip companies, utilities, etc.). This type of ratio points to a proclivity for allocating a larger slice of profits as dividends, hinting at stable or potentially sluggish business growth trajectories.

While this dividend-centric approach may allure investors in search of consistent income, it often sparks inquiries about the company’s forthcoming growth potential and its capacity to channel resources into innovation or expansion. A low retention ratio may signal either the company’s strong financial foundation, reflected in a higher dividend per share, or a lack of enticing investment opportunities for future progress.

What Does a Negative Ratio for Retention Mean?

A retention ratio dips into negative territory when a company disburses dividends surpassing its earnings, resulting in a deficit. Such a negative retention ratio can raise concerns, often suggesting that a company is paying out more in dividends than it’s making in net income.

While this could be a tactic to retain investor trust during challenging periods, it might also indicate concealed financial difficulties or a disconnect between earnings and shareholder rewards. Grasping the underlying causes of a negative retention ratio demands a thorough examination of the company’s overall financial health, market position, and strategic course.

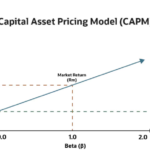

How To Determine a Company’s Growth Rate and Performance

Assessing a company’s potential for long-term growth involves an intricate blend of fundamental and technical analyses across multiple time frames. Beyond basic financial metrics like EPS and share price, a deeper exploration into factors like revenue growth, ROIC, and market position is vital. Additionally, the sustainability of performance and potential for future business expansion are crucial.

Health metrics play a pivotal role here, offering insights into a company’s capability to maintain and grow its market position, innovate, satisfy customers, and efficiently manage internal processes. Alongside all of this, it’s always important to keep a close eye on the general economic environment and assess the potential impacts of major players like the Federal Reserve on market dynamics.

Find Profitable Dividend Payout Ratio and Top Performance Stocks

The dividend payout ratio is crucial for dividend growth investors, representing the percentage of earnings paid out as dividends. An ideal dividend payout ratio is often considered to be in the 40-60% range. This range indicates a healthy balance between distributing profits to shareholders and reinvesting for future growth. Companies with such a payout ratio, especially those with a history of consistent dividend increases, are often attractive to investors seeking stable income and growth potential.

For those seeking to balance growth prospects with dividend returns, understanding the retention ratio is essential. However, there’s no one-size-fits-all approach to determining the ideal payout ratio. In some cases, you may simply want to maximize dividend returns, while in others you may prefer to reinvest earnings for future growth. For more information about maximizing dividend returns, check out our Dividend Growth Strategy to learn how to find top-performing stocks with strong dividend growth and consistent returns.