Stock Ideas and Market Analysis

The Stock ideas and Market analysis presented below are generated by 3rd Party news feeds. Its a collection of articles, reports, and insights from industry-recognized third parties such as S&P Capital IQ, Dow Jones, and Credit Suisse. These resources provide a wealth of information on a broad range of stocks, ETFs, and investment strategies. You can access a variety of helpful tools and resources, like interactive charts, to help you validate new ideas. Our goal is to offer a centralized hub for individuals seeking timely and relevant information on key topics that can potentially impact markets and trading ideas. The ideas do NOT necessarily follow the Green Line Method for investing. If interested in learning more join Above the Green Line today.

-

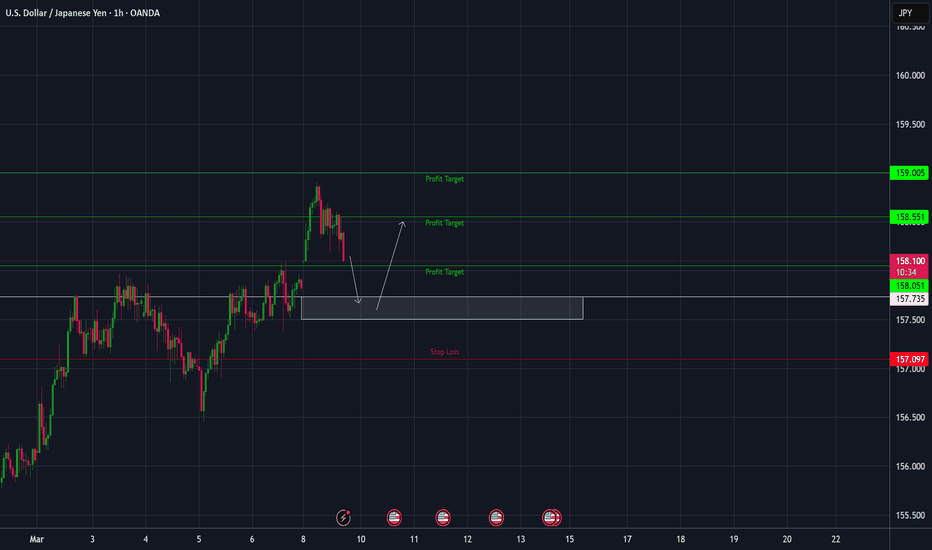

USDJYP | LONG

Entry in the 157,7 - 157,5 area. TP1: 158,05 1:1 40% TP2: 158,55 2:1 30% TP3: 159 3:1 20% 10% running SL: 157,095... Read more

Entry in the 157,7 - 157,5 area. TP1: 158,05 1:1 40% TP2: 158,55 2:1 30% TP3: 159 3:1 20% 10% running SL: 157,095... Read more -

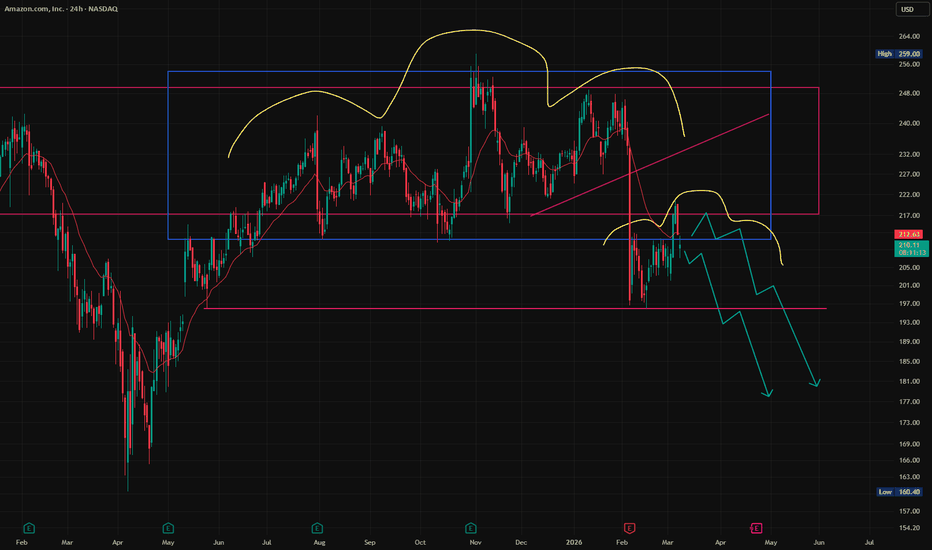

$AMZN looks like its forming a double-shoulder head-and-shoulder

NASDAQ:AMZN looks like its forming a double-shoulder head-and-shoulders pattern. If the neckline gives way, it could open the door for a deeper move lower.... Read more

NASDAQ:AMZN looks like its forming a double-shoulder head-and-shoulders pattern. If the neckline gives way, it could open the door for a deeper move lower.... Read more -

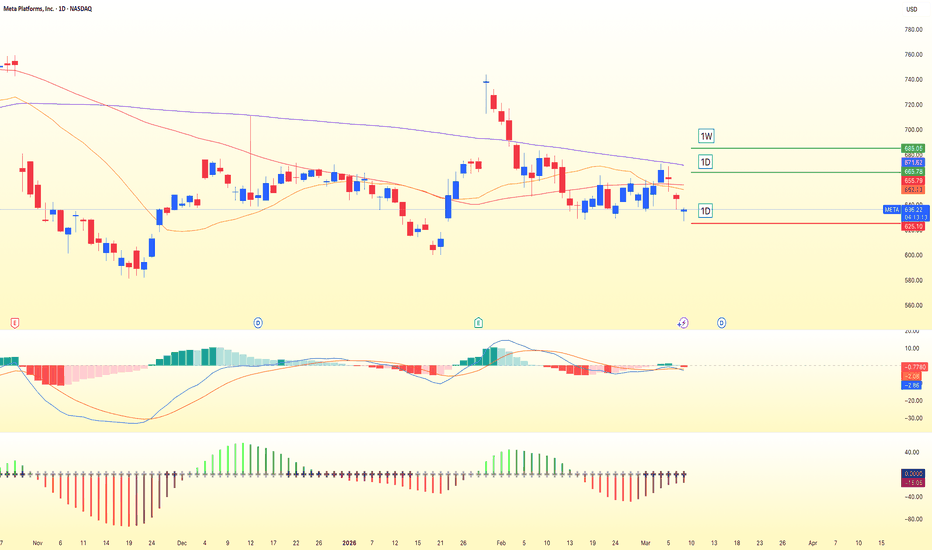

Meta at a Breaking Point as AI Ambitions Clash With Key Support

META is entering a decisive stretch after a sharp corrective phase, with price now trading around $636.38 and still trapped inside a descending channel on the daily chart. The broader story remains constructive as investors continue to reward Meta’s aggressive AI buildout, from content licensing and chip partnerships to rising institutional confidence after a strong Q4 2025 earnings beat. But in the near term, the chart is still doing the heavy lifting, and momentum remains under pressure. On the 1D timeframe, price has slipped below the MA20, MA60, and MA120, with that moving-average cluster now turning into dynamic resistance between $652 and $671. The key trigger for a shift in tone sits near $665, which also marks the upper boundary of the descending channel. A daily close above that level would suggest the correction is losing control and open the path toward $680 first, then $735, with $740 as the... Read more

META is entering a decisive stretch after a sharp corrective phase, with price now trading around $636.38 and still trapped inside a descending channel on the daily chart. The broader story remains constructive as investors continue to reward Meta’s aggressive AI buildout, from content licensing and chip partnerships to rising institutional confidence after a strong Q4 2025 earnings beat. But in the near term, the chart is still doing the heavy lifting, and momentum remains under pressure. On the 1D timeframe, price has slipped below the MA20, MA60, and MA120, with that moving-average cluster now turning into dynamic resistance between $652 and $671. The key trigger for a shift in tone sits near $665, which also marks the upper boundary of the descending channel. A daily close above that level would suggest the correction is losing control and open the path toward $680 first, then $735, with $740 as the... Read more -

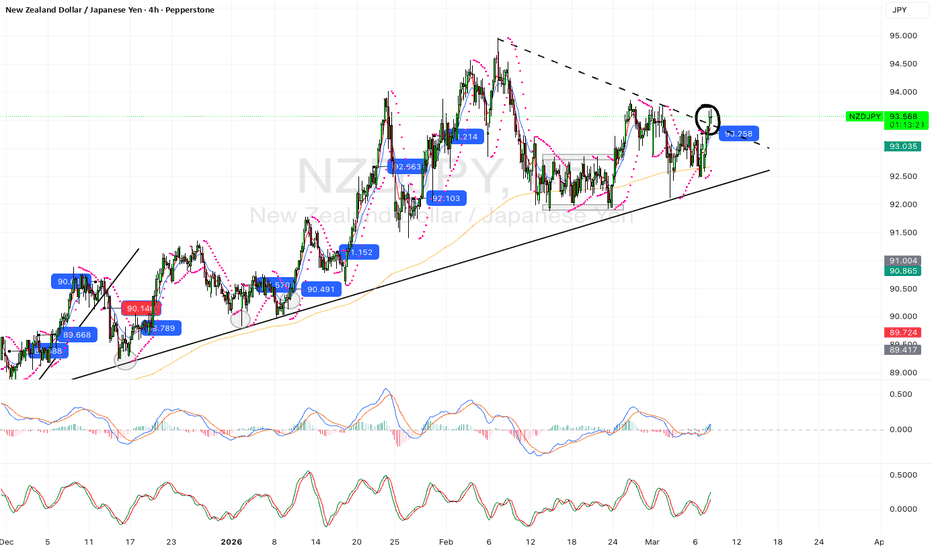

TRADE UNI - NZDJPY

Following this mornings analysis this pair has now pushed higher as expected so we stay long. Our traders are staying long.... Read more

Following this mornings analysis this pair has now pushed higher as expected so we stay long. Our traders are staying long.... Read more -

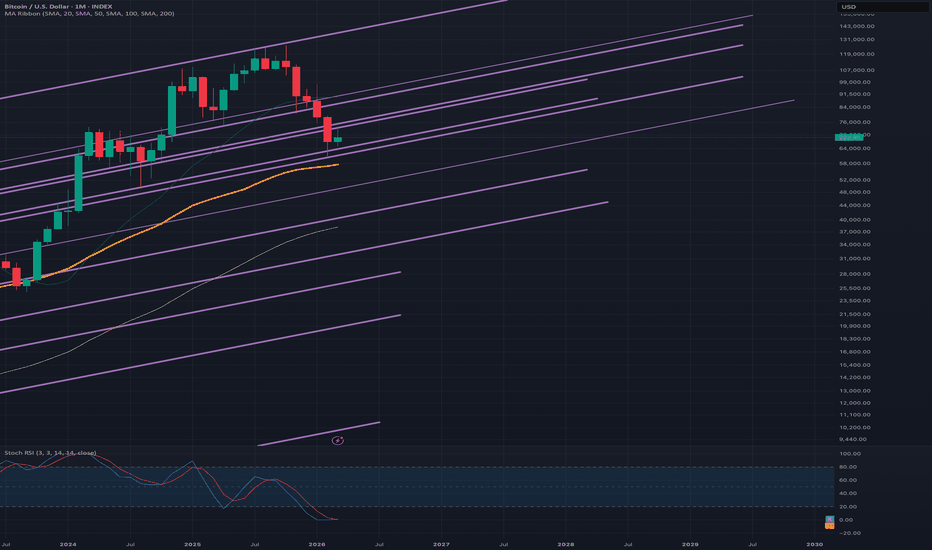

A zoomed in version of the purple log channels on btcusd

Just like I just did with my pink log channels, I thought it would also be useful to post a zoomed in version of my purple log channels as well. *not financial advice*... Read more

Just like I just did with my pink log channels, I thought it would also be useful to post a zoomed in version of my purple log channels as well. *not financial advice*... Read more -

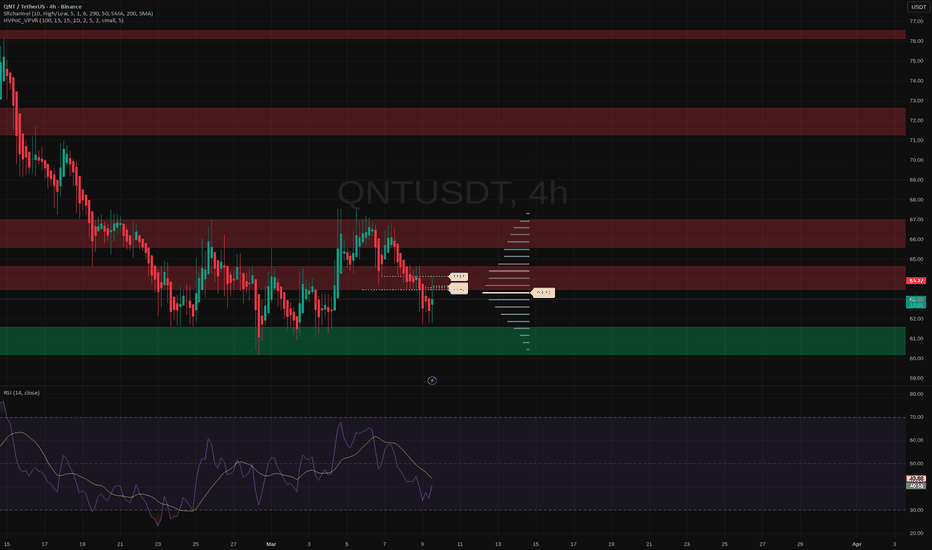

QNT: ready to rally? key levels and targets to watch today

QNT – wondering if this range zombie finally wakes up? While majors keep stealing the spotlight, according to market chatter a lot of infra coins like QNT have just been grinding sideways and bleeding into support. That pullback has now driven price straight back into the big green demand block around 60‑62, where buyers previously defended hard. On the 4H chart, price is sitting on that demand while RSI is curling up from the low 40s, trying to build a higher low. VPVR shows a fat volume node right above at 63‑64 that usually acts like a magnet, with the next supply stacked in the red zone up to roughly 66‑67. So I’m leaning long, looking for a relief bounce as late sellers get squeezed. I might be wrong, but shorts pressing it into this demand look like they’re arriving after the move. My plan: accumulate inside 60‑62 with confirmation... Read more

QNT – wondering if this range zombie finally wakes up? While majors keep stealing the spotlight, according to market chatter a lot of infra coins like QNT have just been grinding sideways and bleeding into support. That pullback has now driven price straight back into the big green demand block around 60‑62, where buyers previously defended hard. On the 4H chart, price is sitting on that demand while RSI is curling up from the low 40s, trying to build a higher low. VPVR shows a fat volume node right above at 63‑64 that usually acts like a magnet, with the next supply stacked in the red zone up to roughly 66‑67. So I’m leaning long, looking for a relief bounce as late sellers get squeezed. I might be wrong, but shorts pressing it into this demand look like they’re arriving after the move. My plan: accumulate inside 60‑62 with confirmation... Read more -

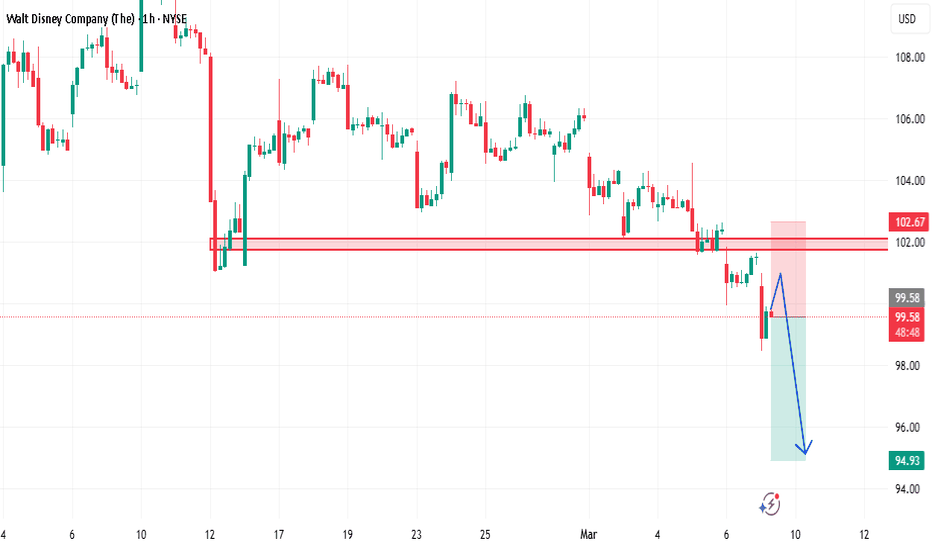

DIS Breaking Key Support – Bearish Continuation Setup

Disney (DIS) has broken below a strong horizontal support zone around $102, which previously acted as a demand area multiple times. After the breakdown, price is now showing signs of a potential retest of the broken support, turning it into resistance.... Read more

Disney (DIS) has broken below a strong horizontal support zone around $102, which previously acted as a demand area multiple times. After the breakdown, price is now showing signs of a potential retest of the broken support, turning it into resistance.... Read more -

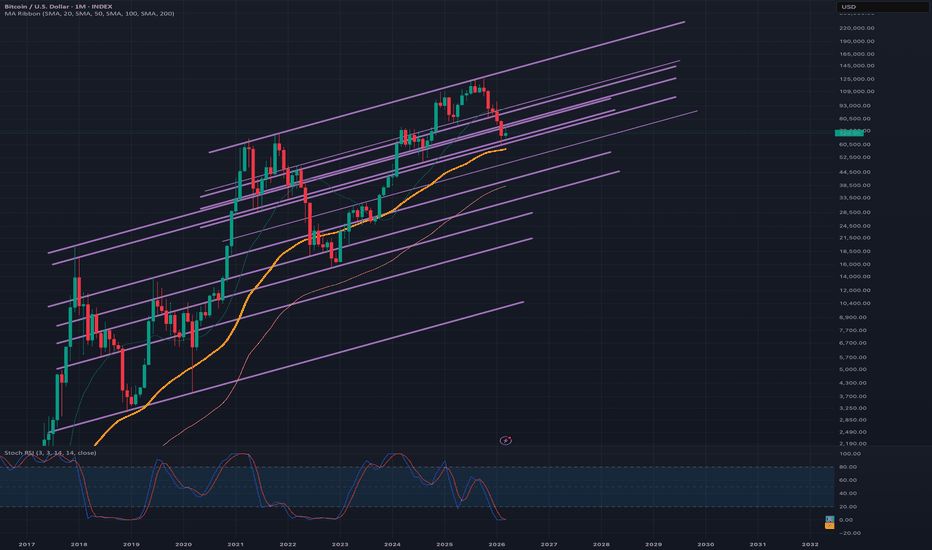

The most pivotal log channels on btcusd

These channels shown here on the 1 month log chart of btcusd are even more pivotal than the ones I posted just before this that have a slightly different trajectory although both sets are very valid and important to keep an eye on. These Channels here that I have colored purple are even more so though because they have key touches on both the 2018 and 2020 bottoms as well as the double tops of the last bull run, the current top, the 2018 top the previous bear market bottom and all sorts of other key fulcrum points as well. The other group of log channels puts the current top one channel below the previous bull markets top where as the trajectory of these purple channels has the current top touching its top trendline. Both series of channels are very valid but I give this purple group of channels a... Read more

These channels shown here on the 1 month log chart of btcusd are even more pivotal than the ones I posted just before this that have a slightly different trajectory although both sets are very valid and important to keep an eye on. These Channels here that I have colored purple are even more so though because they have key touches on both the 2018 and 2020 bottoms as well as the double tops of the last bull run, the current top, the 2018 top the previous bear market bottom and all sorts of other key fulcrum points as well. The other group of log channels puts the current top one channel below the previous bull markets top where as the trajectory of these purple channels has the current top touching its top trendline. Both series of channels are very valid but I give this purple group of channels a... Read more -

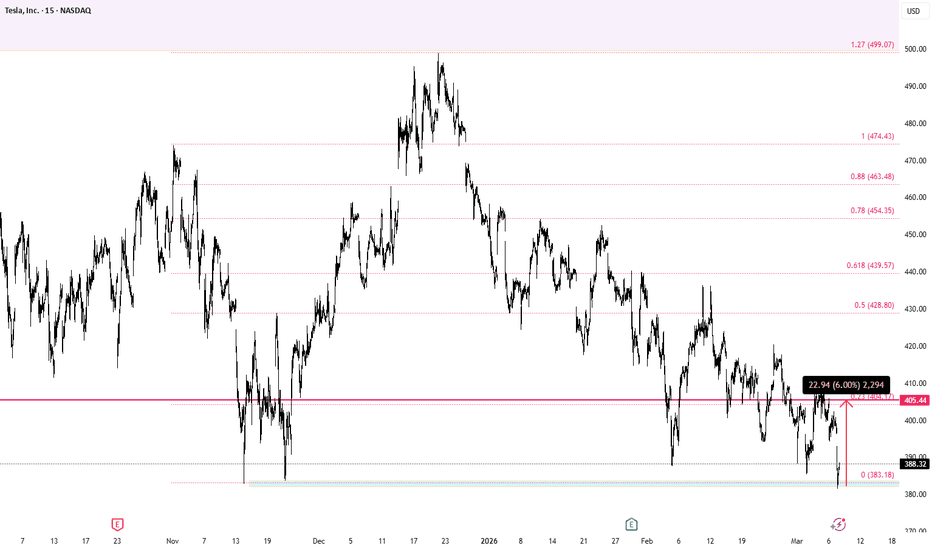

"Tesla call option contract now."

"The chart is clear: the contract, the target, and the entry are based solely on the stop-loss percentage, assuming 10% of the portfolio value."... Read more

"The chart is clear: the contract, the target, and the entry are based solely on the stop-loss percentage, assuming 10% of the portfolio value."... Read more -

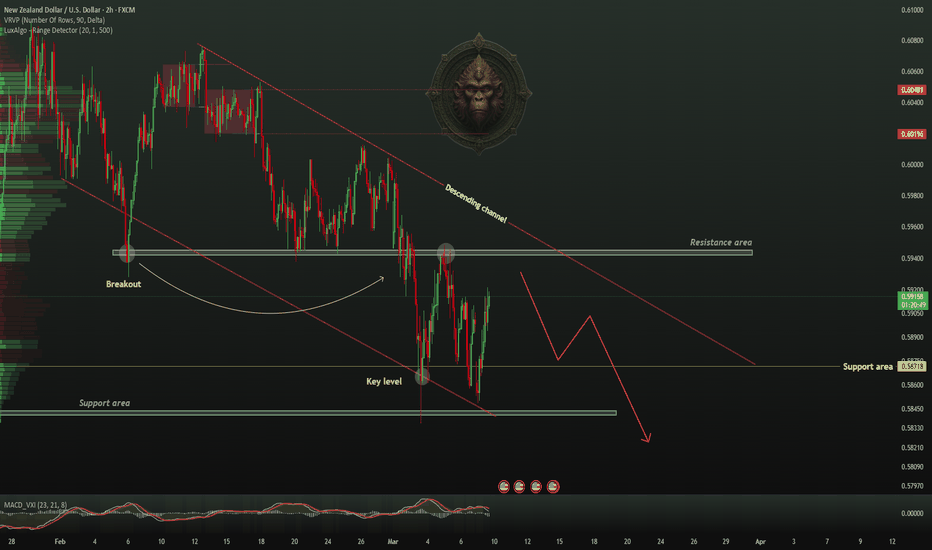

TheGrove | NZDUSD Sell | Idea Trading Analysis

NZDUSD is moving on support area.. We expect a bearish move from the confluence zone and you can expect a reaction in the direction of selling from the specified Resistance zone We expect a decline in the channel after testing the current level Hello Traders, here is the full analysis. I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity NZDUSD I still did my best and this is the most likely count for me at the moment. ------------------- Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️... Read more

NZDUSD is moving on support area.. We expect a bearish move from the confluence zone and you can expect a reaction in the direction of selling from the specified Resistance zone We expect a decline in the channel after testing the current level Hello Traders, here is the full analysis. I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity NZDUSD I still did my best and this is the most likely count for me at the moment. ------------------- Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️... Read more -

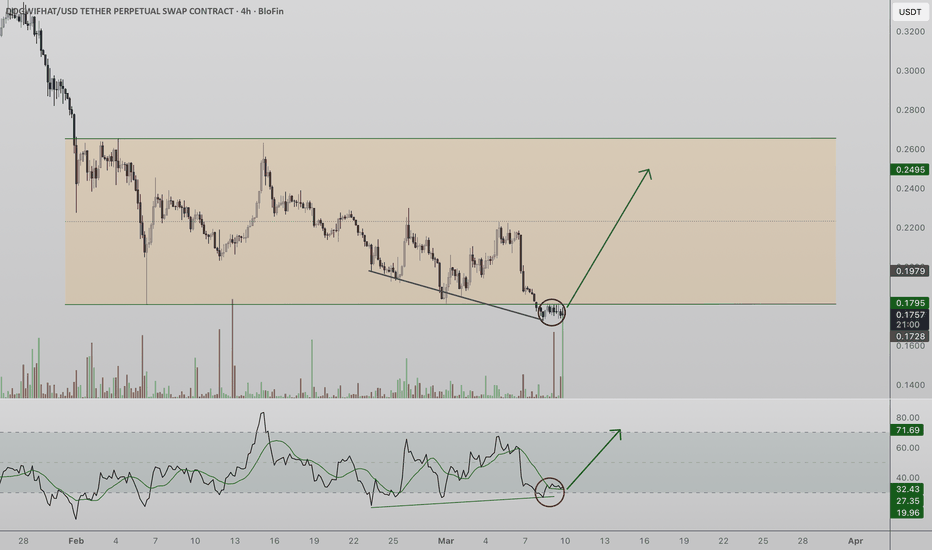

WIF Price Trades in Oversold Conditions, Bullish Divergence

WIF price action is currently trading below the key range low support at $0.18, a level that previously acted as a major structural boundary within the broader trading range. Since the February 6 low, price has been finding acceptance below this region, signaling weakness in the short term as the market continues to trade beneath a key support level. However, momentum indicators are beginning to hint that selling pressure may be weakening. On the Relative Strength Index (RSI), a bullish divergence has formed where the indicator is printing higher lows while price continues to make lower lows. This divergence often signals that bearish momentum is fading and that the market may be preparing for a potential reversal or relief rally. From a market structure perspective, the $0.18 range low remains the most important level to watch. If WIF can reclaim this level and hold it as support, it would likely... Read more

WIF price action is currently trading below the key range low support at $0.18, a level that previously acted as a major structural boundary within the broader trading range. Since the February 6 low, price has been finding acceptance below this region, signaling weakness in the short term as the market continues to trade beneath a key support level. However, momentum indicators are beginning to hint that selling pressure may be weakening. On the Relative Strength Index (RSI), a bullish divergence has formed where the indicator is printing higher lows while price continues to make lower lows. This divergence often signals that bearish momentum is fading and that the market may be preparing for a potential reversal or relief rally. From a market structure perspective, the $0.18 range low remains the most important level to watch. If WIF can reclaim this level and hold it as support, it would likely... Read more -

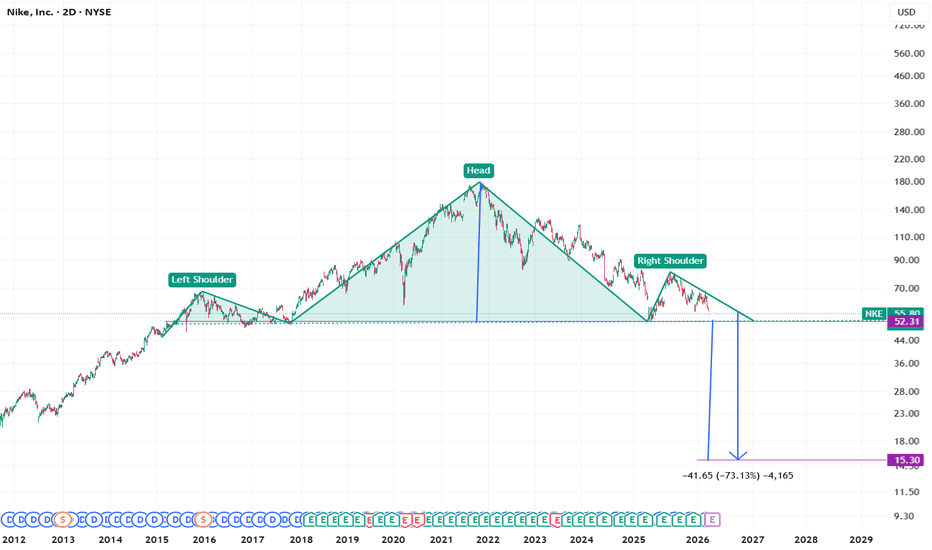

Nike to fall 73% if Head and Shoulders plays out

Bearish about to drop through the floor, * **Weak demand in China** – One of Nike’s largest markets is slowing, with lower consumer spending and stronger local competitors hurting sales. * **Profit margins under pressure** – Higher costs (tariffs, promotions, supply chain) are squeezing margins even when revenue grows. * **Tariff impact and rising costs** – Nike expects tariffs to cost roughly **$1B**, forcing cost cuts and potential price increases. * **Restructuring and layoffs** – Around **$300M in restructuring charges** tied to layoffs signals operational challenges in the short term. * **Slowing direct-to-consumer / digital sales** – Nike’s push into direct sales hasn’t grown as expected, leading to a shift back toward wholesale partners. * **Longer-term downtrend in the stock** – The share price has been below its 2021 highs for years, so rallies tend to get sold as investors wait for clear turnaround signals.... Read more

Bearish about to drop through the floor, * **Weak demand in China** – One of Nike’s largest markets is slowing, with lower consumer spending and stronger local competitors hurting sales. * **Profit margins under pressure** – Higher costs (tariffs, promotions, supply chain) are squeezing margins even when revenue grows. * **Tariff impact and rising costs** – Nike expects tariffs to cost roughly **$1B**, forcing cost cuts and potential price increases. * **Restructuring and layoffs** – Around **$300M in restructuring charges** tied to layoffs signals operational challenges in the short term. * **Slowing direct-to-consumer / digital sales** – Nike’s push into direct sales hasn’t grown as expected, leading to a shift back toward wholesale partners. * **Longer-term downtrend in the stock** – The share price has been below its 2021 highs for years, so rallies tend to get sold as investors wait for clear turnaround signals.... Read more -

TARGET HIT

TARGET HIT Target hit i run new york i am him praises to God who gives me strength... Read more

TARGET HIT Target hit i run new york i am him praises to God who gives me strength... Read more -

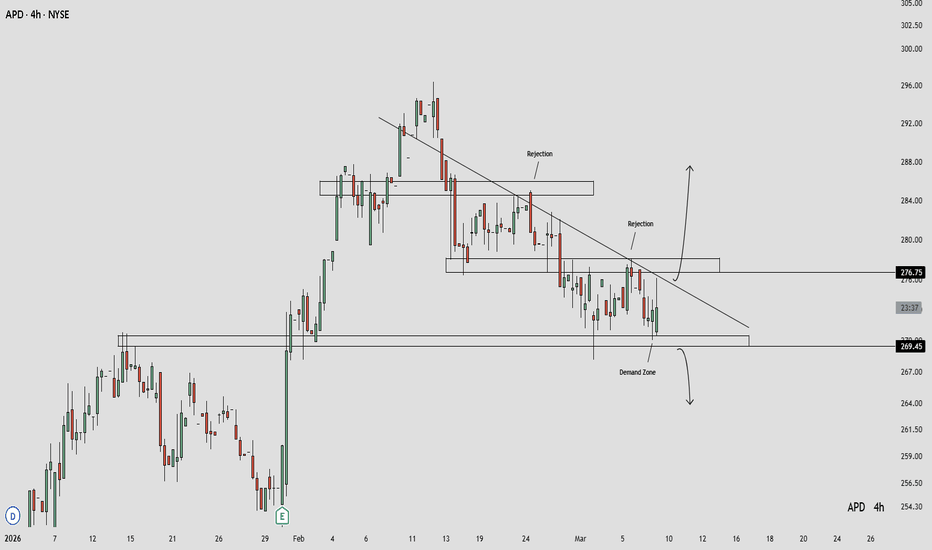

$APD - OUTLOOK

Price is currently neutral and showing signs of indecision, breakout above the TL and flip of the resistance at 276.75 would open the path for further upside, making it a better buy opportunity after confirmation. On the other hand, breakdown below the demand zone at 269.45 would confirm short setup and likely trigger downside move.... Read more

Price is currently neutral and showing signs of indecision, breakout above the TL and flip of the resistance at 276.75 would open the path for further upside, making it a better buy opportunity after confirmation. On the other hand, breakdown below the demand zone at 269.45 would confirm short setup and likely trigger downside move.... Read more -

GBPUSD Short

https://www.tradingview.com/x/zPawdQRm/ Market entry 1.3395 SL 1.3435 TP1 1.3366 GBPUSD is currently trading within a defined price action structure. Price has rejected from a key liquidity zone, aligning with the order-flow bearish readings. The valuation shows short term overvaluation reading and I will expect GBPUSD to drop some value soon. Let's see how this plays out. Trade Plan: Short Bias: Bearish reversal. Entry reason: Rejection confirmation on lower timeframe (M15–M30). Stop Loss: Above recent swing high. First target: 1.3366, risk will be tightened after first target.... Read more

Market Analysis

No feed items found.