Understanding and calculating stock returns is fundamental for investors seeking to evaluate the performance of their investments. The calculation of stock returns holds significance in evaluating the performance of one’s portfolio within a specific timeframe, providing a tangible metric to evaluate the success of your investment decisions. Armed with the knowledge of past returns, investors can make more informed decisions about their future investment strategies. Understanding what worked and what did not can guide adjustments and refinements to optimize future performance.

Additionally, growing one’s wealth is a complex and dynamic process that also involves numerous factors where the importance of long-term planning and risk management cannot be overstated. Both elements are closely tied to examining past performance as historical data provides valuable insights into how investments have performed in different market conditions.

In this comprehensive guide, we will explore four methods commonly used to calculate stock returns.

How Can You Calculate the Return on Your Stock Investment?

Calculating the return on your stock investments, also referred to as rate of return, is a fundamental step in assessing the performance of one’s portfolio. The return on a stock investment can be calculated using various methods depending on the information available and the level of detail you want. Some details to consider when calculating the rate of return include factors such as capital gains, dividends, and investment income. Below are four common methods to calculate stock returns:

- Simple Return

- Total Return

- Annualized Return

- Logarithmic Return

The average return on stocks in a portfolio involves determining the average percentage gain or loss of the individual stocks within the portfolio over a specified period. In contrast, the annual return narrows its focus to a specific one-year timeframe and the daily return is just the performance gain or loss over one day.

Another important aspect of calculating one’s return on investment is a comparison with the average annual stock market return which serves as a benchmark for investors to assess their own performance. Investors often compare their performance or annual investment return against the average return of a relevant stock market index, such as the S&P 500 or NASDAQ 100.

By mastering the methods for calculating portfolio returns, investors can gain a comprehensive toolkit for assessing the profitability of their stock investments and recognizing the impact of stock market risk on the overall return of a stock portfolio.

Use the Return on Investment (ROI) Method

Return on Investment (ROI) is a financial metric that measures the profitability of an investment as a percentage of the initial investment over a period of time. It is a straightforward way to evaluate the success or failure of an investment relative to cost. The ROI is the total return from all sources, such as capital gains, dividends, and other incomes. The formular for calculating ROI is given below:

ROI = (Current Value – Initial Investment + Income) / Initial Investment x 100

In this formula, the current value is calculated using the stock prices for the moment in question and the initial investment is based on the purchase price or share price of the original investment.

An example of the ROI return assuming an initial investment of $1000 in a stock and the current value of $1200, the RIO would be

ROI = (1200 – 1000)/ 100 * 100 = 20%

A keynote to point here is that the ROI and TSR share similarities, especially when considering the specific context of stock investments with dividend income. However, Total Stock Return is more specialized, focusing explicitly on stocks and dividends, while Return on Investments is a broader metric applicable to various types of investments and income sources.

If your portfolio contains dividend-paying stocks, stocks with dividend yield, the ROI formula is well suited for return calculation.

Consider the Total Stock Return Formula

The total stock return (TSR) is a measure that reflects the total gain and loss an investor experiences on an investment in a particular stock. TSR includes both the capital gains (losses) and any income generated from the investment, such as dividends.

The formula for Total Stock Return is:

Total Stock Return = (Current Value – Initial Value + Dividends) / Initial Investments x 100

For example, assuming an initial investment of $1000 in a stock and the current value of $1200, and you received $50 dividends over the holding period. The TSR would be calculated as follows:

TSR = (1200 – 1000 + 50)/ 1000 x 100 = 25%

Like the ROI formula, if your portfolio contains stocks with a dividend yield, one should consider using the TSR rate of return formula when considering an investment over time.

Try the Simple Stock Return Methodology

The Simple Return method focuses on the percentage change in the investments value without considering factors like dividends or other income generated during the holding period. It’s a basic way to understand how much the investment has grown or declined in percentage terms. The formula is very similar to that of ROI with the primary difference being ROI considers additional income generated by the investments and the Simple Return does not.

The formula for the Simple Return is given by:

Simple Return = (End Value – Start Value) / Start Value x 100

A Simple Return example:

Simple Return = (1200 – 1000)/ 1000 x 100 = 20%

While the ROI return assuming a $50 dividend paid during the holding period would be

ROI = (1200 – 1000 + 50)/ 1000 x 100 = 25%

Calculate it Through the Compound Annual Growth Rate

The compound growth rate, also known as the Compound Annual Growth Rate (CAGR), is a measure of the annual growth rate of any investment over a specified time period, taking into account the effect of compounding. The effect of compounding is calculated as a geometric progression ratio. It smoothens out the volatility in returns and provides a more accurate representation of an investment’s annual growth.

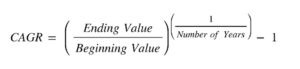

The formula for CAGR is as follows:

A breakdown of the components along with an sample calculation follow.

Ending Value: The value of the investment at the end of period

Beginning Value: The initial investment

Number of Years: The time period over which the investment occurs.

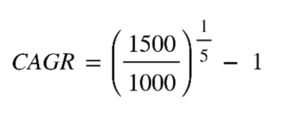

Example: Let’s consider an initial investment of $1000 in a stock five years ago, and the investment is now worth $1500. The CAGR will be:

Which results in the CAGR 8.18%

Increase Your Investment Returns With the Right Strategy

Increasing your investment returns is a multifaceted journey that involves not only choosing the right assets and investment strategy but also understanding how to measure and optimize your portfolio returns. A crucial aspect of this process is having the ability to calculate your portfolio return accurately. Portfolio return calculation is a fundamental skill that empowers investors to assess the performance of their investments, make informed decisions, and fine-tune their strategies for maximum efficiency.

Knowing how to calculate portfolio returns involves tracking the gains and losses of individual investments within your portfolio over a specific period. This measurement can be done through various methods, including the simple return, time-weighted return, or the more sophisticated money-weighted return. Each method offers a different perspective on performance, and choosing the most suitable one depends on factors like cash flows and investment holding periods.

For those eager to delve deeper into the intricacies of portfolio return calculation and enhance their investment acumen, resources like “Above the Green Line” can be invaluable. Above the Green Line provides educational insights and tools to help investors navigate the complexities of portfolio management and refine their understanding of performance metrics. Whether you’re a novice investor seeking foundational knowledge or an experienced one aiming to fine-tune your approach, Above the Green Line can serve as a valuable guide.

In conclusion, the journey to increasing investment returns is a holistic process that begins with choosing the right investment strategy and extends to understanding how to accurately measure portfolio returns. Platforms like Above the Green Line play a pivotal role in providing investors with the knowledge and tools necessary to navigate the dynamic world of investing. Armed with this information, investors can make more informed decisions, optimize their portfolios, and work towards achieving their financial goals.