MARKETS WILL BE CLOSED ON MONDAY FOR PRESIDENT’S DAY HOLIDAY

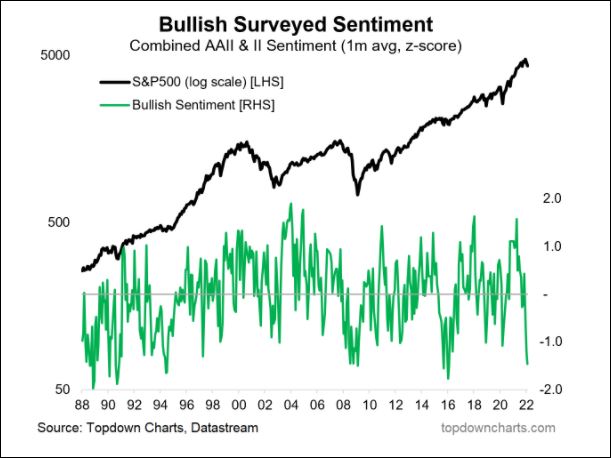

2/20/2022 Markets were lower again for the week as the Indices are going back down to re-test the January Lows. Investor’s FEAR is the now the highest since 2016 according the Investor Sentiment Chart above. This means that most investment newsletter writers are predicting that the Stock Market is now in a Bear Market (down). We will use Inverse Funds in the next Bear Market, but none of them are in Bull Markets, and they currently break the Green Line Rules. We don’t predict, we follow the Money and history. Usually when most of the newsletter writers agree, Smart Money will do the opposite and wait for a bounce up.

If the Market bounces up soon, the complete rally up for the DOW 30 and S&P 500 Indices (CHART) back up to test the Highs should have 5 Waves (3 up waves and 2 down waves). If the current Wave 2 down does not go as low as the January low, we could have a powerful Wave 3 rally up soon. However, the weaker Small Cap and NASDAQ 100 Indices are still Below the Green Lines and might not rally as much.

Many are worried that the FED is going to tighten, or raise short term Interest Rates in March. Probably, but tightening should slow down inflation and long term T-Bonds should like that, and then rally back up near their Green Lines. This would normally cause long term Interest to DECLINE, which should improve stock prices, and hurt Commodities.

If you continue to Follow the Green Line System, your Money should flow into the Strongest areas and your account value should be able to grow in both Bull and Bear Markets.

There has been plenty of action on the Day Trading Scrolling Charts.

DAY TRADING CHARTS FOR INDICES & LARGE CAPS.

We have not had many intra-day Stocks Alerts lately as the Volume has been too Low on Buy Signals. We like to see High Volume on rallies.

For the week the Dow was down 1.67%, the S&P 500 was down 1.41%, and the NASDAQ 100 was down 1.60%. The Long Term Trend for the Indices is up.

The Inflation Index (CRB) was up 0.21% for the week (a New High) and is Above the Green Line, indicating Economic Expansion.

Bonds were down 0.01% for the week, and are Below the Green Line, indicating Economic Expansion.

The US DOLLAR was down 0.05% for the week and is Above the Green Line.

Crude Oil was down 3.10% for the week at $90.21 and GOLD was up 3.13% at $1899.80.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON

We are only in 3 logged Current Positions for the Short & Medium Term, and we have plenty of CASH to Buy soon. There are 7 investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

_________________________________________________________________________________________

LONG TERM INVESTMENTS (many Large Caps no longer have 80 Relative Strength required.)

Long Term Scrolling Charts (Real Time)

AMD ADVANCED MICRO Buy if it Closes above the Red Line with High Volume.

F FORD MOTOR CO. Wait for Weekly Money Wave Close > 20 with High Volume.

NVDA NVIDIA CORP. Buy if it Closes above the Red Line with High Volume.

QQQ NASDAQ 100 Fund Buy if it Closes above the Red Line with High Volume.

XLK TECH FUND Wait for the next Daily Money Wave Buy Signal with High Volume.

XLRE REAL ESTATE FUND Wait for Weekly Money Wave Close > 20 with High Volume.

________________________________________________________________________________

My Trading Dashboard

Swing Trading Scrolling Charts

Day Trading Scrolling Charts

Click for Watch Lists

Click for Current Positions

Click for Closed Positions

Updated Top 100 List Feb 1, 2022

Dividend Growth Portfolio

ETF Sector Rotation System

Dogs of the DOW System

Long Term Strategy for IRAs & 401k Plans

CNN Fear & Greed Index

Scrolling Stage Chart Investing Charts

Alert! Market Risk is LOW (Green). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

________________________________________________________________________________

MerryMe writes “Thank you for the Dashboard. It is nifty. I love being able to scroll through the charts quickly in the morning.”