Financial Independence and Frugal Living

Financial independence is a goal that resonates with individuals seeking autonomy and security in their financial lives. Achieving financial independence involves gaining the ability to sustain one’s desired lifestyle without being dependent on traditional employment income. This journey encompasses various topics and strategies, ranging from prudent budgeting and effective saving to astute investment practices. Delving into these subjects, individuals explore concepts such as passive income streams, frugal living, debt management, and investment diversification. Moreover, topics like entrepreneurship, creating multiple income sources, and long-term financial planning play a pivotal role in the pursuit of financial independence. By understanding and implementing these strategies, individuals aim to build a robust financial foundation that empowers them to live life on their terms, free from financial constraints.

Above the Green Line provides a list of topics to help one achieve their financial freedom. See below.

- My Plan To Reach Financial Independence

- Passive Income Generation

- Ways To Generate Extra Income

- Renting Vs Buying: How To Decide Which Is Best For You

- Frugal Ways To Accumulate Wealth

- How Much Savings Do You Need To Retire?

- The Best Financial Decision I Ever Made

- How I Plan To Retire Before I’m Old

- Buying New Or Used: What To Consider When Buying A Car

- What Is Enough?

- The Importance Of Multiple Income Streams

- The Benefits Of Automatic Investing

- Investing in Rental Properties

- Life After Financial Independence

- Resources For Frugal Living

- Do You Need An Emergency Fund?

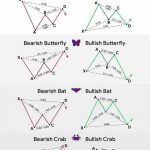

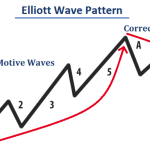

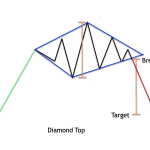

- Simple Investing Principles Worth Following

- How To Never Run Out Of Money In Retirement

- The Road To Financial Independence: How To Stay Motivated