By ATGL

Updated February 8, 2024

The world of stock trading offers a multitude of strategies for individuals seeking to capitalize on market dynamics for profit. Swing trading and day trading are two of the most favored approaches among traders. These methods vary significantly in their execution styles, time frames, and speed of profits. Understanding the fundamental differences between swing and day trading helps traders align their approach to the financial markets with their specific risk appetite and lifestyle.

Swing and day trading appeal to traders with varying expertise levels and available time. Day trading is marked by swift, voluminous trades all within a single trading day, while swing trading adopts a more gradual stance, maintaining positions for several days, weeks, or months. This article explores three key differences in swing trading vs day trading, shedding light to aid traders in choosing the method that aligns best with their investment approach.

Why Are These Trading Methods So Popular?

Day trading attracts a diverse range of individuals for many reasons, one key reason being the potential to make quick profits by capitalizing on short-term price movements, often leveraging small price fluctuations to generate income throughout the day. Another reason for their popularity is the advances in technology have provided traders with sophisticated tools and real-time market information, enabling traders to execute trades quickly and efficiently.

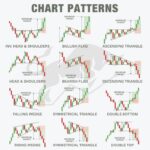

This approach demands careful attention, the capacity for speedy decision-making, and an understanding of trading margin requirements. The charm of day trading lies in the possibility of swift returns as traders leverage short-term trends. It necessitates a thorough comprehension of market behaviors, technical indicators, and effective day trading strategies, ensuring a pre-established solid trading plan.

Conversely, swing trading is more appealing to those who can’t dedicate the substantial time commitment required for the continuous monitoring that day trading demands. Swing traders maintain their positions longer to target profits from short- to medium-term trends. This trading pattern is less taxing and time-intensive compared to day trading, fitting well for those with other occupations or limited time for market involvement.

The growth in popularity of these methods is partly attributed to technological advancements that have rendered stock markets more accessible. Online trading platforms, abundant market data, and a rise of educational materials on technical analysis and fundamental analysis now allow traders to implement advanced strategies from virtually any location. This has introduced an unprecedented level of flexibility and access to the markets.

3 Key Differences Between Day and Swing Trading Strategies

Below are three major differences in swing trading vs day trading:

1. The Time Swing Traders and Day Traders Hold Positions

A fundamental difference between swing and day trading is how long traders hold their positions. Day traders seek to profit from small price fluctuations and usually close their positions before the market closes to avoid overnight exposure to market risks. Some day traders may hold positions for just a few minutes, while others might keep them open for several hours. The key characteristic is the intention to close positions within the same trading day, thereby profiting from intraday market volatility and short-term price movements.

On the flip side, swing traders keep positions for an extended period of time, from a few days or weeks up to several months. The longer duration provides them with a prolonged time frame for analysis and decision-making. This includes the ability to conduct thorough technical and fundamental analyses, identify trends, and set strategic entry and exit points based on a more comprehensive assessment of market conditions. Swing traders also benefit from a reduced impact of intraday volatility due to the longer duration of their trades.

2. The Volume of Trades Executed in a Similar Time Frame

Day traders often execute a larger number of trades compared to swing traders. This is due to the nature of their respective trading styles, timeframes, and objectives. For instance, many day traders employ scalping strategies which involve making numerous small trades to capture very small price differentials — something on the order of $0.01 to $0.10 per share. However, to generate the same amount of profit or more compared to traders using other strategies, scalpers often need to execute a higher number of trades. Most trades opened and closed within the same trading day, often holding positions for just a few minutes to a few hours. The combination of both the short holding period and frequency of trades leads to a greater volume.

This high number of trades necessitates vigilance and responsiveness to market shifts throughout the day. It can lead to higher risk, depending on the trader’s ability to make informed and quick decisions. It also involves managing the stress and emotional impact of continuous trade monitoring and execution.

In contrast, swing trading typically aims to capitalize on larger price trends rather than short-term market gyrations, which means fewer trades. This can be as little as a handful of trades per week or month, contingent on market circumstances and strategic choices. Swing traders strive to capture notable price shifts over longer periods, reducing the necessity for constant buying and selling. This method permits more time for trade analysis and less time engaged in frequent transactions.

3. The Profit Potential of Each Trading Style

Day trading focuses on minor, rapid gains from each single trade, often employing leverage to further maximize potential for profitability. When successful, these small profits can accumulate significantly. However, the high frequency and volume of trades elevate the risk of considerable losses, particularly in unstable market conditions.

Swing trading, though less aggressive in its timing and trade frequency than day trading, has the potential for larger profits per trade. This is because the longer holding periods typically result in larger price movements over extended time frames. While swing trading strategies can yield significant returns, the gains are realized less frequently than in day trading.

Determining which method is more lucrative is complex, and profitability for both trading styles can vary. Each style has its successful practitioners, with their success often hinging on their specific trading strategy, risk management, time commitment, and prevailing market conditions. Some traders excel in the rapid-fire environment of day trading, while others prosper with the patience and analysis inherent in swing trading. The trick to achieving profits in either style lies in developing and consistently applying a sound, repeatable trading strategy that takes advantage of the financial market.

Find the Best Trading Opportunities With Above the Green Line

While there are differences in swing trading vs day trading, each stock trade strategy offers opportunities and challenges. Whether you’re a full-time trader leaning towards the rapid pace of short-term trading or a more relaxed investor interested in the longer approach of swing trading, finding the best trading opportunities requires knowledge, skill, and the right tools.

Above the Green Line offers a comprehensive platform to meet these needs. With real-time market analysis, cutting-edge tools and indicators, and expert analysis from top traders, Above the Green Line equips you with the knowledge to make informed trading decisions. Join today and start your journey towards successful trading.