Markets were lower again today but some of the weakest Stocks (the COVID Darlings from last year) finally popped up off the bottom (profit taking from Short Covering).

Many novice investors were heavily margined (borrowed money) and are having to Sell their stocks at very low prices. Tammy is Selling now when she should have sold in January.

Unsophisticated Investors are still Selling because their FEAR has taken control of their logic. Many don’t understand that long term Interest Rates and Commodities should be peaking soon. That should cause a rally up on the Tech Stocks.

Bonds were up again today, and Closed above the Pink Line (10-day avg.) for more serious Buying to come in. Bonds are 18 % Below the Green Line because of FEAR Selling. Eventually Bonds will normally snap back up towards the Green Line (then Lower Interest Rates).

We don’t want to be Selling any Investments now that are still Above the Green Lines today. They should pop up nicely when this Flushing is over.

This is currently a weak Market, so please be patient wait for more Money Wave Buy Signals. Most stocks at this time do not have high enough Relative Strength to meet the Green Line Rules. BUYS SOON – CHARTS The best moves are when the S&P 500 Index is also coming up out of the Green Zone.

BUYS TODAY 5/12/2022

MOS MOSAIC CO. Money Wave Buy today. Target is $77.00. EXIT if it is going to Close below $55.34.

XLE ENERGY STOCK FUND Money Wave Buy today. Target is $80.00. EXIT if it is going to Close below $75.18.

BUYS TOMORROW – SWING TRADING STOCKS Shop for a better price earlier in the day with Triple Buy Signal, on the same day that a Daily Money Wave Buy Signal will occur.

CRK COMSTOCK RESOURCES INC. Wait for Money Wave Close > 20 with High Volume.

VERU VERU INC. Up 9 % today, but Relative Strength is Below 90. AVOID.

ADM ARCHER DANIELS MIDLAND Wait for Money Wave Close > 20 with High Volume.

BOX BOX INC. Wait for Money Wave Close > 20 with High Volume.

SBS COMPANHIA de SANEAMENTO (WATER) Buy above $9.17 with High Volume with a 5% Trailing Sell Stop Loss below it.

SWN SOUTHWESTERN ENERGY CO. Wait for Money Wave Close > 20 with High Volume. (2nd Buy Signal soon).

Please be patient and wait for Money Wave Buy Signals. We will email you when they are ready. Follow on the WATCH LIST.

The Leaders are Way Above the Green Lines (all Investments eventually return to their Green Lines).

SELLS TODAY

BTU PEABODY ENERGY CORP. LOWER the Sell Stop Loss below $18 until it bottoms. This trade was not logged.

XLP CONSUMER STAPLES FUND LOWER the Sell Stop Loss below $74 until it bottoms. Money Wave is back down in the Green Zone.

XME METALS & MINING FUND LOWER the Sell Stop Loss below $47 until it bottoms. Money Wave is back down in the Green Zone.

______________________________________________________________________________________________________________

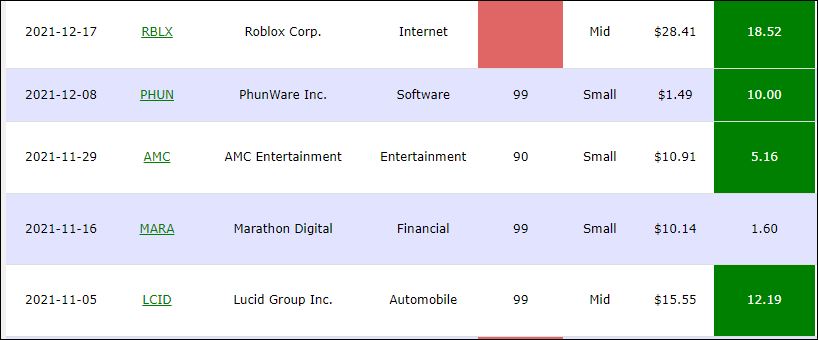

DAY TRADING SETUPS. A few Triple Buy Pops today: AMC (+23 %) LCID (+12%) SOXS (+8%) SQQQ (+6%) VIX (+6%) & RBLX (+18%). Try out the New Side by Side layout.

DAY TRADING FOR INDICES & LARGE CAPS CHARTS.

Bonds were up again today, but are Way Below the Green Line.

Crude Oil was up $1.14 today at $106.85. ________________________________________________________________________________________________________________

MY TRADING DASHBOARD

SWING TRADING CURRENT POSITIONS

DAY TRADING SETUPS

TRADE ALERTS

ARE YOUR INVESTMENTS ABOVE THE GREEN LINE?

GREEN LINE RULES

ETF SECTOR ROTATION SYSTEM

New TOP 100 LIST Updated May 1, 2022

Many like to Buy the Swing Trades just before the Close, if the Money Wave is going to create a Buy Signal (Closing > 20 and up out of the Green Zone).

Don’t Buy if the Investment has already popped up too much. Money Wave Buy Signals are usually good for a 3-6 % move in a few days.

We will “Not Log” trades if the Reward/Risk is not at least 2:1, or Low Volume. These have more risk.

Related Post

– MOS