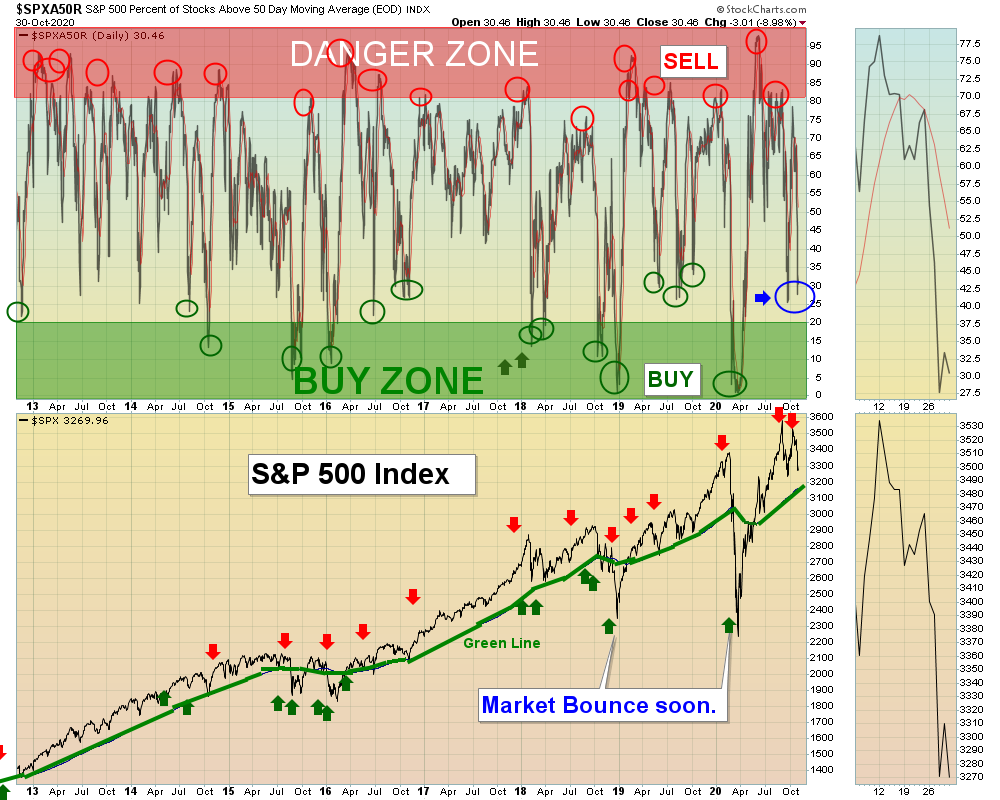

11/01/2020 Markets were down sharply for the week as FEAR and uncertainty has set in before the Election. The Markets need a Stimulus Plan to go higher, but that has been delayed. The Chart above indicates that it is probably too late to Sell, unless there will not be a Stimulus Plan. Congress loves to give away our Money, so there should be more Stimulus soon. We like to Buy on FEAR and the CNN Fear & Greed Index is back down to 27, the lowest since April.

Most of the Leaders are back down in the Green Zones so we should see a Market pop up soon. Investments that have Relative Strength above 90 and are still above the Red Lines (50-day avgs.) should bounce up soon and re-test the recent Highs, if the Markets can bottom soon. These are : BABA BBY BBBY CLF DE DKS DKNG ENPH EXAS EEM FCX GM GME HBI HOG HZNP JKS KWEB NET NIO NLS PACB PINS PTON ROKU QCOM SE SID SNAP SPWR TSM TTD TUP TWLO. Hopefully you have some Cash left to Buy some of these soon.

CYH COMMUNITY HEALTH finally met the Target on the Long Term Portfolio for a 16 % Gain.

PENNY STOCK WATCH LIST has many Green Zones Buy Signals soon that are 50-80% off the recent Highs.

For the week the Dow was down 6.45%, the S&P 500 was down 5.56%, and the Nasdaq 100 was down 5.39%. The Long Term Trend for the Indices is up.

The Inflation Index (CRB) was down 3.95% and is below the Green Line, indicating Economic Weakness.

Bonds were down 0.28% for the week and are slightly Above the Green Line, indicating Economic Weakness.

The US DOLLAR was up 1.32% for the week and is Below the Green Line.

Crude Oil was down 10.19% for the week at $35.79 and GOLD was down 1.33% at $1879.90.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON

We are currently in 9 logged Current Positions, for the Short & Medium Term. There are 8 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM INVESTMENTS (Most of the Leaders are back up in the Weekly Red Zones.)

Buy the Leading Investments that are down near the Weekly Green Zones.

ALT ALTIMMUNE INC. Buy if it Closes above $15.63 on High Volume.

FCEL FUELCELL ENERGY INC. Buy if it Closes above $3.42 on High Volume. All time High is $682.00.

FSLY FASTLY INC. Wait for the next Daily Money wave Buy.

INSG INSEEGO CORP. Buy when it Closes above the Red Line around $10.37.

NVAX NOVAVAX INC. Buy when it Closes above the Pink Line around $90.49.

VBIV VBI VACCINES INC. Buy when it Closes above the Red Line around $3.01.

______________________________________________________________________________________

Click for Current Positions

Click for Watch List

Click for Closed Positions

Dividend Growth Portfolio (we are now posting a Dividend Calendar for the entire portfolio to assist with planning purposes).

ETF Sector Rotation System – The System closed all 5 positions on Sep 30 and Bought SPY QQQ SLV EEM & EFA on Oct 1, 2020 (20% into each).

Long Term Strategy for IRAs & 401k Plans

Alert! Market Risk is LOW (Green Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals

___________________________________________________________________________________________

QUESTION: Tom K writes “Hello.You send me today buys less than five minutes before closing!”

ANSWER: Hi Tom. Thank you for writing! Emails can be sometimes delayed at your email server or can go into your Spam Folder.

You might want a backup also… Twitter notifications are the best and fastest.

4 Ways to Get your Daily Money Wave Alert:

- Emailed to your box between 3:30 3:50pm EST.

- Website menu Commentary/Buy/Sell Signals

- Twitter notifications @AboveGreenLine

- Text messages: Email us your Cell number & phone carrier.

Thank you,

ATGL