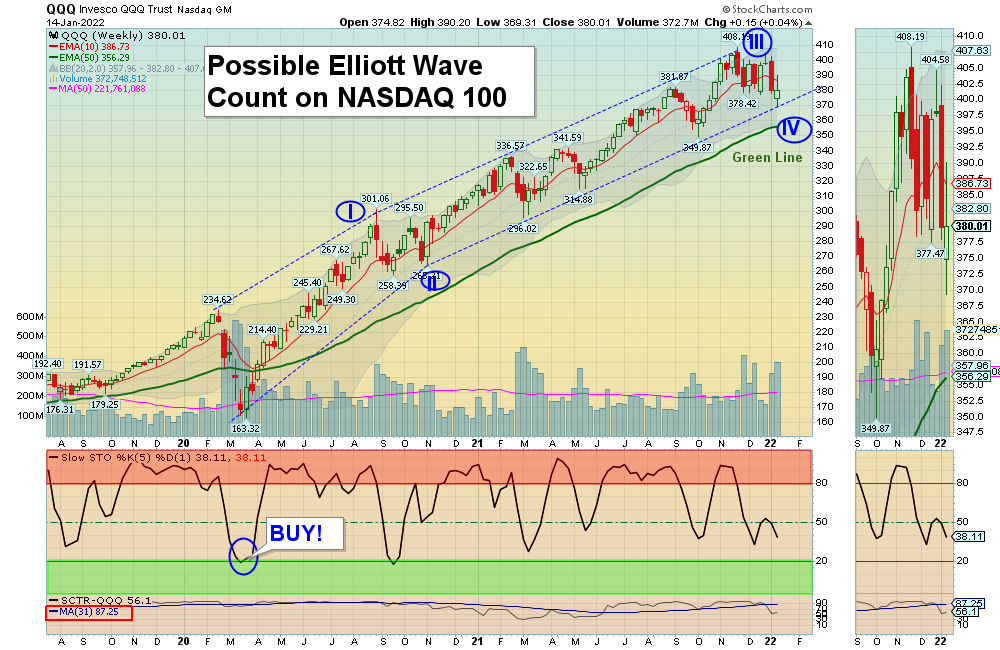

1/16/2022 Markets were slightly lower for the week. The Markets tried to rally from Monday’s Low, but there was very Low Volume as the Buyers did not come in. Then on Friday the Markets went back down to re-test the recent Lows. So the Bulls are hoping for a “W” Pattern back up soon, on Higher Volume.

If good Buying does not come in soon, then the Markets might have to drop to a lower level to bring in more buying from Smart Money. Smart Money is being very cautious, since the FED Printing and Tapering should reduce the amount of liquidity in the Markets.

If you continue to Follow the Green Line System, your Money should flow into the Strongest areas and your account value should be able to grow in both Bull and Bear Markets.

There has been plenty of action on the Day Trading Scrolling Charts.

NEW! DAY TRADING CHARTS FOR INDICES & LARGE CAPS.

We have not had many intra-day Stocks Alerts lately as the Volume has been too Low on Buy Signals. We like to see High Volume on rallies.

For the week the Dow was down 0.87%, the S&P 500 was down 0.29%, and the NASDAQ 100 was up 0.04%. The Long Term Trend for the Indices is up.

The Inflation Index (CRB) was up 3.17% for the week (a New High) and is Above the Green Line, indicating Economic Expansion.

Bonds were down 0.11% for the week, and are Below the Green Line, indicating Economic Expansion.

The US DOLLAR was down 0.59% for the week and is Above the Green Line.

Crude Oil was up 6.24% for the week at $83.82 and GOLD was up 1.06% at $1816.50.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON

We are only in 3 logged Current Positions, for the Short & Medium Term. There are 4 investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

_________________________________________________________________________________________

LONG TERM INVESTMENTS (many Large Caps no longer have 80 Relative Strength required.)

Long Term Scrolling Charts (Real Time)

BX BLACKSTONE GROUP Buy if it Closes above $124.39 with High Volume.

CROX CROCS INC. Buy if it Closes above $136.81 with High Volume.

DKS DICKS SPORTING GOODS Buy if it Closes above $118.25 with High Volume.

LC LENDING CLUB CORP. Buy if it Closes above $27.92 with High Volume.

RRC RANGE RESOURCES Bought on the Close above $19.76, and it shot up 16.46% this week.

________________________________________________________________________________

My Trading Dashboard

Swing Trading Scrolling Charts

Day Trading Scrolling Charts

Click for Watch Lists

Click for Current Positions

Click for Closed Positions

Updated Top 100 List Jan 1, 2022

Dividend Growth Portfolio

ETF Sector Rotation System

Dogs of the DOW System

Long Term Strategy for IRAs & 401k Plans

CNN Fear & Greed Index

Scrolling Stage Chart Investing Charts

Alert! Market Risk is MEDIUM (Yellow Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals.

________________________________________________________________________________

QUESTION: Steve V. writes “Do you do both long and short positions or does someone just invert the rules in a down market?”

ANSWER: Yes, invert the Rules to Sell Short (Below the G L, Below 10 R S, Dropping below 80 on the Money Wave).

We will wait until the Market is in a Bear (below the Green Line), and not Short the next Correction back down to Green Line.

Once the Market is BEAR, we will mainly do Inverse Funds, as most investors don’t understand Shorting…

The Leaders should have nice pops up if they hold above the G L after the next Correction, and we don’t like to Sail into the Wind.

Good trading and tell your friends!

ATGL