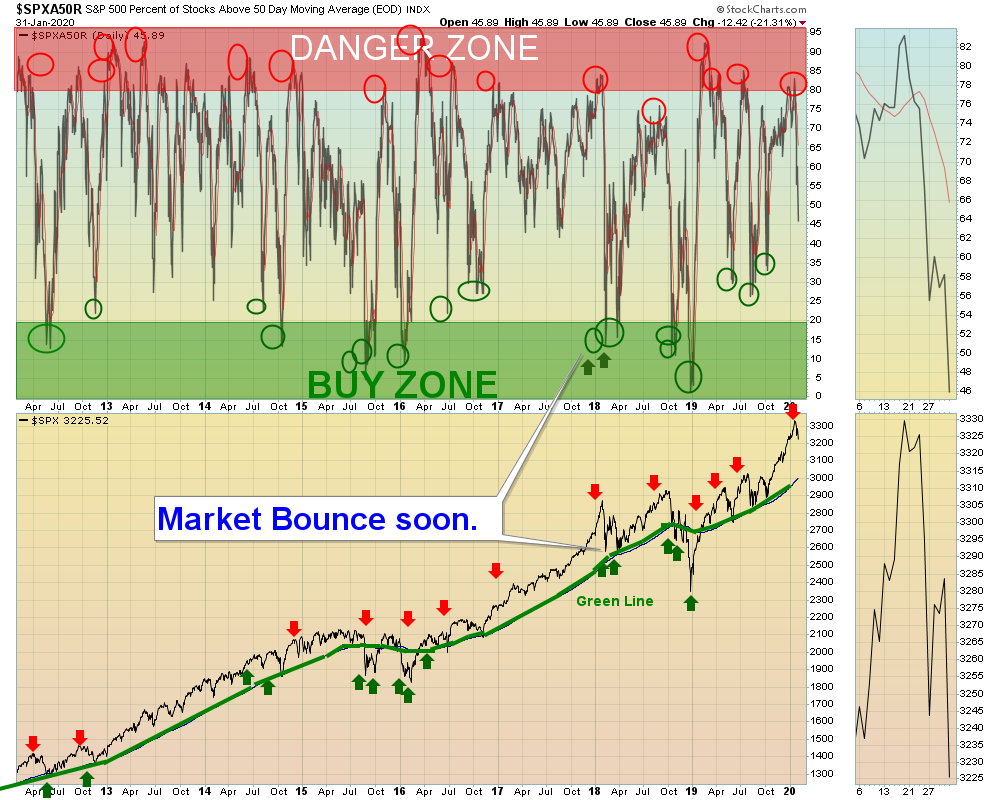

02/02/2020: Markets were down again for the week on profit taking and Corona Virus Fears. How quickly Investors’ Sentiment changed from Greed to Fear. The S&P 500 Index is almost over-sold on the Short Term and should bounce soon near the Red Line (50-day avg.)

Many Earnings have come out so traders have been selling on the good news. Many Leaders are finally returning to their Green Zones for Money Wave Buys soon. The NASDAQ 100 (QQQ) is the strongest major Index, along with the Tech Fund (XLK). Use your Cash and Buy Investments that are still above their Red Lines for more probable bounces.

Normally the Indices will re-test the recent Highs after this correction is over. The CNN Greed Index has slipped back to 44 from 96 last month.

New Subscribers: The Leaders and strongest Indices are finally returning down to the Green Zones (first time since October, and it is usually every 1-2 months). This should create better bounces up from Money Wave Buy Signals.

For the week the Dow was down 2.55%, the S&P 500 was down 2.14%, and the Nasdaq 100 was down 1.63%. The Long Term Trend on the Stock Markets is UP.

The Inflation Index (CRB) was down 3.10% and is Below the Green Line, indicating Economic Weakness.

Bonds were up 2.69% for the week and are Above the Green Line, indicating Economic Weakness.

The US DOLLAR was down 0.42% for the week and is over-bought.

Crude Oil was down 4.85% for the week at $51.56, and GOLD was up 1.02% at $1587.90.

_____________________________________________________________________________________________

NEW! LONGER TERM INVESTMENT STRATEGIES:

DOGS OF THE DOW For Value Investors with Dividends.

ETF SECTOR ROTATION SYSTEM For Retirement Plans (IRAs & 401k Plans).

MONEY WAVE BUYS SOON:

We are currently in 2 logged Open Positions, for the Short & Medium Term. There are 8 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM INVESTMENTS

Buy the Leading Investments that are down near the weekly Green Zones.

ARWR ARROWHEAD PHARMA. Buy if it Closes above the Pink Line on High Volume.

GDX GOLD MINERS FUND Buy if it Closes above $31.06 on High Volume.

GE GENERAL ELECTRIC CORP. Broke Out above $12.23 on Earnings. Buy on next Daily Money Wave Buy Signal.

NWL NEWELL BRANDS Buy if it Closes above $20.84 on High Volume.

PLG PLATINUM GROUP Wait for the next Daily Money Wave Buy Signal.

RAD RITE AID CORP. Struggling to hold Above the Green Line. WAIT .

______________________________________________________________________________________

Click for Portfolio (Open Positions)

Click for Watch List

Click for Closed Positions

Long Term Strategy for IRAs & 401k Plans: Currently invested in all 4 Funds.

Alert! Market Risk is MEDIUM (Yellow Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals

___________________________________________________________________________________________

QUESTION: Mark writes “Thinking now about the medium term for my long term holdings especially in SPY. Is it too late to jump into an Inverse ETF to ward off the correction we are currently experiencing?”

ANSWER: It depends on your time frame…

1. To hedge the SPY for the Short Term, maybe Buy SH or SDS when SPY has Daily Sell Signals (closes below the Pink Line). EXIT Inverse Fund on next SPY Daily Buy.

2. Medium Term: Hedge when SPY is in the Red Zone of this Chart.

3. Long Term: EXIT the SPY when it Closes below the Green Line, and Buy SH when it is Above the Green Line + 80 Relative Strength (like in 2008).