02/19/2017: THE US & Canadian Markets will be closed on Monday for a Federal Holiday.

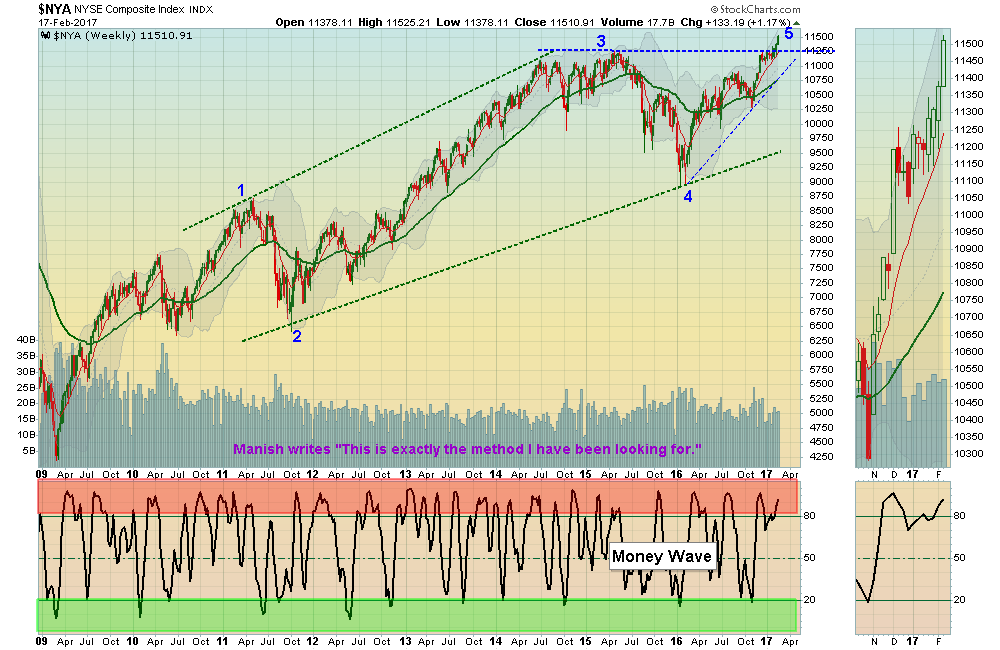

Markets were up about 1% for the week, as the Indices have stretched like a tight rubber band Above the Green Line. Eventually the Markets will snap back down to the Green Line (like they always do) so there should be some Negative news soon. The only unknown, is HOW FAR the Markets will stretch up.

When the Markets move Way Above or Below the Green Line, Human Emotions have taken over (Way Above = GREED, Way Below = FEAR). Smart Money has been selling up here to the Dumb Money. Smart Money bought on the possible BAD NEWS or FEAR of the November Election (at the Green Line). Remember the Smart Money Rule: Buy on BAD NEWS, take profits on GREAT NEWS… Investors are buying now, as if all our problems will be fixed.

The January Inflation or CPI Index was up 0.6%. If you annualize that, it would be a 7.2% Inflation Rate, which would represent a Booming Economy. The problem there is that Bonds would FREAK OUT and Interest Rates would normally shoot up with the Inflation Rate. We will monitor the CPI Index for you to see if January was just a 1 month blip…

There should always be Investments going up EVERY YEAR that meet the Green Line Rules.

Raise some CASH, and wait… there will be some BAD NEWS, and we will be ready to BUY!

MONEY WAVE BUYS SOON: There are currently 5 Open Positions.

ON DECK to Buy soon: NVDA NVIDIA CORP, SN SANCHEZ ENERGY, and WDC WESTERN DIGITAL. Wait for GREEN ZONE BUYS. We will email or text when they are ready. WATCH LIST

LONG TERM TRADES – We are looking for a good Entry Point for these, which could possible Double:

UGA US GASOLINE FUND Waiting to see if it will hold Above the Green Line.

JJC COPPER FUND Weekly Red Zone. Waiting on a Pull-back.

MDR MCDERMOTT INT’L. Waiting for a Pull-back

SN SANCHEZ ENERGY Weekly Red Zone. Waiting on a Pull-back.

URA URANIUM FUND Weekly Red Zone. Waiting on a Pull-back.

Click for Open Positions

Click for Closed Positions

Alert! Market Risk HIGH (Red Zone). The probability of successful Short Term Trades is lower, when the S&P 500 is Way Above the Green Line. Even the Strongest Funds can get chopped up. Either take quick gains from Money Wave Pops, or STAY IN CASH & WAIT for a larger correction.

[s_static_display]

Tell your Friend about us, and HELP ANIMALS.

QUESTION: Ken B. writes “I’m also confused with the open positions – if you didn’t log it – then it’s not open (seems to me).”

ANSWER: Hi Ken, since the Markets are very over-bought in the 3 month Trump Rally, we are hesitant to Buy much.

The Mechanical Money Wave System is still getting regular Buy & Sell Signals, and some Subscribers want to see every Signal.

We maintain a Performance Record of the Trades, and some of the Mechanical Trades have a poor Reward / Risk, so we are not logging or counting those for our track record.