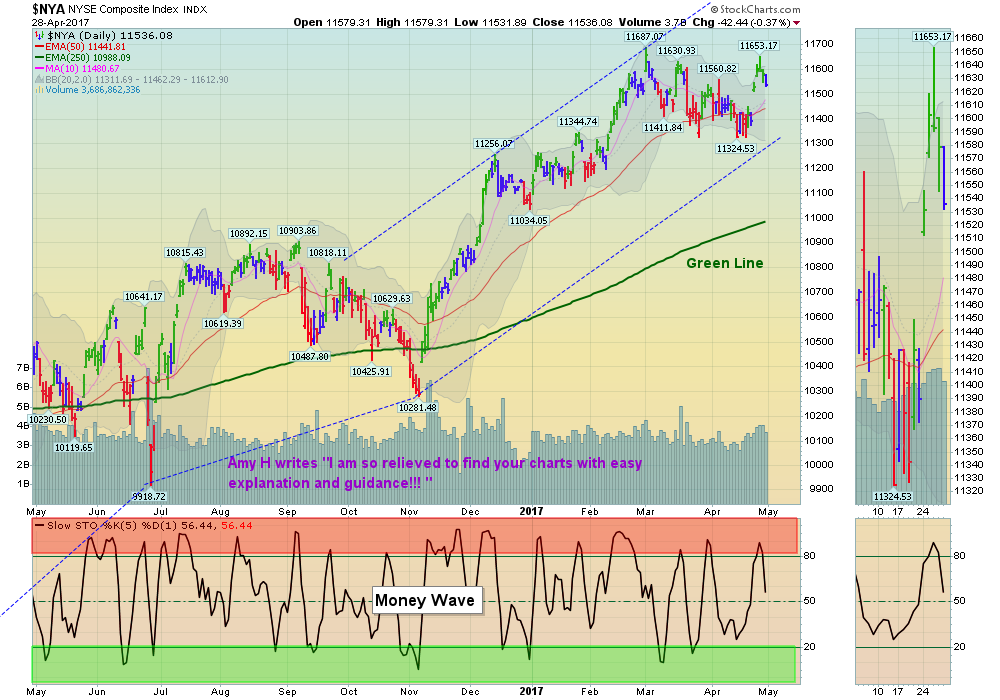

The New York Index is Struggling back up to the March Highs.

04/30/2017: Markets were up for the week, as the Strongest Leaders made New Highs. The weaker Indices (Dow, NYSE Financials & Transports) have not made it back up to the March Highs, indicating a lack of Buyers. Eventually the Markets will not make New Highs, and return back to the Green Lines, (like they always do).

Currently the S&P held at Support above 2322, and has made a “W” pattern back up to the March Highs again. Watch out for a possible “Double Top”. Also please be patient, as the Trump Rally has not had a good pull-back yet. Short Term Trading should get better once some better selling comes in…

Bonds have rallied all the way back up to the Green Line, indicating either War Fears, or expectations of a Slowing Economy…

Commodities are weak, indicating expectations of a slowing Economy.

MONEY WAVE BUYS SOON: There are currently 9 Open Positions, and 0 Investments are on the Watch List.

ON DECK to Buy soon: Watch List. Wait for GREEN ZONE BUYS. We will email or text when they are ready.

LONG TERM TRADES – We are looking for a good Entry Point for these, which could possibly Double:

DBC COMMODITY FUND Waiting for Break Out Above $16.08.

IPI INTREPID POTASH Waiting for Break Out Above $3.04.

JJC COPPER FUND Waiting on a Pull-back.

KOL COAL FUND Waiting for a Pull-back.

MDR MCDERMOTT INT’L. Waiting for Bounce Up & Above 90 Relative Strength.

UGA US GASOLINE FUND Waiting on Break Out Above $32.03.

WFM WHOLE FOODS MARKET Waiting on a Pull-back.

Click for Portfolio (Open Positions)

Click for Watch List

Click for Closed Positions

Alert! Market Risk is High (Red Zone). The probability of successful Short Term Trades is lower, when the S&P 500 is Way Above the Green Line. Even the Strongest Funds can get chopped up. Either take quick gains from Money Wave Pops, or STAY IN CASH & WAIT for a larger correction.

[s_static_display]

Tell your Friend about us, and HELP ANIMALS.

QUESTION: Dominick writes ” I was wondering after looking at all the charts, do we take trades that have clear bearish technical patterns, or since the sctr is above 90, we take the sto when it drops below 20, buy after cross over?”

ANSWER: Don’t try to Short the Investments that have High relative Strength, Dominick. It usually does not work well, as Strong Investments can Correct Sideways, and then go much Higher. It is Safer to Buy the Leaders on pull-backs only.

If you want to Sell Short, Reverse the Green Line Rules (Below the G L, Below 10 RS, and Money Wave < 80).