Do You Want a System That Gives You the EDGE to Beat the Markets?

Are You Able to Keep Up With the Flow of Money Into & Out of Market Sectors? You need Technology & Filtering to give you the EDGE to win!

The Green Line System can help you make more Money in the Stock Market.

#1 Public Site at Stockcharts.com.

How? Follow these 3 Rules:

1. Only Buy Investments that are Above the Green Line. (250 day avg.)

2. Only Buy Investments Above 90 Relative Strength Factor * (Top 10% of All Investments).

3. The Money Wave should be < 20 and turning up (Buy in Green Zone, Sell in Red Zone).

First Pick your style of Investing: (Please only pick one at first, if you are a New Investor).

Day Trading – The goal is a quick 3 -15 % pop in one day. This requires your time during the day.

Swing Trading – Short Term = 3 days to 3 weeks. Wait for Daily email, and most trades use End of Day Buying and Selling Prices.

Long Term Strategies:

- Dividend Growth

- Dogs of the Dow

- ETF Sector Rotation

- Stage Chart Investing

- Long Term Strategy for IRAs and 401kPlans

KEEP IT SIMPLE: We will email, Tweet or text you when to Buy Investments from our Swing Trading, Day Trading, and Long Term Strategy pages. Buy when the Investments are coming out of the Green Zone, and take profits in the Red Zone. Split your account into 5-10 positions with Sell Stop Losses. Your Daily Email Alert will have Entry and EXIT Points, and you can follow them on your Current Positions Page.

Stocks – We filter through the Universe of high volume stocks for the very Strongest Investments based on Relative Strength.

* Relative Strength can indicate how Investments have fared over the past year relative to the S&P 500 Index. It’s a simple 0-100 ranking that makes comparisons a snap. It is a percentile ranking of the price performance relative to other securities and relative to the broad U.S. market performance.

For a sample of our Daily Alerts, please see our commentary of prior months. You can also follow us on X (Twitter) (@AboveGreenLine) & Discord. We post ideas there regularly.

Swing Trading

Swing Trading is a strategy where a trader purchases a financial instrument and holds onto it anywhere from a few days to a couple of months. Over this period of time, a swing trader will carefully observe chart trends and patterns to sell at a moment they believe is the most profitable, thus capturing gains off of short term price movements.

Dogs of Dow

Dogs of the Dow is a stock picking strategy that tries to beat the Dow Jones Industrial Average (DJIA) each year by selecting the highest dividend DOW stocks. The strategy produces a portfolio resulting in an equal amount of money being invested in the 10 highest dividend-yielding, blue-chip stocks among the 30 components of the DJIA. At the beginning of each year the portfolio is re-balanced.

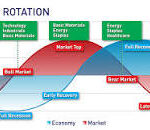

ETF Sector Rotation

Many investors are interested in investing and diversifying their portfolio in various global and local sectors, but are often unsure of where to start. Sector rotation with ETF’s is a strategy used by investors whereby they hold an overweight position in strong sectors and underweight positions in weaker sectors.

Day Trading

Day traders buy and sell stocks or other assets during the trading day in order to profit from the rapid fluctuations in prices. Day trading employs a wide variety of techniques and strategies to capitalize on these perceived market inefficiencies.

Dividend Growth

The Dividend Growth Investment Strategy is a relatively simple way to increase one’s overall income. Here at Above the Green Line, we follow multiple sources including the DVK system for owning dividend stocks and Dividend Growth Metrics and Definitions for long term investing.

Disclaimer: The information provided herein is not to be construed as an offer to buy or sell Investments of any kind. The Investment selections on this website are not to be considered a recommendation to buy or sell any Investment but as is a mere form of expression of the writer. All information offered by Above the Green Line is for educational purposes only. Readers are urged to check with their own investment counselor before making any investment decisions.