RITE AID CORP. (RAD)

Company Profile

Belonging to the Drug Store industry, Rite Aid Corp. is a $977-million Drug Store chain in the US. The company ranked No. 94 in the 2018 Fortune 500 list of the largest United States corporations by total revenue.

What Happened?

The story is pretty simple. E-commerce happened. When e-commerce happened, everything changed. Consumers shifted from physical to digital shopping. Some retailers changed with the times — in the pharmacy world, see Walgreens (NASDAQ:WBA) and CVS (NYSE:CVS) — and have since thrived as omni-channel retailers. Both Walgreens and CVS have seen their pharmacy market shares grow from 2010 to 2018.

Other retailers didn’t adapt. See Rite Aid, who didn’t refresh stores to be tech-savvy or build out a robust e-commerce business. Not surprisingly, Rite Aid’s pharmacy market share has dropped from 6.2% in 2010, to 2.6% in 2018, while it has gone from a top three pharmacy retailer in 2010, to being nudged out of the top five by the likes of Walmart (NYSE:WMT) and Kroger (NYSE:KR).

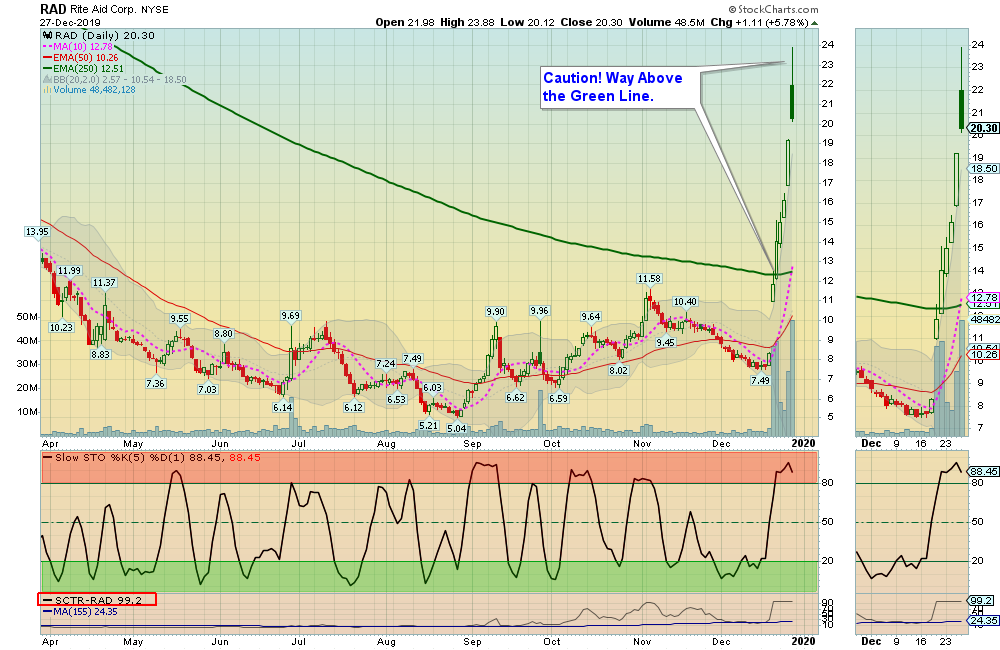

However, recently shares of Rite Aid (NYSE:RAD) were skyrocketing 45.7% higher on Thursday after the company announced its third-quarter results before the market opened. Rite Aid reported revenue of $5.46 billion, above the average analysts’ estimate of $5.42 billion. The pharmacy retailer posted adjusted earnings of $0.54 per share, blowing past the consensus Wall Street estimate of earnings of $0.09 per share. has been improving as a result of newly formed partnerships that expanded the customer base. As a result, its Relative Strength as evidence in the daily chart is now 99.

When to Buy?

RAD is currently Way Above the Green Line. We will wait to Buy when RAD returns to the Green Zone for a Daily Money Wave Buy Signal.

Objective

Above the Green Line is watching RAD for a long term investment.

Follow the Rules: Above the Green Line + Above 90 Relative Strength