The Markets are up today as the Indices are going up to re-test the recent Highs.

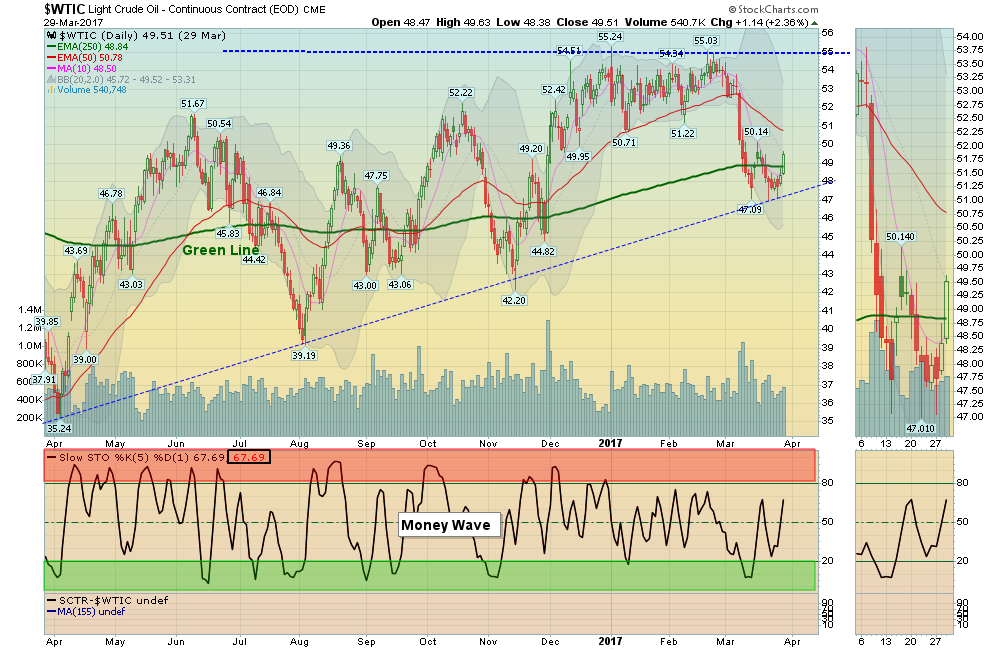

S0 far the Money Wave Pops have been very poor, indicating a tired Market. Most of the Leaders are already back up in the Red Zones. Short Term traders should have Sell stops underneath all positions…

Try to EXIT positions that are not near the recent highs, and ones that are Below the Red Lines.

The Reward / Risk ratio of investing now is poor, so please do not Buy unless you are VERY NIMBLE, as the Leaders are still Way Above the Green Lines.

Many Money Wave Buys soon!

The Following Investments will probably have a Money Wave Buy Signal

(Slow Stochastic Closing > 20) on today’s Close.

BUYS TODAY: NONE TODAY

ON DECK to Buy soon: ESPR ESPERION THERA. & CLVS CLOVIS ONCOLOGY. Please click on WatchList We will email when they are ready.

SELLS:

We will EXIT CENX CENTURY ALUMINUM on the Close, or have a tight Sell Stop Loss on it.

We will EXIT X US STEEL on the Close, or have a tight Sell Stop Loss on it.

Click for PORTFOLIO (Open Positions)

Click for CLOSED POSITIONS

Many like to Buy the day before, near the Close, if the Money Wave is going to create a Buy Signal (Closing > 20).

Don’t Buy if the Investment has already popped up too much. Money Wave Buys are usually good for a 3-6 % move in a few days.

About 1/3 of the time, the Money Wave Buys will result small losses, so please use a Sell Stop Loss after all Buy orders.