Markets were higher today as investor FEAR has disappeared in just a week, and now they are almost panic buying again. Many of the Leaders and Indices are re-testing Tuesday’s Highs with a little success. Leaders are back up in the Red Zones (probably too late to Buy for the Short Term) but the Markets seem to think a war settlement might be coming soon.

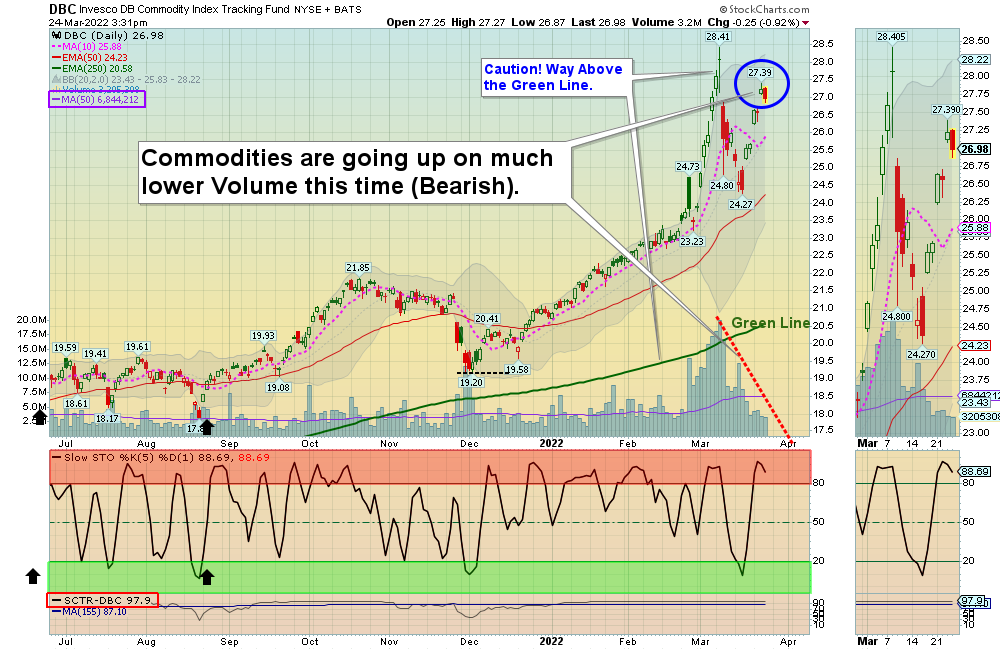

The strong Commodity Funds are back up re-testing the recent Highs, but the Volume is much lower. That could mean a Double Top or Failure for Commodities. The DOW 30, S&P 500 & NASDAQ 100 Indices are now back Above the Green Lines, but the weaker Small Cap Index is not.

New Subscribers: Most of the strongest Stocks are still back up in the Red Zones. Please be patient and Wait for more Green Zone Buy Signals soon. BUYS SOON – CHARTS The best moves are when the S&P 500 Index is also coming up out of the Green Zone. (Now back in the Red Zone).

BUYS TODAY 3/24/2022 NONE TODAY

BUYS TOMORROW – JUMP START STOCKS Shop for a better price earlier in the day. Only use Jump Start on the same day that a Daily Money Wave Buy Signal will occur.

SARK INVERSE ARK INNOVATION FUND Buy above $48.85 with High Volume with a 5% Trailing Sell Stop Loss below it.

EUM INVERSE EMERGING MARKETS FUND Wait for Money Wave Close > 20 with High Volume.

PFE PFIZER CORP. Wait for Money Wave Close > 20 with High Volume.

Please be patient and wait for Money Wave Buy Signals. We will email you when they are ready. Follow on the WATCH LIST.

The Leaders are Way Above the Green Lines (all Investments eventually return to their Green Lines).

SELLS TODAY

CTIC CTI BIOPHARMA Target Hit at $4.75 for a 10 % Gain. This trade was not logged.

WEAT WHEAT FUND Slipped below the Buy Price and was Stopped Out even. (Don’t Take a Loss!)

_________________________________________________________________________________________________________________

DAY TRADING SETUPS. A few Triple Buy Pops today. AMD (+5%) BBIG (+8%) NVDA (+10%) & TQQQ (+5%). Try out the New Side by Side layout.

DAY TRADING FOR INDICES & LARGE CAPS CHARTS.

Bonds were down today, and are Below the Green Line.

Crude Oil was down $3.69 today at $111.25.

_________________________________________________________________________________________________________________

MY TRADING DASHBOARD

SWING TRADING CURRENT POSITIONS

DAY TRADING SETUPS

TRADE ALERTS

ARE YOUR INVESTMENTS ABOVE THE GREEN LINE?

GREEN LINE RULES

ETF SECTOR ROTATION SYSTEM

New TOP 100 LIST Updated Mar 1, 2022

Many like to Buy the Swing Trades just before the Close, if the Money Wave is going to create a Buy Signal (Closing > 20 and up out of the Green Zone).

Don’t Buy if the Investment has already popped up too much. Money Wave Buy Signals are usually good for a 3-6 % move in a few days.

We will “Not Log” trades if the Reward/Risk is not at least 2:1, or Low Volume. These have more risk.

Related Post

– SARK