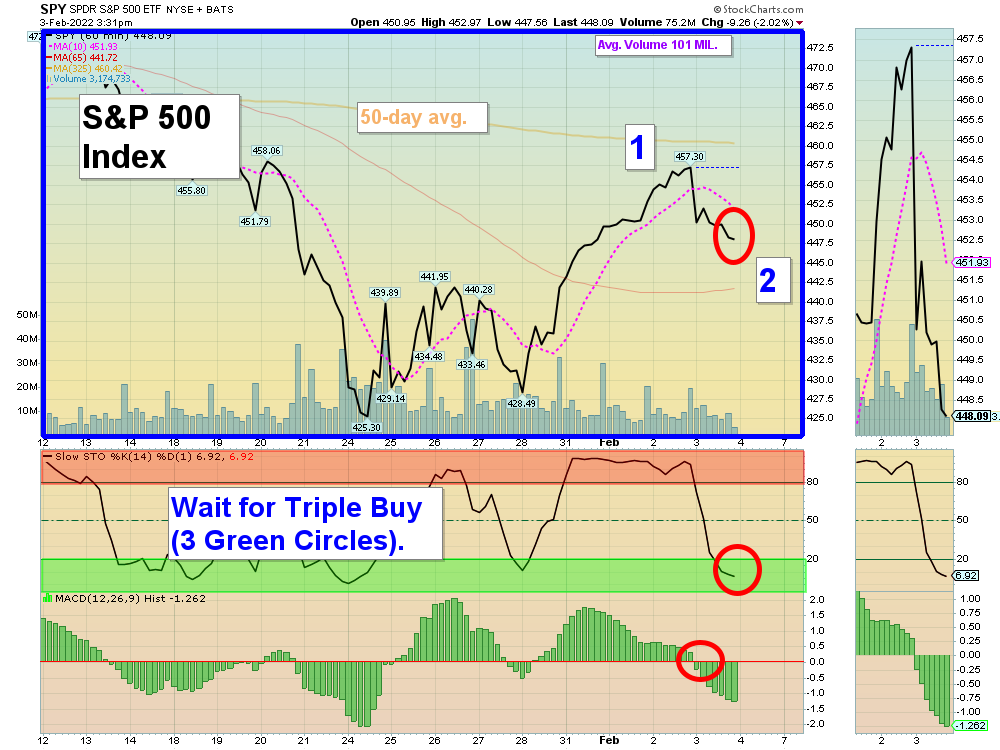

Markets were lower today as FaceBook dropped 26 % on weaker than expected Earnings. Most of the Leaders were back up in the Red Zones (probably too late to Buy for the Short term), so we were expecting a Wave 2 pull-back down to re-test last week’s Low. The stronger DOW 30 and S&P 500 Indices have stalled out at normal Resistance near the Red Lines (50-day avgs).

Normally the Indices that made fresh New Highs in January like the S&P 500 and DOW 30 Indices should re-test the Highs. Weaker Investments might not get back up past the Red Lines (50-day avgs.)

New Subscribers: We use Charts and Technical Analysis to determine which are the Strongest Investments to own, not free predictions from some guy on the Media. Technical Analysis is new to many, and is simply a way to “Follow the Money”. Historically, predicting is not reliable, so turn off the Volume and watch the Charts to see where Smart Money is going. Please WAIT for more Money Wave Buy Signals soon. The S&P 500 has just popped up 8 % from last Monday’s Low. Money Wave pops work best when the S&P 500 Index is just coming out of the Green Zone.

_________________________________________________________________________________________________________________

BUYS TODAY 2/3/2022

SARK INVERSE ARK INNOVATION FUND Money Wave Buy today, but SARK will not be Bought or Logged as it is already 10.7 % up off of Support (we probably missed it…)

BUYS TOMORROW – JUMP START STOCKS Shop for a better price earlier in the day. Only use Jump Start on the same day that a Daily Money Wave Buy Signal will occur.

KSS KOHLS CORP. Wait for Money Wave Close > 20 with High Volume.

PCG PG&E CORP. Wait for Money Wave Close > 20 with High Volume.

F FORD MOTOR CO. Buy above $21.04 with High Volume with a 5% Trailing Sell Stop Loss below it.

Please be patient and wait for Money Wave Buy Signals. We will email you when they are ready. Follow on the WATCH LIST.

The Leaders are Way Above the Green Lines (all Investments eventually return to their Green Lines).

SELLS TODAY

BLDR BUILDERS FIRSTSOURCE Slipped below the Buy Price and was Stopped Out even. (Don’t Take a Loss!) This trade was not logged.

_________________________________________________________________________________________________________________

DAY TRADING SETUPS. A few Triple Buy Pops today: CFVI (+9%) DWAC (+6%) PHUN (+13%) & VXX (+8%). Try out the New Side by Side layout.

DAY TRADING FOR INDICES & LARGE CAPS CHARTS.

Bonds were down today, and are Below the Green Line.

Crude Oil was up $1.93 today at $90.19, a New High.

_________________________________________________________________________________________________________________

MY TRADING DASHBOARD

SWING TRADING CURRENT POSITIONS

DAY TRADING SETUPS

TRADE ALERTS

ARE YOUR INVESTMENTS ABOVE THE GREEN LINE?

GREEN LINE RULES

ETF SECTOR ROTATION SYSTEM

New TOP 100 LIST Updated Feb 1, 2022

Many like to Buy the Swing Trades just before the Close, if the Money Wave is going to create a Buy Signal (Closing > 20 and up out of the Green Zone).

Don’t Buy if the Investment has already popped up too much. Money Wave Buy Signals are usually good for a 3-6 % move in a few days.

We will “Not Log” trades if the Reward/Risk is not at least 2:1, or Low Volume. These have more risk.

Related Post

– SARK