Put-Call Ratio

The put-call ratio is an indicator ratio that provides information about relative trading volumes of an underlying security’s put options to its call options. The put-call ratio has long been viewed as an indicator of investor sentiment in the markets, where a large proportion of puts to calls indicates bearish sentiment, and vice versa. Technical traders use the put-call ratio as an indicator of performance and as a barometer of overall market sentiment. Put-call ratios on broader indexes such as the S&P 500 are also used as more general gauges of market climate.

KEY TAKEAWAYS

- Put-call ratios are indicators of relative trading volumes of put options to call options in the options market.

- A put-call ratio above 1 is considered to be an indicator of a selloff while a put-call ratio below 1 is an opportunity to buy. Some traders use the put-call ratio as a contrarian indicator, and buy when the ratio is above 1 and sell when the ratio is below that figure.

Basics of the Put-Call Ratio

A put is a derivative instrument that gives the holder the right, but not the obligation, to sell a security. A call, on the other hand, is a derivative instrument that gives the holder the right, but not the obligation, to buy a security. Holders of puts are expecting (or hedging against) the price of the security to go down. Owners of calls are expecting (or speculating on) the price of the security to go up.

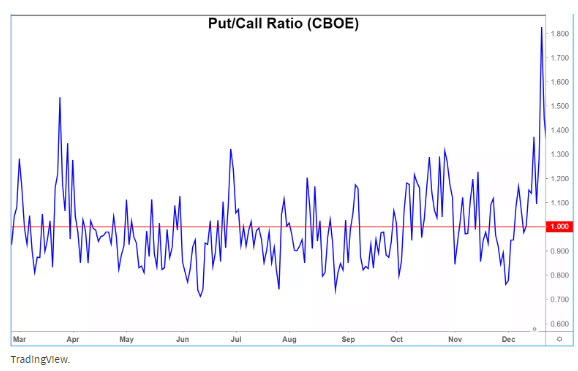

The put-call ratio shows an underlying security’s put volume relative to its call volume over a period of time (typically a day or week) and is calculated simply by dividing put volume by call volume. When there are more open positions in puts than calls, the ratio is calculated to be above 1. Likewise, when call volume is higher, the ratio is less than 1. Analysts use the ratio to measure market sentiment. The Chicago Board Options Exchange (CBOE) publishes daily and weekly put/call options. Below is a sample chart from TradingView.com showing the Put-Call ratio for CBOE.