The Investment Risk Ladder

Learning the ins and outs of investing can seem overwhelming and discouraging, yet those who take the time to grasp its most basic components benefit in the long-haul. Let’s take the first step together and explain what is known as the investment risk ladder, which defines groups of different assets based upon their riskiness. There are six main asset classes a new investor should be aware of; below, they have been listed from the least to the greatest risk.

Cash

Cash investments are considered to be the lowest risk asset class on the investment risk ladder. There are three major forms of cash investments: bank deposits, Money Market Accounts (MMA’s), and Certificates of Deposits (CD’s). When placing your money into a bank account, it is easy to think that the bank of your choice is simply providing you a place to hold your funds, yet it is not that straightforward. Putting your money into a bank is an investment in itself, yet the risk associated is quite low due to a bank guarantee that your money is available whenever you desire it. A savings account is typically the most popular form of investing with bank deposits. Cash kept within a savings account pays interest and is all the while insured by the Federal Deposit Insurance Corporation (FDIC). Savings accounts seem like a safe bet for growing money, but the interest rates are incredibly low. Placing your future into a savings account will not provide the returns one may hope to use in order to send their children to college or plan for retirement. Money Market Accounts (MMA’s) are bank accounts that are typically very short-term cash investments. MMA’s are easily liquidated, or easily turned to cash, and tend to yield higher interest rates than savings accounts. They also sometimes allow for the ability to write checks and to link a debit card, which a savings account does not permit. Though the interest rates of an MMA tend to be higher than those of a savings account, they are still relatively low and are likely not enough to build a solid future. The last form of cash investments are Certificates of Deposits (CD’s). A CD carries the same principles as a bond in that it makes interest payments on an investment that is held for a predetermined amount of time. However, unlike bonds, CD’s held within a bank cannot be sold before the maturity date. This is not the case for CD’s held within a brokerage. Similarly to savings accounts, CDs are insured by the FDIC up to $100,000. It is important to note that while savings accounts, MMAs, and CDs pay interest, the interest gained may not always outperform inflation. Though cash investments do not yield high returns, it does not mean they are useless, bad places to put your money. Cash investments are incredibly beneficial for those who do not have funds to throw into a volatile market with the potential to lose. They are also great for teaching children and young people the basics of investing their money and growing a better future. All in all, cash investments are a safe, low-risk method of investing that everyone should utilize in some way, shape, or form.

Bonds

A bond is a debt instrument or a fixed income instrument that illustrates a loan made by an investor to a borrower. Generally, a bond involves a government agency or a large corporation that will provide a fixed interest rate to the lender in return for their money. Then, the government agency or large corporation can utilize the lender’s money to finance their projects or operations. In essence, a bond is determined by its interest rate. The price of a bond and its interest rate are inversely related; when interest rates are high, bond prices are low and vice-versa. Most bonds are publicly traded, yet there are some that are privately owned between the lender and the borrower. To understand why bonds are the second safest asset class, one must grasp how bonds work. The initial price of most bonds is set at what it will be redeemed at by the end of the loaning term. For example, if a bond is valued at $1,000 and has a rate of 5%, the bondholder will be paid 50$ annually until the loan expires. At the end of the lending term, the bondholder will receive their $1,000 back and also keep the profits of their interest rate returns. The obligation of the borrower to return the loan while also paying interest on it is what makes bonds such a safe investment. However, buying bonds is not always a clear-cut method to accruing extra money. There are three main factors that affect the safety of a bond: prevailing interest rates, age of the bond, and the credit quality of the bond. Typically, bonds move in the opposing direction of prevailing interest rates. Say you bought the bond at $1,000 with a 5% interest rate in the example listed above. If prevailing interest rates rise to 6% or higher during your loan period, your bond has become less valuable. Conversely, if prevailing interest rates drop to 4% or lower, your bond has become quite valuable. The age of a bond affects the safety of a bond due to swings in prevailing interest rates. Bonds with longer lending terms tend to endure swings in prevailing interest rates more often than those with medium or short lending terms. Nevertheless, long-term bonds have many benefits. The longer the lending term, the more money available to accrue over a large period of time. Additionally, some investors will purchase long-term bonds when interest rates are lower due to the fact that they will most likely rise again over the lending period of the bond. The last factor that affects bond safety is the credit quality of a bond. Just like any average person who desires a loan, issuers of bonds must pay higher interest rates for borrowing if they have a poor credit rating. One must be wary of bonds with high yields as they normally signify instability. Overall, bonds are an incredibly safe way to gain more money. With a guarantee of your money back after a predetermined period and the obligation of interest payments annually, one can assume that by purchasing a bond they will accrue more money than they once had. However, it is important to keep in mind that the money you lend may not be redeemable until the end of the lending term. Thus, it is crucial not to lend money that you may need in the near future.

Mutual Funds

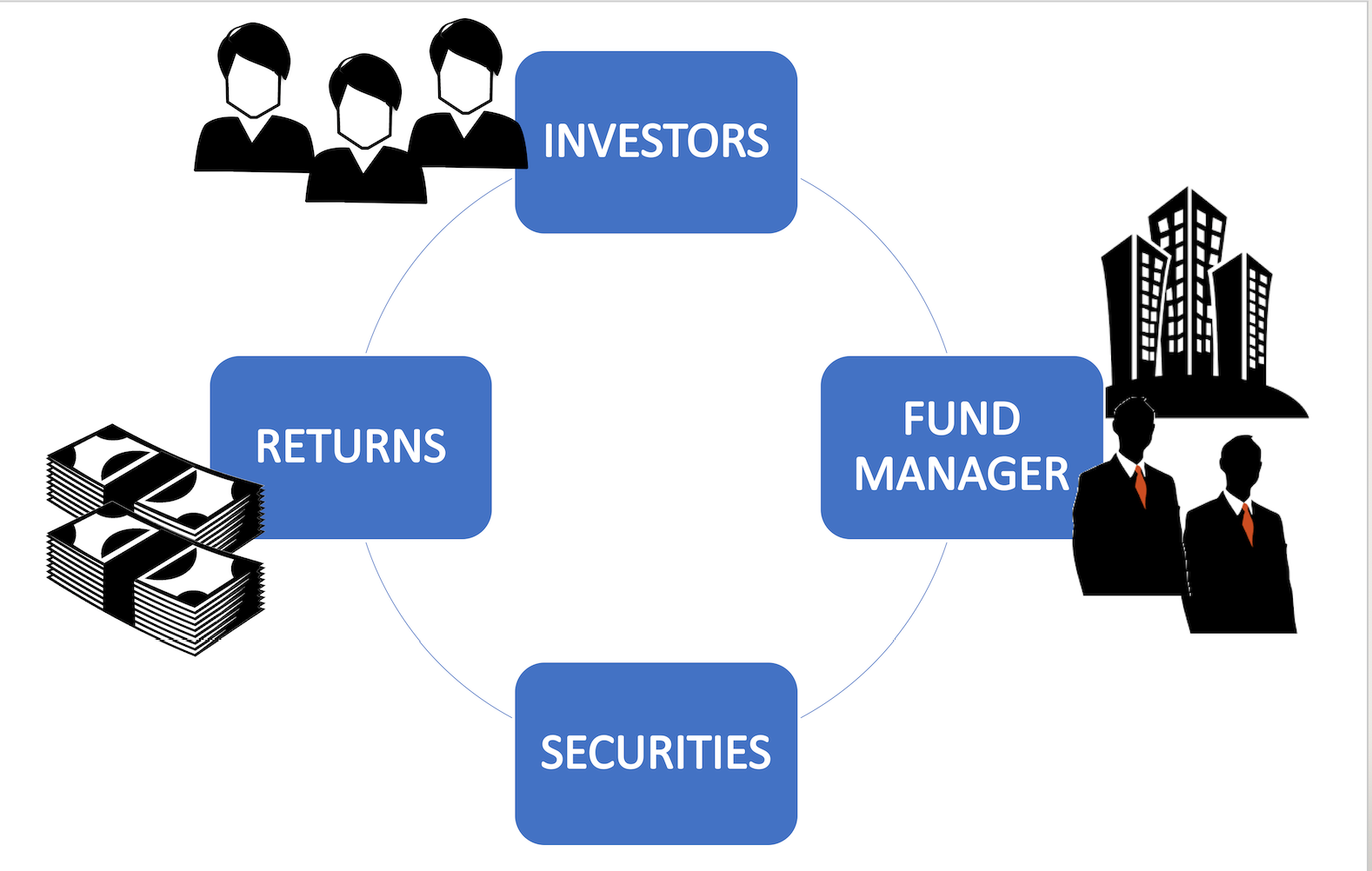

Ranking third on the investment risk ladder are mutual funds, which are a type of investment that consists of multiple investors pooling their money in order to purchase securities. Mutual funds are managed by portfolio managers who disperse the allocated funds into various stocks, assets, and securities in an attempt to provide gains for their investors. The amount of each stock, asset, or securities than an investor owns depends on the amount invested into the mutual fund. In other words, the money put into a mutual fund is directly proportional to the value of your holdings. When one opts to buy a share of a mutual fund, they are betting on the performance of the entire portfolio by simply owning a fraction of its value. As you may notice, the basics of mutual funds sound quite similar to that of stocks, yet there are a couple of key differences. Technically, when one buys a share of a stock they have what is called “voting rights”, or the right to voice opinions on corporate decisions. Owning a share of a mutual fund does not grant this right as a mutual fund is composed of a multiplicity of stocks and securities. Furthermore, the price of a mutual fund is referred to as the Net Asset Value (NAV or NAVP) due to its composition. Unlike the price of stocks, the NAV does not fluctuate within market hours and is instead valued at the close of each trading day. Mutuals funds provide returns for their investors in three ways. Primarily, income is derived from collecting dividends on the stocks and bonds within the portfolio. Investors can collect these dividends or reinvest them if they so choose. Another way that an investor might accrue money is if the mutual fund sells one or more of its securities. The profits made from the sale are referred to as “capital gain” and are distributed between the investors. Lastly, if the fund’s securities increase in price and the fund manager chooses not to sell them, the mutual fund itself increases in price. If an investor so decides, they may sell the mutual fund and make a profit. To participate in a mutual fund, an investor must pay either operating or shareholder fees. Operating fees are a percentage of the annual value of the funds, generally ranging from 1-3% of the overall value. Shareholder fees are those that are a product of purchasing or selling shares of the mutual fund. When a mutual fund has a “front-end load”, the shareholder fees are charged when purchasing shares of the mutual fund. When there’s a “back-end load”, the shareholder fees are charged when an investor sells their shares of the mutual fund. Sometimes, an investment company will choose not to charge either front-end or back-end loads. There are many advantages of mutual funds, which is why many employee-sponsored retirement plans utilize them to plan a future. Due to their diversity, mutual funds are subjected to less risk while simultaneously enhancing an investor’s returns. Additionally, they’re quite accessible and can be bought and sold with ease. Maybe the most appealing aspect of a mutual fund is that it is operated professionally so that the average investor does not have the bother with extensive research. Nevertheless, mutual funds also have their disadvantages. Similar to most other investment strategies, there’s always a possibility that a mutual fund will depreciate in value. The FDIC does not insure mutual funds, and thus there is risk involved. However, this risk isn’t much different than other investments. Furthermore, since mutual funds are composed of a pool of investors, people are often buying in and selling their shares of the fund. In order to satisfy the needs of many investors, mutual funds have high liquidity, or in other words, a high amount of their value sitting in cash. Sitting cash does not accrue profit, and thus mutual funds are known to have a “cash drag”. There are pros and cons to any investment strategy, and the cons should not deter you entirely from participating in what could be an advantageous investment; it is simply important to be aware of them in order to decide what investment strategy suits your needs.

Exchange Traded Funds (ETFs)

In the past few decades, Exchange Traded Funds (ETFs) have become one of the most popular methods of investing for both institutions and individuals. ETFs are often thought of as the cheaper version of a mutual fund due to its offering of low-cost diversified portfolios. Essentially, an ETF is a collection of stocks and securities that adheres to an underlying index. The principal difference between an ETF and a mutual fund is that they are listed on exchanges and can be traded throughout a trading day just like the average stock. Thus, the price of an ETF’s shares will fluctuate throughout the day as they are bought and sold. There are various types of ETFs that correspond with their underlying indexes such as Bond ETFs, Industry ETFs, Commodity ETFs, Currency ETFs, and more. Popular ETFs that you might recognize are SPDR S&P 500 (SPY), Invesco QQQ (QQQ), and the SPDR Dow Jones Industrial Average (DIA). Those are just to name a few. There are many advantages to investing in ETFs. For one, they provide a lower-average cost due to the fact that it would be far more expensive to purchase each stock within the fund separately. Furthermore, buying or selling an ETF only requires one transaction which results in fewer fees. On low-cost ETFs, some brokers will not charge fees at all. Since an ETF follows an underlying index, such as the S&P 500 Index, they do not have to be actively managed and thus result in fewer operating fees. However, actively managed ETFs (where a portfolio manager is heavily involved in the buying and selling of securities within the portfolio) do exist and normally have higher expenses associated with them. There are disadvantages to ETFs that further distinguish this type of security from mutual funds. For one, many ETFs are focused on a single industry. When solely investing in one industry, the diversification becomes limited and the risk heightens. Additionally, unlike mutual funds, ETFs have low liquidity which can sometimes make it difficult for investors to enter and exit the ETF. The concept of an ETF was born in only the 1990s yet has already become one of the most popular forms of investing today. There is definitely something to be said for how quickly ETFs took off. They do come with risk, though. Markets can be volatile, and since ETFs are listed on the exchange, they can be too. However, it should be noted that their diversification lowers the risk in comparison to the average stock. Overall, ETFs have risks to consider, yet they also have rewards. As with any investment strategy, it is important to weigh the pros and cons and assess what best suits your needs.

Stocks

A stock is a type of security that represents ownership of part of a corporation. Possessing shares of stocks grants the investor ownership of corporate assets and profits in relation to how many shares they own. Primarily, stocks are bought and sold on stock exchanges; however, some can be privately bought and sold. Historically, investing in stocks has outperformed most other investments when the profits are assessed after a long period of time. Their profitability in the long-run is precisely why trading stocks has become one of the most common methods for investors to build a better future. Let’s explain exactly what stocks are. Corporations sell stocks in order to fund their business operations. A buyer of a corporation’s stock owns a piece of the corporation itself and, depending on the amount bought, may be entitled to the corporation’s assets. It is important to clarify that a stockholder does not own the corporation, they own shares that the corporation has listed. Thus, the corporation can be sued, go bankrupt, etc. and the shareholders are not liable. Nevertheless, the value of the stock would most likely drop drastically if the corporation experienced negative things as such. The same principles apply to shareholders. If a large shareholder goes bankrupt, they cannot sell the companies assets to pay off their debts. Both the investor and the corporation are legally treated as individuals. Let’s say an investor owned 50% of the shares of a company. It would not be right to say that they own 50% of the company. Rather, they own 50% of the shares of the company. This maintains a company’s individuality. Ownership of a company’s shares allows the shareholder “voting rights” in shareholder meetings. Ownership also sometimes pays out dividends to shareholders. The more shares owned, the more voting rights and dividends paid to the shareholder. Voting rights are not normally of great significance to the average investor. What is important to many investors is the entitlement to a company’s profits proportional to shares owned. Now that we have covered the basics of stocks, let’s look at the two most common types of stocks: common and preferred. Common stock shareholders receive voting rights and dividend payouts, as we have discussed. Preferred stock shareholders typically do not have voting rights, but they have higher ownership of company assets and preference for their profits. In accordance with this, preferred stock shareholders would receive dividends before common stock shareholders. Stocks land on the more risky side of the investment risk ladder due to the risky nature of the market, but that does not mean one should fear them. With the right tools and knowledge, an investor can gain a better perspective on their shares and walk away with enough profits to build a secure future. For the most part, investors that put much of their money into the stock market seek out advice from a financial advisor. But paying someone to assess your stocks is not always mandatory if you have the time and drive to educate yourself. For those who want to learn about the ways of the market and experiment stocks, start by putting a little into the market, read educational articles, and watch educational videos. The stock market is risky, but it can also be fun. Having the right tools makes all the difference.

Alternative Investments

The last and typically most risky asset class to invest in are alternative investments. Alternative investments are asset classes that do not fit within the common categories listed above. Most alternative investments are held by institutions or high-income individuals due to their lack of regulation and complexity. In comparison to mutual funds and ETFs, alternative investments tend to have higher minimum initial investments and more fees associated with the purchase of them. However, the transaction costs tend to be lower than mutual funds and ETFs due to a lower turnover rate. Thus, alternative investments also tend to be very illiquid. This is because alternative investments can range anywhere from hedge funds to art and antiques. An investor who holds valuable antique statue would probably find it much harder to sell than 2,000 shares of a company simply due to the limited amount of buyers available. As we have discussed, there is a wide range of assets that fall under the category of alternative investments. For convenience, we will discuss the most common alternative investments for institutions and high-income individuals. Real estate is often considered an alternative investment. Investors may begin investing in real estate by purchasing commercial or residential properties, or they can purchase shares of Real Estate Investment Trusts (REITs). REITs share characteristics of both a mutual fund and an ETF; investors pool money into REITs to purchase properties yet they trade just like stocks on the exchange. Other common alternative investments are hedge funds and private equity funds. Hedge funds have similar principles to mutual funds in the sense that investors pool money in an attempt to gain returns, yet they are only available to accredited investors. A hedge fund’s performance is not guaranteed and they may significantly underperform. Private equity funds are composed of capital that is not listed on the stock exchange. In other words, private equity funds are composed of funds and investors who invest in private companies. Both hedge funds and private equity funds tend to impose net worth restrictions and require high minimum investments. Lastly, commodities are common alternative investments. Commodities describe tangible resources such as silver, gold, agriculture, etc. It is of great importance to highlight the lack of regulation found within alternative investments as they are prone to fraud. Though they fall under the Dodd-Frank Wall Street Reform and Consumer Protection Act and can be scrutinized by the Securities and Exchange Commission (SEC), they do not have to register with the SEC. As a consequence, it is imperative that investors conduct their own investigation into alternative investments before purchasing them.