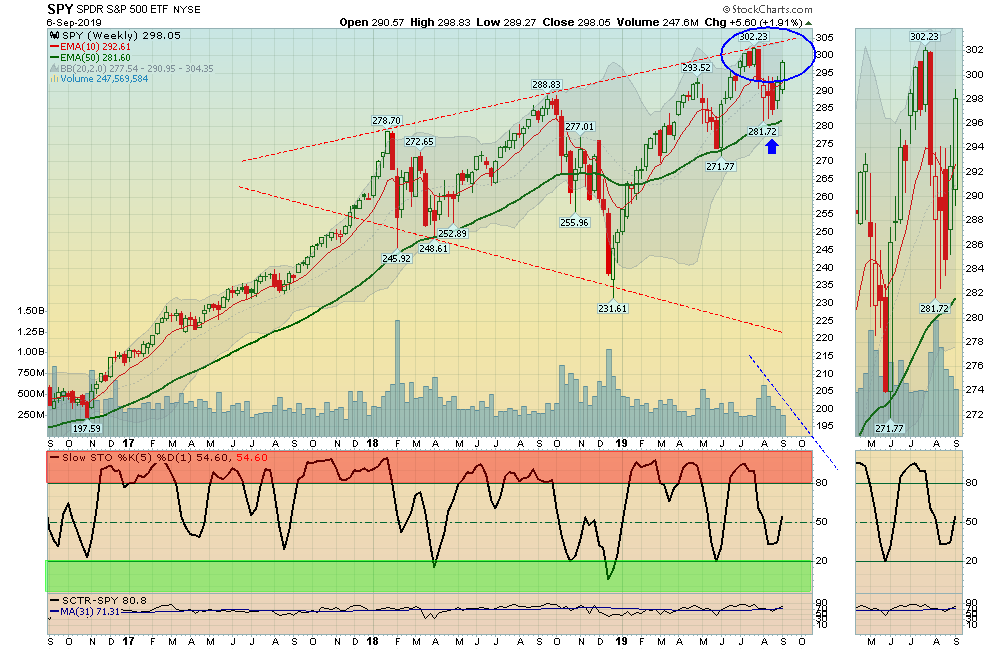

09/08/2019: Markets were up again for the week, after Good News about a meeting to resolve the Trade War. The S&P 500 Index was able to Close above 2944, so next Resistance is the July High of 3028. The Small Caps and Transports are still weak.

The 2 FEAR Trades (Bonds and Gold) were both down for the week, as the FEAR is diminishing. Bonds and Gold still have High Momentum and could re-test the Highs again after correcting down a little more. (See Watch List ). So probably no Trade Deal right away.

For the week the Dow was up 1.59%, the S&P 500 was up 1.79%, and the Nasdaq 100 was up 2.20%. The Long Term Trend on the Stock Markets is UP.

The Inflation Index (CRB) was up 1.33% and is Below the Green Line, indicating Economic Weakness.

Bonds were down 0.84% for the week and are Way Above the Green Line, indicating Economic Weakness.

The US DOLLAR was down 0.33%, after making another 3 year High.

Crude Oil was up 2.58% for the week at $56.52, and GOLD was down 0.91% at $1515.50.

___________________________________________________________________________________________

MONEY WAVE BUYS SOON:

We are currently in 4 logged Open Positions, for the Short & Medium Term. There are 4 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM INVESTMENTS

Buy the Leading Investments that are down near the weekly Green Zones.

KTOS KRATOS DEFENSE Wait for next Daily Green Zone Buy.

PYPL PAYPAL HOLDINGS Wait for next Daily Green Zone Buy.

SBGI SINCLAIR BROADCAST GROUP Buy if it is going to Close above $47.55.

XRX XEROX CORP. Buy when it Closes back Above the Green Line.

ZEN ZENDESK INC. Wait for next Daily Green Zone Buy.

ZNGA ZYNGA INC. Buy when it Closes back Above the Red Line.

ZS ZSCALER INC. Buy when it Closes back Above the Pink Line.

___________________________________________________________________________________________

Click for Portfolio (Open Positions)

Click for Watch List

Click for Closed Positions

Alert! Market Risk is MEDIUM (Yell0w Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals

___________________________________________________________________________________________

QUESTION: James M. writes:

1. I received a Money Wave Buy text today on BRFS at the usual time. Was that for a short, medium, or long term hold? It doesn’t specify.

2. I understand the target and exit stops, but when do I buy? At the moment of the text? At close?

3. When the money wave buy text’s come, do I assume your 3 golden rules have been met?

4. Finally, why is your Forum so dated?

ANSWER:

- All Money Wave Buys are Short Term (we will clarify that in the Rules). Medium and Long Term Buys will be stated.

- The Rules require that the Money Wave is going to Close > 20. So we send out the email just before the Close so you can Buy before or on the Close.

Also read about “JUMP START” as many pop too much by the end of the day.

- Yes, the 3 Green Line Rules must apply. (today the Relative Strength of NVTA dropped below 90, so we let you know in the email).

- The Forum had a problem with adding new content, but that is fixed now. Please try out the Forum!