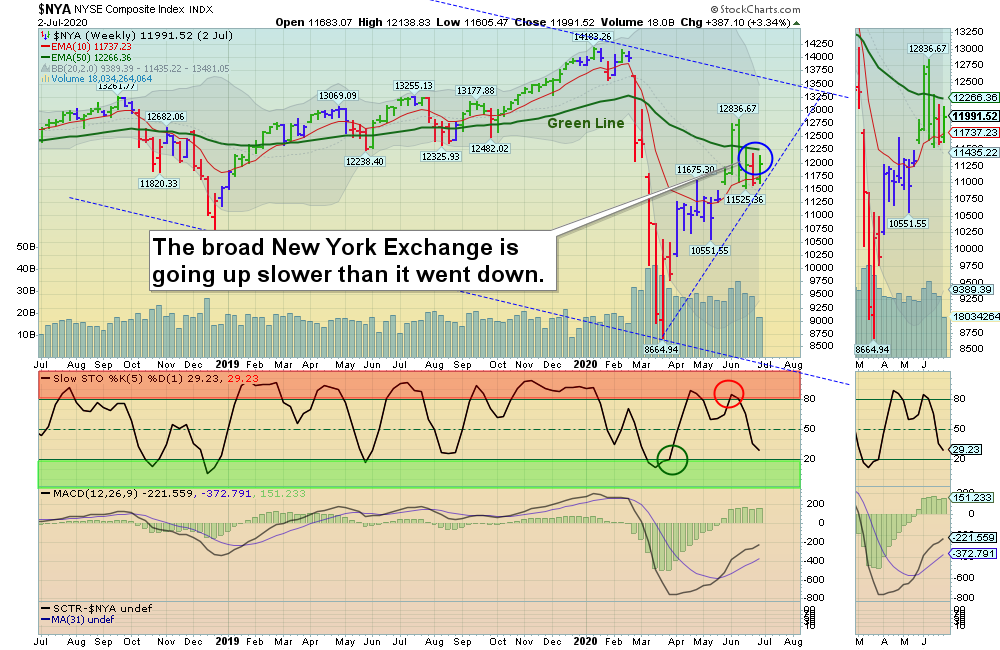

07/05/2020 Markets were up big for the week as the Indices are trying to get back up to the early June Highs. The S&P 500 Index is doing a “W” pattern off the Red Line (50-day avg.) and needs to exceed the June Highs for this rally up to continue. The CNN Fear & Greed Index is neutral at 50.

We like to Buy the very Strongest Leaders on pull-backs, like AAPL ADBE AMZN DOCU NFLX NVDA PYPL QQQ SHOP TSLA TWLO & ZS. But these have “blown out” since the March Lows, as some have Doubled and Tripled on panic Buying Climaxes. Eventually the Leaders will pull back near the Red Lines (50-day averages) like they always do. We would prefer to WAIT on the Leaders to pull-back than buy weaker Investments, even though they still meet the Green Line Rules.

Please WAIT for Watch List to grow with Leaders when they return to the Green Zones for Money Wave Buy Signals.

For the week the Dow was up 3.21%, the S&P 500 was up 4.06%, and the Nasdaq 100 was up 4.98%. The Long Term Trend for the Indices is up.

The Inflation Index (CRB) was up 4.60% and is Below the Green Line, indicating Economic Weakness.

Bonds were down 0.89% for the week and are Above the Green Line, indicating Economic Weakness.

The US DOLLAR was down 0.27 % for the week and Closed Below the Green Line.

Crude Oil was up 5.61% for the week at $40.65 and GOLD was up 0.54% at $1790.00, a New High.

_____________________________________________________________________________________________

MONEY WAVE BUYS SOON:

We are currently in 2 logged Current Positions, for the Short & Medium Term. There are 5 Investments on the Short Term Watch List.

Be patient and WAIT for Green Zone Buy Signals!

______________________________________________________________________________________________

LONG TERM INVESTMENTS (Most of the Leaders are back up in the Weekly Red Zones.)

Buy the Leading Investments that are down near the Weekly Green Zones.

AUY YAMANA GOLD Buy if it Closes above $5.65 on High Volume. All time High is $18.50.

IOVA IOVANCE BIO. Wait for the next Daily Money Wave Buy.

NG NOVA GOLD RESOURCES Buy if it Closes above $9.28 on High Volume. All time High s $16.00.

RRC RANGE RESOURCES CORP. Buy if it Closes above $7.14 on High Volume. All time High is $92.45.

______________________________________________________________________________________

Click for Current Positions

Click for Watch List

Click for Closed Positions

NEW DAY TRADE LIST JUN 27, 2020

Dividend Growth Portfolio (we are now posting a Dividend Calendar for the entire portfolio to assist with planning purposes).

ETF Sector Rotation System – New Quarterly Rotation was on June 30 & July 1, 2020.

Long Term Strategy for IRAs & 401k Plans

Alert! Market Risk is MEDIUM (Yellow Zone). The probability of successful Short Term Trades is better, when the % of stocks above the 50-day avg. is below 20.

Tell your Friends about the Green Line, and Help Animals

___________________________________________________________________________________________

4 Ways to Get your Daily Money Wave Alert:

- Emailed to your box between 3:30 3:50pm EST.

- Website menu Commentary/Buy/Sell Signals

- Twitter notifications @AboveGreenLine

- Text messages: Email us your Cell number & phone carrier.