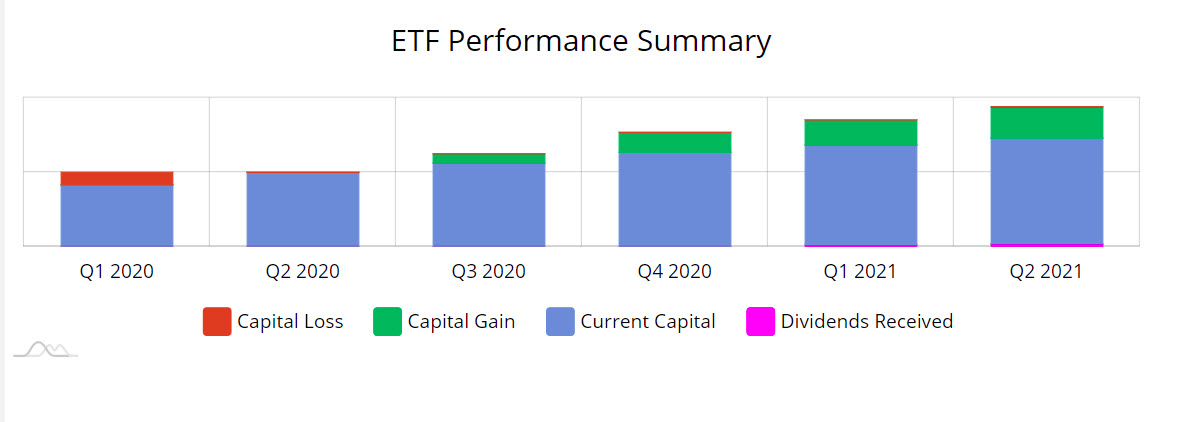

On December 31, 2021, we closed our ETF Sector Portfolio for Quarter 4. Shown below are results of the ETF Sector Portfolio since inception. The 5 Funds (XLI, SLV, IWM, XLE and XLF) were Sold on the Close December 31. On Jan 3rd, 2022, 20 % of the account value will be allocated into the new funds. The ETF portfolio for Quarter 1 2022 will consist of SPY, XRT, IWM, XLE and XLF. CORRECTION – the funds purchased on 1/3/2022 were SPY, QQQ, XLV, XLE and XLF. Please note the daily post that went out on 1/3/2022 and the portfolio itself on the ETF page correctly showed the funds.