Welcome to the January 2022 edition of ATGL Dividend Growth Portfolio. It has been several months since we added any stocks to the Dividend Growth Portfolio, no particular reason other than choosing to wait until sufficient cash was accumulated. This month, we screened for stocks with a dividend increase streak of at least 10 years which qualifies as a “Contender” as defined by George L Smith, founder of Dividend Resource Center. I was looking for a strong stable growth stock with high quality dividend looking specifically at the Energy sector to balance the overall portfolio. After carefull review, the stock added this month was ENB, which is a Dividend Champion based on its long dividend history. Please see below for details. Please NOTE, the Dividend Growth portfolio is NOT a trading portfolio but a long term buy and hold portfolio with the goal of accumulating dividends.

ENB, Enbridge Pipeline, with a current dividend yield of 6.89% and an SCTR score of 41, was selected for the ATGL Dividend Growth Portfolio based on its long sequence of consecutively dividend. Enbridge, Inc. engages in the provision of gas and oil businesses. It operates through the following segments: Liquid Pipelines, Gas Distribution & Storage, Gas Transmission & Midstream, Renewable Power Generation, and Energy Services.

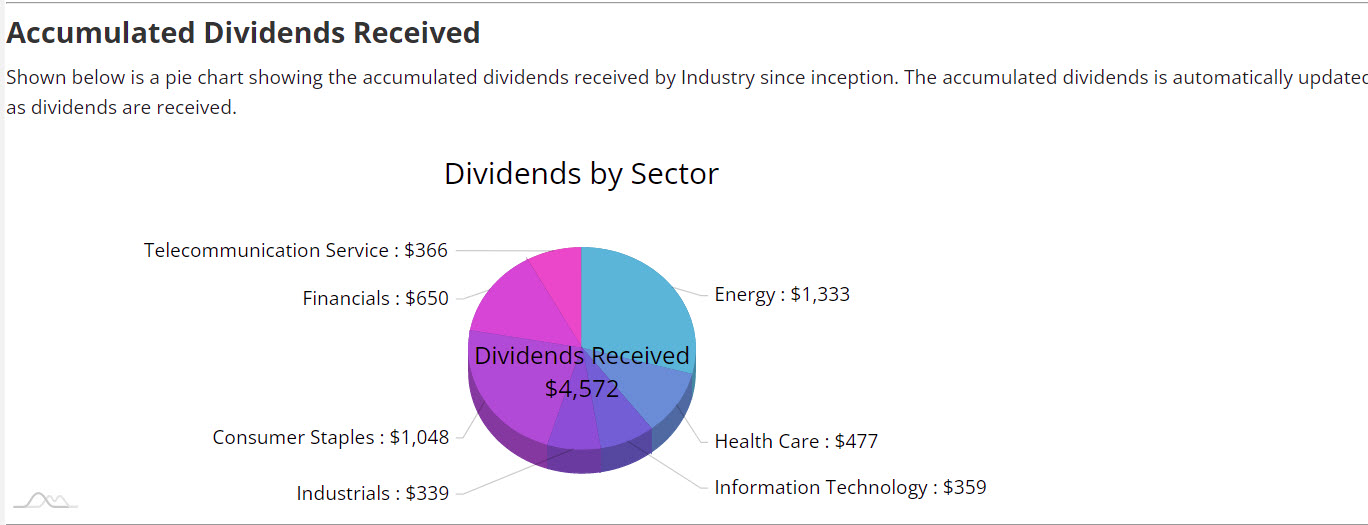

Presented below is the Dividend Distribution by Sector with the addition of ENB to the ATGL Dividend Growth Portfolio.

Dividends by Sector

To see the current DivGro Portfolio, please visit the ATGL Dividend Growth Portfolio.