What can we say, 2020 was a wild, crazy and unreal year with the pandemic, riots and turmoil. It was also our inaugural year for ATGL Dividend Growth Portfolio. Why a Dividend Growth portfolio? One can say why not? One only needs to look at the stock market decline in March 2020 and realize that diversification is invaluable when talking about investments and strategies. So, Above the Green Line decided to present several new investment strategies which included the Dividend Growth Portfolio, ETF Sector Rotation and Dogs of the Dow.

In starting the Dividend Growth Portfolio, we started with an initial investment of $50,000 to purchase high quality stocks that provide dividends and with the idea we would continue to invest on a periodic basis. Unlike other strategies like Swing or Day Trading, the objective of the Dividend Growth Portfolio is NOT market timing but buy and hold. So, just like with company sponsored retirement plans (e.g. 401k), the goal was to contribute to the portfolio on a monthly basis and purchase new stocks in increments of about $5000. Another objective of Dividend Growth portfolio was to maintain diversification across industry sectors to avoid to much exposure in any one area.

What stocks did we buy initially and what was our selection criteria? Our initial investment consisted of equal dollars in the following stocks: ADM, AFL, CV, KO, MMM, MO, T, TROW, WBA and XOM. Since our initial investment we added new positions in IBM, EMR and ABBV. The process for selecting the stocks combines the ATGL stock selection criteria of only purchasing the strongest stocks based on STCR and those companies identified as Dividend Champions. Dividend Champions, first defined by Dave Fish in 2008, defines Dividend Champions as companies that have increased their dividend every year for the past 25 years.

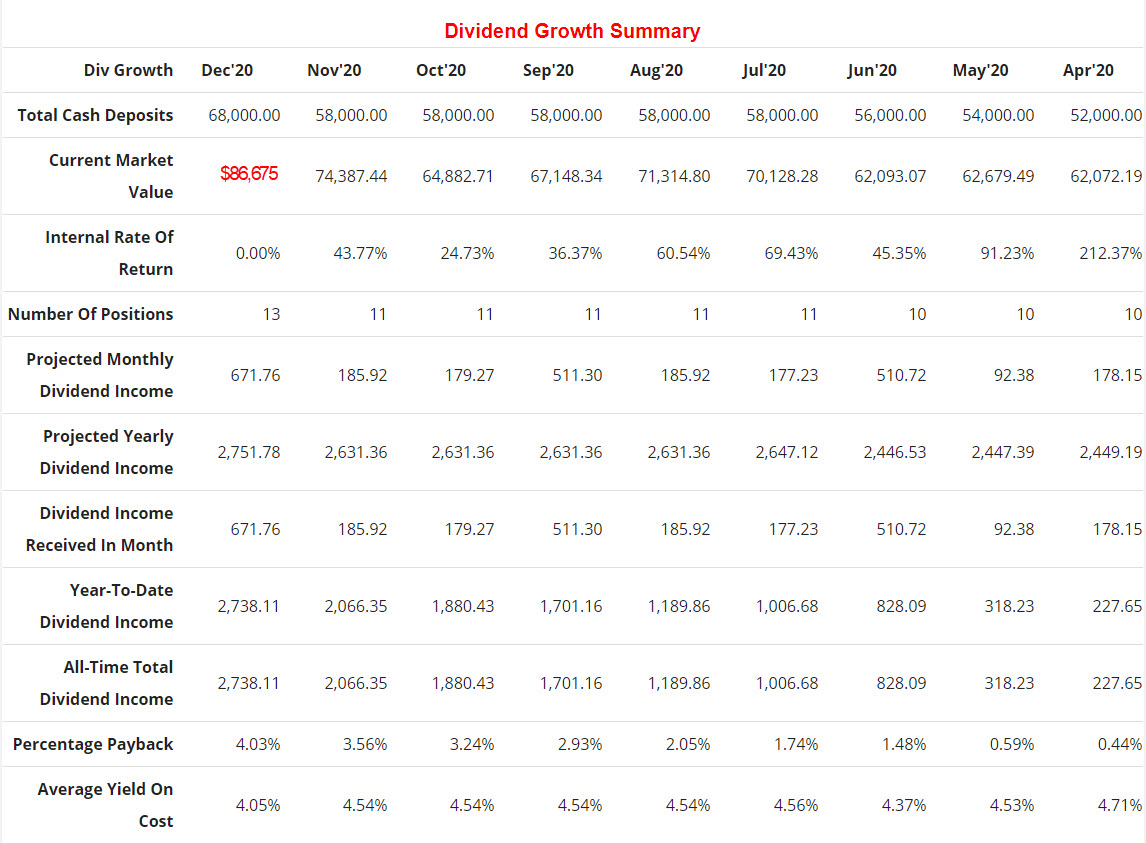

Because the objective of this Portfolio is the collection of dividends, we like to announce that we received $2738 for the year 2020 from 13 stocks in the portfolio. This represents a Pay Back of approximately 4.12% of our investments. Presented below is the Monthly Dividend Growth Snapshot showing key metrics.

To see the current DivGro Portfolio, please visit the ATGL Dividend Growth Portfolio.