The 4 Stages of any Investment

QUESTION from Dave:

“I have followed your site for some time. My problem is my job (airline pilot) did not allow me to track daily closes and buy or sell on them due to the odd hours we work. Also, as this is a retirement account I have to play the long game and these pops and short term gains become too much of a job. I see your long term trading concept, but cant understand how that applies as when the funds you list go to a buy, they would often lose money if you simply held the position off the buy signal until it crossed below the green line.

What am I missing? How can I use your system with a long time horizon?

Thank you for your time and talent. I’m happy to help and get the word out if you would like as I am all about making money and sharing info with my peers.

Cheers, Dave

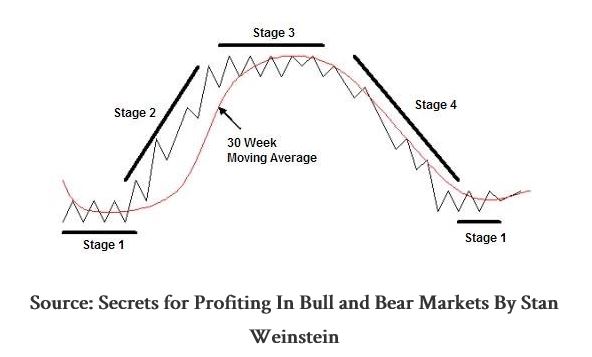

ANSWER: Thank you for writing, Dave. We follow the Stage Chart Analysis of Stan Weinstein… And you should read his book Secrets For Profiting in Bull and Bear Markets for timeless Technical Analysis (digital copy only $1.99). At least read Chapter 2.

Most Stocks and Bonds are very High historically, and are well into Stage 2 (See Chart above) of an 8 year Bull in Stocks & (Bonds might be entering Stage 3 after 35 year unbelievable BULL). There should be some nice trades back up when the Leaders like NVDA finally correct down near the Green Line.

Commodities & Inverse Funds are In Stage 4 Decline (Steel & Coal already starting up) and could Double or Triple in the next BULL, based on History.

The HERD is in Stocks & Bonds, so Money will normally flow to where they ARE NOT.

While we are waiting for Inverse Funds and Commodities to begin Stage 2 UP, we are only doing Short Term Trading…

To expect Home Depot of Boeing to Double quickly from these levels is most likely ridiculous, based on current valuations.

Eventually, Markets will DUMP again, as INSIDERS are mostly SELLING now… And we should do very well in Inverse Funds, like we did in 2008, but we must wait until they MEET THE RULES.

Good trading, and tell your friends!