Are your Investments Above the Green Line and Above 90 Relative Strength?

Swing trading, a popular strategy in financial markets, relies on short- to medium-term price movements to capture profits. Charts play a pivotal role in swing trading, offering traders visual insights into price patterns, trends, and potential entry and exit points. Utilizing various charting tools and indicators, swing traders analyze historical price data to identify trading opportunities with favorable risk-reward ratios.

One of the primary chart types used in swing trading is the candlestick chart. Candlestick charts provide comprehensive information about price action within a specific time frame, typically displaying open, high, low, and close prices for each period. By observing candlestick patterns such as bullish engulfing, bearish harami, or doji, swing traders can gauge market sentiment and anticipate potential trend reversals or continuations.

Another essential tool for swing traders is trendlines. Trendlines are drawn by connecting consecutive highs or lows on a chart, outlining the prevailing direction of price movement. Identifying and respecting trendlines can help traders determine the strength of a trend and make informed decisions about entering or exiting positions. Additionally, moving averages, such as the simple moving average (SMA) or exponential moving average (EMA), are commonly used to smooth out price fluctuations and identify trend direction.

The benefits of incorporating charts into swing trading are manifold. Firstly, charts provide a visual representation of market data, allowing traders to quickly interpret price movements and identify potential trading opportunities. Moreover, by analyzing historical price patterns and trends, traders can develop effective trading strategies based on probabilistic outcomes. Charts also facilitate the application of technical indicators, enabling traders to confirm signals and make informed decisions about trade execution.

While mastering chart analysis is essential for successful swing trading, navigating the complexities of financial markets can be daunting. This is where companies like Above the Green Line (ATGL) can be invaluable. ATGL offers comprehensive resources and tools designed to assist swing traders in navigating the markets with confidence. From educational materials on chart analysis to proprietary trading algorithms, ATGL provides traders with the knowledge and support needed to optimize their trading strategies and achieve their financial goals.

With the assistance of companies like Above the Green Line, swing traders can enhance their chart analysis skills and elevate their trading performance in dynamic financial markets.

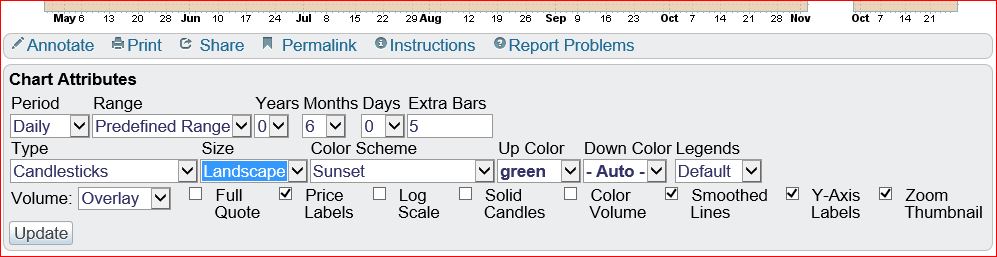

Click Here to see your favorite Chart at StockCharts:

(For LARGER CHARTS, input the Symbol, and scroll down to change the Size to Landscape, and then Click on the Update button).